Dollars and sense: The case for teaching personal finance

Americans aren’t good at managing their money — and there are signs that the problem is getting worse.

Already saddled with record levels of student debt, young adults today, for example, are even more unlikely to monitor their credit card debt and bank balances. Some people trick themselves into thinking that store refunds or anything less than $5 amount to free money . And too many people pay for online subscriptions they don’t use.

Thanks to the pioneering work of Stanford economist Annamaria Lusardi , numerous studies show how little people know about money. For two decades, Lusardi has been tracking financial literacy rates using three basic questions that she helped design and are now used as a standard measure around the world.

Her latest analysis of how Americans responded to those three questions in 2021 underscores their lack of financial know-how.

Only 53.1 percent of respondents demonstrated an understanding of how inflation works as prices on everything from cereal and cars were spiking. About two-thirds (69.4 percent) knew how to do a simple interest-rate calculation, but only 41.5 percent understood how, when it comes to investment risks, mutual funds are generally safer investments than a single company’s stock.

In all, just 28.5 percent of survey participants answered all three questions correctly, while the rest either got them wrong, or indicated they didn’t know.

The results are especially troubling as methods of managing money have evolved, says Lusardi, a globally recognized expert on personal finance who joined Stanford in September as a senior fellow at the Stanford Institute for Economic Policy Research (SIEPR) and director of the new Initiative for Financial Decision-Making. Workers now shoulder more of their retirement planning; consumers quickly and easily move money using their mobile phones; and investors make increasingly complex decisions.

“The world is changing really fast and we just expect people to have the skills to make financial decisions that have critical lifelong impacts,” says Lusardi, who is also a professor of finance (by courtesy) at the Graduate School of Business (GSB).

High rates of financial illiteracy are also problematic, she says, given today’s heightened economic uncertainty and growing wealth inequality. Respondents who were young, less educated, female, or not employed scored the lowest. Black Americans and Hispanics were also among the least financially literate.

A global pattern of illiteracy

Financial illiteracy, it turns out, is pervasive around the world, according to a newly published global analysis in the Journal of Financial Literacy and Wellbeing . Whether they are in a Nordic country with strong education systems, like Finland, or in a Latin American country, like Peru, which experienced inflation in 1990 upwards of 10,000 percent, most people don’t understand how money works, says Lusardi. And just like in the United States, the least knowledgeable tend to be women, racial minorities, the least-educated, and the unemployed.

Lusardi’s latest U.S. analysis — co-authored with Jialu Streeter , the executive director and a senior research scholar at SIEPR — is part of a special edition of the journal that includes analyses of 16 countries. Each study in the issue is based on the results of the “Big Three” questions that Lusardi and her longtime collaborator, economist Olivia Mitchell of The Wharton School at the University of Pennsylvania, crafted 20 years ago.

In 2011, Lusardi oversaw and contributed to a similar series of country comparisons — which yielded similar results and appeared in the Journal of Pension Economics & Finance .

“Financial illiteracy has been and continues to be a global phenomenon,” says Lusardi, who is one of the founders and inaugural editors of the Journal of Financial Literacy and Wellbeing , published by Cambridge University Press .

Why the ABCs of money matters

Beyond measuring and analyzing financial literacy rates, Lusardi’s extensive research has found how people who understand basic financial concepts are better at managing money. They save more for retirement, make smarter investment decisions, and manage their debts more effectively. Lusardi’s latest study shows that people who are financially literate are more likely to have money on hand to weather at least the early stages of an economic shock like a pandemic.

Lusardi has also shown that people think they know more about personal finance than they actually do, which she says makes them even more vulnerable to poor decision-making.

Stanford’s commitment to improving financial literacy is a key reason Lusardi says she joined The Farm. In addition to the Initiative for Financial Decision-Making — a collaboration between SIEPR, the GSB, and the Department of Economics in the School of Humanities and Sciences — Lusardi continues to serve as academic director of the Global Financial Literacy Excellence Center , which she founded in 2011. Prior to Stanford, Lusardi was the University Professor of Economics and Accountancy at The George Washington University.

The Big Three as global standard

In Lusardi, Stanford gains a leader in establishing financial literacy as a specialty within the field of economics.

Lusardi’s contributions to the field began in 2004, when The University of Michigan’s closely watched Health and Retirement Study added the so-called Big Three to a module dedicated to financial literacy and retirement planning. Then, in 2009, the financial education arm of the Financial Industry Regulatory Authority, which helps provide oversight of registered securities brokers and brokerage firms, began incorporating the same measures in its triennial survey of roughly 25,000 Americans.

Since then, other organizations, including central banks around the world, have integrated the Big Three into their respective assessments of household finances.

The underlying datasets in these surveys differ, but the results have uniformly shown that most people don’t understand how money, or financial systems broadly, functions, Lusardi says. In the U.S., this remained the case even after the Great Recession of 2008 and 2009 — the most severe economic downturn since the Great Depression — buffeted household finances.

“The continuous surprise is just how low financial literacy is in the United States and around the world,” says Lusardi, whose policy work includes advising the U.S. Treasury, the Organisation for Economic Co-operation and Development, and chairing the Italian Financial Education Committee in charge of designing a national strategy for financial literacy.

Solutions in education

To Lusardi, the answer to financial illiteracy lies in providing people with a basic education on the ABCs of personal finance.

“Developing personal finance skills is as important as learning how to read and write,” says Lusardi, who has been teaching financial literacy to undergraduate and graduate students for more than a decade. In fact, her move to Stanford is rooted in her experience working with SIEPR’s Michael Boskin and John Shoven to organize the first annual Teaching Personal Finance Conference in 2022.

“I’m not talking about expecting people to become Warren Buffet,” she says. “I’m talking about teaching people, especially the young, how to make savvy financial decisions. For first-generation or low-income students, it often means talking about topics they seldom discuss with their parents.”

Even as personal finance education has become somewhat of a cottage industry, results are mixed at best. Instructors, Lusardi says, often lack training and students tend to forget what they learn. In a 2014 journal publication , Lusardi and Mitchell noted that lack of sufficient funding or teacher training in financial education are still an issue; in a follow-up paper published this past fall, however, they said there’s reason for optimism.

More than half of U.S. states, for example, have added personal finance instruction as a high school graduation requirement. Universities, including Stanford, are now offering personal finance courses. Employers, too, are recognizing that financial anxiety hurts employee productivity and are sponsoring personal finance lessons in the workplace.

“Financial literacy education is really accelerating,” Lusardi says. “We’re finally seeing things turn around and, to me, that’s a very positive result.”

This story was updated on Feb. 15, 2024 with the new official name of Stanford's Initiative for Financial Decision-Making.

More News Topics

A plan for election-year rate cuts without the political chaos.

- Media Mention

- Politics and Media

- Money and Finance

Hospitals that pursue patients for unpaid bills will have to tell L.A. County

The world’s most valuable unused resource.

- Centers for Economic Education

- Certified Educator

- Partners and Donors

- Staff & Board of Directors

- Privacy Policy

- Free Workshops

- Professional Development & Certification

- Economic Decision-Making

- Mini-Economy Classroom Start-up Experience

- Performance Assessments

- Reading Makes Cents

- State Standards & Resources

- Stock Market Game™

- Virginia Economic Educator Awards

- Remote Learning Lessons

- Virginia Reads One Book

- Virginia Personal Finance Teacher Fellowship Program

- Life After High School School Resources

- Economics & Personal Finance Course

- Free Personal Finance & Economic Ed Teacher Resources

- Governor’s Challenge

- Register For SMG

- Classroom Resources

- Scholarships

- Stock Market Game Winners

- Frequently Asked Questions

Personal Finance Case Study

Regardless of whether you are able to participate in the Governor’s Challenge, we hope you will review the issues raised in the case study and consider using them in the classroom as group presentations and breakouts. Doing so will provide a good opportunity to apply many of the personal finance concepts and knowledge for your students. Below are examples of Case Studies. They also provide a good opportunity to exercise financial knowledge.

Click to download our Case Study Teacher Guidelines

Click to download the 2021 Governor’s Challenge Case Study

Click here to download the 2021 Governor’s Challenge Rubric

Click to download the 2021 Governor’s Challenge Financial Statements

Example 1 Personal Finance Case Study Example 1 Case Study Financial Statements Example 1 Rubric for Judging

Example 2 Personal Finance Case Study Example 2 Case Study Financial Statements Example 2 Rubric for Judging

2017 Governor’s Challenge Personal Finance Case Study

2016 Governor’s Challenge Personal Finance Case Study

2015 Governor’s Challenge Personal Finance Case Study

Yes, I'd like to help!

Sign up for educator emails.

Get resources for your K-12 classroom from the Virginia Council on Economic Education.

- Name * First Last

- School Name

- School Division School Division Not Teaching Independent Administrator Homeschool Private School Other Accomack County Albemarle County Alexandria Alleghany County Amelia County Amherst County Appomattox County Arlington County Augusta County Bath County Bedford County Bland County Botetourt County Bristol Brunswick County Buchanan County Buckingham County Buena Vista Campbell County Caroline County Carroll County Charles City County Charlotte County Charlottesville Chesapeake Chesterfield County Clarke County Colonial Beach Colonial Heights Covington Craig County Culpeper County Cumberland County Danville Dickenson County Dinwiddie County Essex County Fairfax County Falls Church Fauquier County Floyd County Fluvanna County Franklin City Franklin County Frederick County Fredericksburg Galax Giles County Gloucester County Goochland County Grayson County Greene County Greensville County Halifax County Hampton Hanover County Harrisonburg Henrico County Henry County Highland County Hopewell Isle of Wight County King and Queen County King George County King William County Lancaster County Lee County Lexington Loudoun County Louisa County Lunenburg County Lynchburg Madison County Manassas Manassas Park Martinsville Mathews County Mecklenburg County Middlesex County Montgomery County Nelson County New Kent County Newport News Norfolk Northampton County Northumberland County Norton Nottoway County Orange County Page County Patrick County Petersburg Pittsylvania County Poquoson Portsmouth Powhatan County Prince Edward County Prince George County Prince William County Pulaski County Radford Rappahannock County Richmond City Richmond County Roanoke City Roanoke County Rockbridge County Rockingham County Russell County Salem Scott County Shenandoah County Smyth County Southampton County Spotsylvania County Stafford County Staunton Suffolk Surry County Sussex County Tazewell County Virginia Beach Warren County Washington County Waynesboro West Point Westmoreland County Williamsburg-James City County Winchester Wise County Wythe County York County

- Middle School

- High School

- Comments This field is for validation purposes and should be left unchanged.

Information

- Author Services

Initiatives

You are accessing a machine-readable page. In order to be human-readable, please install an RSS reader.

All articles published by MDPI are made immediately available worldwide under an open access license. No special permission is required to reuse all or part of the article published by MDPI, including figures and tables. For articles published under an open access Creative Common CC BY license, any part of the article may be reused without permission provided that the original article is clearly cited. For more information, please refer to https://www.mdpi.com/openaccess .

Feature papers represent the most advanced research with significant potential for high impact in the field. A Feature Paper should be a substantial original Article that involves several techniques or approaches, provides an outlook for future research directions and describes possible research applications.

Feature papers are submitted upon individual invitation or recommendation by the scientific editors and must receive positive feedback from the reviewers.

Editor’s Choice articles are based on recommendations by the scientific editors of MDPI journals from around the world. Editors select a small number of articles recently published in the journal that they believe will be particularly interesting to readers, or important in the respective research area. The aim is to provide a snapshot of some of the most exciting work published in the various research areas of the journal.

Original Submission Date Received: .

- Active Journals

- Find a Journal

- Proceedings Series

- For Authors

- For Reviewers

- For Editors

- For Librarians

- For Publishers

- For Societies

- For Conference Organizers

- Open Access Policy

- Institutional Open Access Program

- Special Issues Guidelines

- Editorial Process

- Research and Publication Ethics

- Article Processing Charges

- Testimonials

- Preprints.org

- SciProfiles

- Encyclopedia

Article Menu

- Subscribe SciFeed

- Recommended Articles

- Google Scholar

- on Google Scholar

- Table of Contents

Find support for a specific problem in the support section of our website.

Please let us know what you think of our products and services.

Visit our dedicated information section to learn more about MDPI.

JSmol Viewer

Managing personal finance literacy in the united states: a case study.

1. Introduction

2. review of related literature, 2.1. student debts, 2.2. financial literacy, 2.3. underqualified teachers, 2.4. pedagogy, 2.5. starting personal finances with youth, 3. methodology, 4. participants, 5.1. foresight, 5.2. co-curricular implementation, 5.3. math infusion, 5.4. esteemed personal finance, 5.5. education, 5.7. generational findings, 6. discussion, 7. conclusions, 8. limitations and future recommendations, author contributions, conflicts of interest.

- Dyer, S.P.; Lambeth, D.T.; Martin, E.P. Effects of multimodal instruction on personal finance skills for high school students. J. Sch. Educ. Technol. 2016 , 11 , 1–17. [ Google Scholar ]

- Hite, N.G.; Slocombe, T.E.; Railsback, B.; Miller, D. Personal finance education in recessionary time. J. Educ. Bus. 2011 , 86 , 253–257. [ Google Scholar ] [ CrossRef ]

- Franklin, D. Teacher Involvement in Implementing State Personal Finance Mandates. Ph.D. Thesis, Indiana State University, Terre Haute, Indiana, 2015. [ Google Scholar ]

- Danes, S.M.; Huddleston-Casas, C.; Boyce, L. Financial planning curriculum for teens: Impact evaluation. J. Financ. Couns. Plan. 1999 , 10 , 26–39. [ Google Scholar ]

- Harter, C.L.; Harter, J.F.R. Assessing the effectiveness of financial fitness for life in Eastern Kentucky. J. Appl. Econ. Policy 2009 , 28 , 20–33. [ Google Scholar ]

- Hilgert, M.A.; Hogarth, J.M.; Beverly, S. Household financial management: The connection between knowledge and behavior. Fed. Reserve Bull. 2003 , 89 , 309–322. [ Google Scholar ]

- Campbell, J.L. The U.S. financial crisis: Lessons for theories of institutional complementarity. Socio-Econ. Rev. 2011 , 9 , 211–234. [ Google Scholar ] [ CrossRef ]

- Financial Crisis Inquiry Commission & United States. The Financial Crisis Inquiry Report, Authorized Edition: Final Report of the National Commission on the Causes of the Financial and Economic Crisis in the United States ; Public Affairs: New York, NY, USA, 2011; pp. 1–623. [ Google Scholar ]

- Acharya, V.V.; Richardson, M. Restoring Financial Stability: How to Repair a Failed System ; John Wiley & Sons: Hoboken, NJ, USA, 2009; pp. 1–381. [ Google Scholar ]

- Claessens, S.; Kodres, L.E. The Regulatory Responses to the Global Financial Crisis: Some Uncomfortable Questions ; International Monetary Fund: Washington, DC, USA, 2014; pp. 1–29. [ Google Scholar ]

- Dinwoodie, J. Ignorance is not a bliss: Financial illiteracy, the mortgage market collapse, and the global economic crisis. Univ. Miami Bus. Law Rev. 2010 , 18 , 181–206. [ Google Scholar ] [ CrossRef ]

- Frank, H. The Financial crisis of 2008: A clarion call to include economic policy and financial illiteracy on public administration’s intellectual radar screen. Adm. Theory Prax. 2009 , 31 , 409–416. [ Google Scholar ] [ CrossRef ]

- Taylor, M.W.; Arner, D.W. Global regulation for global markets? In Lessons from the Financial Crisis: Causes, Consequences, and Our Economic Future ; Kolb, R., Ed.; Wiley: Hoboken, NJ, USA, 2010; pp. 383–391. [ Google Scholar ]

- Lusardi, A.; Tufano, P. Debt literacy, financial experiences, and overindebtedness. J. Pension Econ. Financ. 2015 , 14 , 332–368. [ Google Scholar ] [ CrossRef ] [ Green Version ]

- Boatman, A.; Evans, B.J. How financial literacy, federal aid knowledge, and credit market experience predict loan aversion for education. Am. Acad. Political Soc. Sci. 2017 , 671 , 49–68. [ Google Scholar ] [ CrossRef ]

- Baum, S.; Schwartz, S. Student Aid, Student Behavior, and Educational Attainment ; George Washington University: Washington, DC, USA, 2013; pp. 1–26. [ Google Scholar ]

- Dynarski, S. How to and how not to manage student debt. The Milken Institute Review. Available online: https://www.milkenreview.org/articles/how-to-and-how-not-to-manage-student-debt (accessed on 1 March 2019).

- Federal Reserve Bank of New York. Quarterly Report on Household Debt and Credit ; Federal Reserve Bank: New York, NY, USA, 2016; pp. 1–33. [ Google Scholar ]

- Poll, H. The 2017 Consumer Financial Literacy Survey, National Foundation for Credit Counseling. Available online: https://nfcc.org/wp-content/uploads/2017/03/NFCC_BECU_2017-FLS_datasheet-with-key-findings.pdf (accessed on 1 March 2019).

- Clark, R.L.; Morrill, M.S.; Allen, S.G. The role of financial literacy in determining retirement plans. Econ. Inq. 2012 , 50 , 851–866. [ Google Scholar ] [ CrossRef ]

- Lusardi, A.; Mitchell, O.S. Financial literacy and retirement preparedness: Evidence and implications for financial education. Bus. Econ. 2007 , 42 , 35–44. [ Google Scholar ] [ CrossRef ]

- Carpenter, M. School programs aim to teach kids about money because parents don’t. Pittsburgh Post-Gazette. Available online: https://archives.post-gazette.com/image/96551396 (accessed on 1 March 2019).

- Green, A. Push for financial literacy spreads to schools. Christ. Sci. Monit. 2009 , 101 , 13. [ Google Scholar ]

- Lusardi, A.; Mitchell, O.S. Financial literacy and retirement planning in the United States. J. Pension Econ. Financ. 2011 , 10 , 509–525. [ Google Scholar ] [ CrossRef ] [ Green Version ]

- Lusardi, A.; Scheresberg, C. Financial literacy and high-cost borrowing in the United States ; NBER Working Papers; National Bureau of Economic Research: Cambridge, MA, USA, 2013; Volume 2, pp. 1–41. [ Google Scholar ]

- Mandell, L. The Financial Literacy of Young American Adults: Results of 2008 National Jump $ Start Coalition Survey of High School Seniors and College Students ; Jumpstart Colation: Washington, DC, USA, 2008; pp. 1–243. [ Google Scholar ]

- Kadlec, D. Why We Want but Can’t Have Personal Finance in Schools. TIME . Available online: http://business.time.com/2013/10/10/why-we-want-but-cant-have-personal-finance-in-schools/ (accessed on 1 March 2019).

- Walstad, W. Economics education in U.S. high schools. J. Econ. Perspect. 2001 , 15 , 195–210. [ Google Scholar ] [ CrossRef ]

- Finkelstein, N.; Hanson, T.; Huang, C.; Hirschman, B.; Huang, M. Effects of Problem Based Economics on High School Economics Instruction ; US Department of Education: Washington, DC, USA, 2011; pp. 1–102.

- Atchley, R.C. Educating the public about personal finance: A call for action. J. Financ. Serv. Prof. 1998 , 52 , 28–32. [ Google Scholar ]

- Blue, L.; Grootenboer, P.; Brimble, M. Financial literacy education in the curriculum: Making the grade or missing the mark? Int. Rev. Econ. Educ. 2014 , 16 , 51–62. [ Google Scholar ] [ CrossRef ] [ Green Version ]

- Way, W.L.; Holden, K.C. Teachers’ background and capacity to teach personal finance: Results of a national study. J. Financ. Couns. Plan. 2009 , 20 , 64–78. [ Google Scholar ]

- Gundmunson, C.G.; Zuiker, V.S.; Katras, M.J.; Sabri, M.F. Enhancing personal and family finance courses using case studies. Coll. Stud. J. 2015 , 49 , 321–330. [ Google Scholar ]

- Haynes, D.; Chinadle, N. Private sector/educator collaboration: Project improves financial, economic literacy of America’s youth. J. Fam. Consum. Sci. 2007 , 99 , 8–10. [ Google Scholar ]

- Mandell, L.; Klein, L. The impact of financial literacy education on subsequent financial behavior. J. Financ. Couns. Plan. 2009 , 20 , 15–24. [ Google Scholar ]

- Walstad, W.B.; Salemi, M.K. Results from a faculty development program in teaching economics. J. Econ. Educ. 2011 , 42 , 283–293. [ Google Scholar ] [ CrossRef ]

- Totenhagen, C.; Casper, D.; Faber, K.; Bosch, L.; Wiggs, C.; Borden, L. Youth financial literacy: A review of key considerations and promising delivery methods. J. Fam. Econ. Issues 2015 , 36 , 167. [ Google Scholar ] [ CrossRef ]

- Miller, D.; Hite, N.G.; Slocombe, T.; Railsback, B. Student Perspectives toward key personal finance variables. Delta Pi Epsil. J. 2010 , 52 , 168–181. [ Google Scholar ]

- Mandell, L.; Klein, L.S. Motivation and financial literacy. Financ. Serv. Rev. 2007 , 16 , 105–116. [ Google Scholar ]

- The 2016 National State of Financial & Economic Education. Available online: http://www.surveyofthestates.com/#situation-1 (accessed on 3 March 2019).

- McCormick, M. The effectiveness of youth financial education: A review of the literature. J. Financ. Couns. Plan. 2009 , 20 , 70–83. [ Google Scholar ]

- Starting Younger: Evidence Supporting the Effectiveness of Personal Finance Education for Pre-High School Students. Available online: http://www.nationaltheatre.com/ntccom/pdfs/financialliteracy.pdf (accessed on 3 March 2019).

- Godfrey, N.S. Making our students smart about money. Educ. Dig. 2006 , 71 , 21–26. [ Google Scholar ]

- Chen, W.; Heath, J.A. The efficacy of financial education in the early grades: Results from a statewide program. In Reframing Financial Literacy: Exploring the Value of Social Currency ; Lucey, T., Lucey, J., Eds.; Information Age Publishing, Inc.: Charlotte, NC, USA, 2012; pp. 189–208. [ Google Scholar ]

- Amagir, A.; Groot, W.; Maassen van den Brink, H.; Wilschut, A. A review of financial-literacy education programs for children and adolescents. Citizsh. Soc. Econ. Educ. 2018 , 17 , 56–80. [ Google Scholar ] [ CrossRef ]

- Morton, J. The interdependence of economic and personal finance education. Soc. Educ. 2005 , 69 , 66–69. [ Google Scholar ]

- Crowe, S.; Creswell, K.; Robertson, A.; Huby, G.; Avery, A.; Sheikh, A. The case study approach. BMC Med Res. Methodol. 2011 , 11 , 100–108. [ Google Scholar ] [ CrossRef ]

- Yin, R.K. The case study crisis: Some answers. Adm. Sci. Q. 1981 , 26 , 58–65. [ Google Scholar ] [ CrossRef ]

- Creswell, J. Qualitative Inquiry & Research Design: Choosing among Five Approaches , 3rd ed.; Sage: Thousand Oaks, CA, USA, 2013; pp. 1–442. [ Google Scholar ]

- Charmaz, K. Constructing Grounded Theory , 2nd ed.; Sage: Thousand Oaks, CA, USA, 2014; pp. 1–379. [ Google Scholar ]

- Strauss, A.L. Qualitative Analysis for Social Scientists ; Cambridge University Press: New York, NY, USA, 1987; pp. 1–317. [ Google Scholar ]

- Saldana, J. The Coding Manual for Qualitative Researchers , 3rd ed.; Sage: Thousand Oaks, CA, USA, 2016; pp. 1–333. [ Google Scholar ]

- Smola, K.; Sutton, C. Generational differences: Revisiting generational work values for the new millennium. J. Organ. Behav. 2002 , 23 , 363–382. [ Google Scholar ] [ CrossRef ]

- Taylor, P. The Next America: Boomers, Millennials, and the Looming Generational Showdown ; Public Affairs: New York, NY, USA, 2014; pp. 1–345. [ Google Scholar ]

- Walstad, W.; Urban, C.; Asarta, C.; Breitbach, E.; Bosshard, W.; Heath, J.; O’Neill, B.; Wagner, J.; Xio, J. Perspectives on evaluation in financial education: Landscape, issues, and studies. J. Econ. Educ. 2017 , 48 , 93–112. [ Google Scholar ] [ CrossRef ]

- Walstad, W.; Rebeck, K. The test of financial literacy: Development and measurement characteristics. J. Econ. Educ. 2017 , 48 , 113–122. [ Google Scholar ] [ CrossRef ]

- Financial Fitness for Life. Available online: http://fffl.councilforeconed.org/ (accessed on 4 March 2019).

- Batty, M.; Collins, J.M.; Odders-White, E. Experimental evidence on the effects of financial education on elementary school students’ knowledge, behavior, and attitudes. J. Consum. Aff. 2015 , 49 , 69–96. [ Google Scholar ] [ CrossRef ]

- National Endowment for Financial Education. Available online: https://www.nefe.org/What-We-Do (accessed on 5 March 2019).

- Suiter, M.C.; Wolla, S.A. Considering the times: Resources for teaching economic and financial literacy in light of the great recession. Soc. Educ. 2015 , 79 , 74–77. [ Google Scholar ]

- Jacob, K. Evaluating Your Financial Literacy Program: A Practical Guide ; Woodstock Institute: Chicago, IL, USA, 2002; pp. 1–19. [ Google Scholar ]

| Participant | Generation | Gender |

|---|---|---|

| P1 | Gen X | M |

| P2 | Gen X | F |

| P3 | Gen Z | M |

| P4 | Gen Z | M |

| P5 | Gen X | F |

| P6 | Gen Z | M |

| P7 | Gen Z | F |

| P8 | Gen X | F |

| P9 | Gen X | F |

| P10 | Gen X | F |

| P11 | Gen Z | F |

| P12 | Gen Z | F |

| P13 | Millennial | M |

| P14 | Millennial | M |

| P15 | Millennial | F |

Share and Cite

Beck, J.J.; Garris, R.O., III. Managing Personal Finance Literacy in the United States: A Case Study. Educ. Sci. 2019 , 9 , 129. https://doi.org/10.3390/educsci9020129

Beck JJ, Garris RO III. Managing Personal Finance Literacy in the United States: A Case Study. Education Sciences . 2019; 9(2):129. https://doi.org/10.3390/educsci9020129

Beck, Joshua J., and Richard O. Garris, III. 2019. "Managing Personal Finance Literacy in the United States: A Case Study" Education Sciences 9, no. 2: 129. https://doi.org/10.3390/educsci9020129

Building Case Studies

At some point in your business career you will likely be asked to build a case study. Whether it’s for school or for work, building a case study is a very methodical task. While case studies will differ across companies and sectors, your process should remain the same. When conducting a case study, you should try to include these core pieces: a summary of the company’s background, analysis of their background, the company’s internal strengths and weaknesses, their opportunities and threats, the external environment that they compete in, an evaluation of your SWOT analysis, and some recommendations to remedy potential issues you find. After figuring out which company you’re looking to examine, the first step will be to write a summary of that company’s background.

Summarizing a Company’s Background

A summary of a company’s background is just as it sounds — a brief synopsis of who the company is and what they do. Here is a summary of Ford Motor Co. found on CNNMoney’s website:

The summary is short and succinct. It explains who Ford is, which segments they operate in, and a brief explanation of what they do in each of their segments. When making a summary of your own, you’ll want to keep it short and sweet; the summary is only meant to introduce the company and what they do, it’s not meant to be comprehensive. Once you’ve summarized your company’s background your next step will be to start analyzing their history, development, and growth.

Analyzing a Company’s Background

Now that you’ve summarized the company, you’ll want to more thoroughly understand their background to get an idea of how they got to where they are today. Primarily, you’ll want to analyze their history, development, and growth.

When mulling through a company’s history you’ll start at their inception. You will be looking backwards to see how they got to where they are. The good, the bad, the ugly, the fantastic; you’ll want to see how your company dealt with both their successes and their failures. It can show you how they handle certain situations. When faced with competition, do they try to be more creative to get a leg up, or do they budget more effectively and out finance their opposition? Finding the answers to these questions can explain how the company will likely handle similar situations in the future.

Development and growth shows how the company developed and grew from the beginning until now. Did they bring a revolutionary idea to the market and change an industry like Ford, or did they take something old and put a new spin on it? Did they burst onto the scene and never look back or did they slowly build into a profitable company? When analyzing your company’s growth and development you’ll want to see how successful they were in growing their business. With exponential increases in available capital, a successful business will find ways to continue growing at a healthy rate — until a certain point. Eventually every company will reach their growth potential and will look to extract as much value from their business as possible, such as General Electric. Observing how well your company uses their cash flows to grow and develop their business will give you an insight into how they plan to develop in the future and how likely they are to succeed.

SWOT Analysis

After you’ve finished analyzing your company’s background, you will begin conducting a Strengths, Weaknesses, Opportunities, and Threats (SWOT) analysis. The first part of your SWOT analysis will be identifying the company’s internal strengths and weaknesses.

Internal Strengths and Weaknesses

When analyzing a company’s internal strengths and weaknesses, you should be looking only at things within the company’s control. This will typically include the company’s culture, expertise, and resources.

Management Structure

Part of looking at a company’s culture will involve understanding their management structure and control systems. The management structure shows who is in authority and how work is divided. There are three main types of management structures: horizontal, vertical, and matrixed.

Horizontal management is one where there is no middle management between staff members and executives. In this style of management, each supervisor has a larger number of people to manage. This means that a manager in a horizontal structure will have more responsibility than one in a vertical structure. The benefit to this is that information moves quicker, since there is no middle management to pass through. It also benefits workers, as it allows them to be more autonomous and directly involved in the decision-making process. Horizontal management is more common in companies that are growing and trying to harbor innovation. Since innovation requires lots of free-flowing information, it is better when there are fewer people it must pass through to reach the top executives.

Vertical management is one where information is passed from the top to the bottom — from supervisors to staff members. You can think of vertical management as a pyramid — where you have a CEO at the top then three vice presidents then five senior managers and so on. Unlike horizontal management, vertical management is very rigid and bureaucratic. Information flows in a slow, steady manner, passing from supervisor to subordinate until it reaches the very bottom. This style of management is more common in larger conglomerates like General Electric, who would prefer more executives since they operate in many different sectors. These companies don’t require information to move as quickly, so they’d rather it be refined as it moves through the chain of command.

A company’s expertise involves how knowledgeable they are in their given field. Expertise is measured by comparing how vital a company’s skills are relative to the market they compete in. If your company has skilled employees in computer software, but there are other companies with similar skills, their expertise may not be considered a strength. On the other hand, if your company is significantly more knowledgeable than their competitors, it could be considered a strength. While expertise involves an external factor by comparing your company’s knowledge to their competitors, it’s something that is internally controlled. A company can control their expertise by hiring and investing in highly skilled employees; they cannot control who their competitors hire and how they invest in their skills.

A company’s resources include their finances, assets, and infrastructure. Analyzing a company’s resources involves observing how they manage their resources compared to their competitors.

Corporate Level Strategy

Using a company’s resources, you can begin to examine their corporate level strategy. Corporate level strategy is concerned with the company’s business decisions and how they affect the entire organization. Financials, mergers and acquisition, and the overall management of resources are all things involved with corporate level strategy.

Usually, companies within the same industry will have similar corporate level strategies. For example, companies in the telecom industry have higher levels of debt than companies in other industries. This is because they must make larger initial investments in infrastructure before they can start to deliver their products. However, that doesn’t mean companies who break from the industry tradition are always weaker, in fact, it could be a strength.

Understanding your company’s corporate level strategy will help explain some of the decisions they’ve made, as well as allow you to formulate recommendations that help them enhance their strategy.

Intellectual Property

A company’s resources can also include their intellectual property. Intellectual property is a creative invention that a company has legal access to use commercially. This includes trademarks, patents, and copyrights. Intellectual property can be a big internal strength for a company, especially if it restricts competitors from being covered under fair use, such as Apples pinch-to-zoom feature.

Now that you’ve covered the Strengths and Weaknesses portion of your SWOT analysis, you’ll need to find identify the company’s Opportunities and Threats. This is done by looking at the external environment of your company.

External Environment

The external environment is composed of all the outside factors that impact your company’s operations. These are the factors that your company doesn’t have control over. It can include their competitors, their customers, the government, and the economic climate. From the external environment, you will be able to observe potential threats to your company as well as potential opportunities they may have.

Opportunities

Opportunities in your SWOT analysis will consist of ways that your company can potentially improve their business operations. These will include both internal and external strengths. Building on employee knowledge, launching of a new product, or a positive economic forecast are all potential opportunities for a company. The primary goal of an opportunity is to positively affect a company’s business operations.

Once you’ve completed your SWOT analysis, you will then want to evaluate what you’ve found. What you find will likely be part of the recommendations that you formulate to your company.

Evaluating your SWOT analysis

By conducting your Strengths, Weaknesses, Opportunities, and Threats analysis, you will have identified what your company does well, what they need to work on, what opportunities are present for them, and what threats they may face. The information you’ve discovered will then be used to help formulate recommendations to the company.

Formulating Recommendations

Get PersonalFinanceLab

This lesson is part of the PersonalFinanceLab curriculum library. Schools with a PersonalFinanceLab.com site license can get this lesson, plus our full library of 300 others, along with our budgeting game, stock game, and automatically-graded assessments for their classroom - complete with LMS integration and rostering support!

- Search Search

From Our Blog

- Feature Highlight – Updated Lesson Plans

- Feature Highlight – Stocks by Sector

- Planning For Unexpected Expenses

- Feature Highlight – Student Stock Comparison Tool

- Feature Highlight – Weekend Choices

Personal Finance Lab

Finder’s case study database: Share your story

Share your personal finance experiences and you could get £60 if we use your story..

Finder’s research team sometimes needs case studies who have had positive or negative experiences with their personal finances to accompany our research in order to help bring it to life. We are therefore building a database of case studies who would be willing to share their personal finance stories with us.

What’s in it for me?

If we use your case study in research that we send to journalists, we will pay you £60 for your contribution. This may also be featured on our website, like the example below. We also need case studies solely for our website from time to time and will pay £20 for people we select for this (if you haven’t already given your testimony as a press case study). Last but not least, you get to share your story and help other people with their finances!

Case study: Bank branch closure has left Samantha stressed

Samantha Evans

It has made sure it's harder for me to access actual face-to-face support. It's meant that if I have a problem, I have to call or use my mobile banking app to access support.

There was no support offered or in place. To be honest, there wasn't very much warning either, and it was only by chance that I discovered it was closing.

What do I have to do?

To submit your story and be in with a chance of earning £60 for being a case study, you need to fill in this form.

The more detail you include in your response, the better, as this will increase the likelihood that we choose you to be part of our research! Experiences can be positive (e.g. a provider you have been impressed by or success you’ve had with a side hustle) or negative (you’ve been dealing with issues in a particular area or a company has treated you badly).

To give some further examples, this could be you talking about how you have a digital-only bank account (like Starling and Monzo) or about the steps you’ve taken to deal with the cost of living crisis or your mortgage.

Please leave your email below and if you prefer to be contacted via Twitter, you can also follow our head of research, Matt, on twitter and he might contact you on there as opposed to email. His handle is @mckmatt10 (https://twitter.com/MckMatt10).

If we decide to use your case study in our research, your story and a picture could appear in national news publications.

If you’re not comfortable with having your name and picture in the press, please don’t fill out this form.

Submit your case study

What might it look like if my case study is used.

The research, including your story and a picture, could appear in national news sites. In the unlikely event a TV news show wanted to cover the research, you may also be asked to be filmed for this.

Why do we use case studies?

Case studies bring our research to life and help people understand the real life stories behind personal finance issues, whether it’s bank accounts, investing, credit cards or the general cost of living (or anything else relating to finance!)

What happens if I no longer want to be part of the case study database?

Please direct any questions, concerns or requests to be taken off the database via email to: [email protected] and you can see our terms and policy here: https://www.finder.com/uk/privacy-policy

Click here for more research. For all media enquiries, please contact –

Matt Mckenna UK Head of Communications T: +44 20 8191 8806

More guides on Finder

Finder Studios creates multimedia sponsored content with partners. Engage a new audience with finance content like they’ve never seen before.

Our Editorial Review Board and expert contributors are a key part of Finder’s content. Here are the opportunities for experts who work with us.

Contact details for organisations offering free money guidance, debt support, help with benefits and support with complaints about a provider.

A note from Frank, Fred and J.

If you’d like to help, you can donate through one of these registered charities which are supporting Ukrainians.

How to share your product experiences with Finder and our readers.

Please rate your experience of finder.com!

We love hearing from our users, so pick up the phone, send us an email, tweet us, post to our wall or pop by the office. We’re more than happy to answer your questions and help you out any way we can.

Say ‘Hi’ to the personal finance pros producing the content at Finder UK!

About our partnerships.

How likely would you be to recommend Finder to a friend or colleague?

Our goal is to create the best possible product, and your thoughts, ideas and suggestions play a major role in helping us identify opportunities to improve.

Advertiser Disclosure

finder.com is an independent comparison platform and information service that aims to provide you with the tools you need to make better decisions. While we are independent, the offers that appear on this site are from companies from which finder.com receives compensation. We may receive compensation from our partners for placement of their products or services. We may also receive compensation if you click on certain links posted on our site. While compensation arrangements may affect the order, position or placement of product information, it doesn't influence our assessment of those products. Please don't interpret the order in which products appear on our Site as any endorsement or recommendation from us. finder.com compares a wide range of products, providers and services but we don't provide information on all available products, providers or services. Please appreciate that there may be other options available to you than the products, providers or services covered by our service.

We update our data regularly, but information can change between updates. Confirm details with the provider you're interested in before making a decision.

Learn how we maintain accuracy on our site.

Newly Launched - AI Presentation Maker

Researched by Consultants from Top-Tier Management Companies

AI PPT Maker

Powerpoint Templates

Icon Bundle

Kpi Dashboard

Professional

Business Plans

Swot Analysis

Gantt Chart

Business Proposal

Marketing Plan

Project Management

Business Case

Business Model

Cyber Security

Business PPT

Digital Marketing

Digital Transformation

Human Resources

Product Management

Artificial Intelligence

Company Profile

Acknowledgement PPT

PPT Presentation

Reports Brochures

One Page Pitch

Interview PPT

All Categories

Must-Have Financial Case Study Examples with Samples and Templates

Mayuri Gangwal

Case studies are valuable tools for understanding the real-world applications of financial concepts and strategies. They provide insights into practical scenarios, showcasing the decision-making processes and outcomes in various financial situations. Whether you are a student, professional, entrepreneur, having access to well-crafted financial case study templates can be immensely beneficial in developing a deeper understanding of financial principles and honing your analytical skills.

SlideTeam’s premium PPT templates help you grasp complex financial concepts like investment analysis, financial planning, risk management, etc. Each case study offers a unique scenario, presenting a problem or challenge that requires thoughtful analysis and strategic decision-making.

By using these content-ready slides, you can enhance your problem-solving abilities, learn from real-world success stories and mistakes, and gain valuable insights into the intricacies of financial decision-making. The included samples and templates are practical tools for structuring your case studies, enabling you to apply your knowledge and skills to different financial scenarios.

Whether preparing for exams, a professional seeking to broaden your financial expertise, or an entrepreneur looking to make informed business decisions, these financial case study examples, samples, and templates are indispensable resources to elevate your financial understanding and make well-informed decisions in your personal or professional life.

Financial Case Study Templates

Template 1: financial case study environment business solution problems.

Introducing our ready to use template designed to elevate your content and make you look like a presentation pro. With a wide range of PPT slides covering various topics, this deck encompasses all the core areas of your business needs.

The deck focuses on Financial Case Study Environment Business Solution Problems, offering professionally designed templates that combine suitable graphics and relevant content. With eight slides, thoughtfully crafted to enhance your message and captivate your audience.

Don't miss out on this opportunity to impress your audience with visually stunning slides and compelling content. Click the download button and access our pre-designed PPT presentation and take your presentations to the next level. We also have templates to propose a business case if you aim for a higher company turnover.

Download Now

Template 2: Case Study for Financial Management PowerPoint Template

Introducing our captivating case study template designed to provide an environment conducive to productive discussions and effective decision-making. This template is perfect for showcasing real-life examples and analyzing financial management scenarios visually engagingly.

With its three-stage process, this template simplifies complex concepts and guides your audience through the essential components of a comprehensive business case study. It enables you to present your findings, solutions, and recommendations.

Whether you are analyzing past financial performances, identifying challenges , or proposing solutions, this template provides a flexible framework for organizing and presenting your ideas. You can also elevate your financial management presentations with our marketing Case Study for Financial Management PowerPoint Template . Download it now and unlock a wealth of possibilities to engage your audience, foster integration, and showcase your expertise in financial management.

Download Now

Conclusion

Financial case studies are invaluable tools for understanding real-world financial scenarios and developing practical solutions. By examining concrete examples, individuals and organizations can gain insights into financial challenges, apply analytical techniques, and make informed decisions.

This article has highlighted the importance of collecting financial case study examples and accompanying samples and templates as valuable resources for learning and applying financial principles in various contexts. These resources can serve as guides for conducting comprehensive analyses, formulating recommendations, and ultimately achieving financial success.

FAQs on Financial Case Study

What is a case study in finance.

A case study in finance is an in-depth analysis of a specific financial situation, company, investment, or financial strategy. It involves examining real-world scenarios, often based on actual events, to understand and evaluate the financial implications, decision-making processes, and outcomes.

In finance, case studies are commonly used as a teaching and learning tool to assess and explore complex financial issues in academic and professional settings. They provide a practical approach to understanding financial theories, concepts, and practices by applying them to real-life situations.

A finance case study typically involves the following elements:

- Background: The case study begins by presenting relevant information about the company, industry, or financial situation under examination. This includes details about the organization's financial statements, market conditions, competitive landscape, and other pertinent background information.

- Problem or Challenge: The case study outlines the specific financial problem or challenge that needs to be addressed. This could be related to financial analysis, investment decisions, capital budgeting, risk management, financial restructuring, or any other financial aspect of the organization.

- Data Analysis: The case study analyzes financial data, such as income statements, balance sheets, cash flow statements, and key financial ratios. Various financial analysis tools and techniques, such as ratio analysis, discounted cash flow analysis, or valuation models, may be used to evaluate the situation.

- Alternatives and Solutions: Based on the analysis, different alternatives or solutions are identified to address the financial problem or challenge. These could include recommendations for financial strategies, investment decisions, capital allocation, cost reduction measures, or other relevant actions.

- Decision-Making and Implementation: The case study explores the decision-making process, considering risk, return, financial feasibility, and strategic considerations. It also discusses the potential implementation of the recommended solution and the expected outcomes.

- Lessons Learned: The case study concludes by discussing the lessons learned from the financial situation or decision-making process. This may involve reflections on successful strategies, potential pitfalls, and broader implications for financial management and decision-making in similar contexts.

How do you write a financial case study?

Writing a financial case study involves analyzing a real or hypothetical financial situation or problem and presenting a detailed examination of the facts, analysis, and potential solutions. Here is a step-by-step guide on how to write a financial case study:

- Identify the purpose and scope: Clearly define the purpose of the case study and the specific financial issue you want to address. Determine the scope of the study, including the period, entities involved, and relevant financial data.

- Gather information: Collect all relevant financial data and supporting documents related to the case. This may include financial statements, transaction records, market data, industry reports, and any other information necessary for the analysis.

- Describe the background: Provide an overview of the company or individual involved in the case study. Include relevant details such as the company's history, industry , size, key stakeholders, and any recent events or developments that may have a financial impact.

- State the problem or objective: Clearly define the financial problem or objective that needs to be addressed. Identify the key challenges or issues the company or individual faces and explain why they are essential.

- Conduct financial analysis: Analyze the financial data and apply appropriate financial analysis techniques to evaluate the situation. This may involve calculating financial ratios, conducting trend analysis, performing a discounted cash flow analysis, or any other relevant method to gain insights into the financial performance and position of the entity.

- Present findings: Summarize the results of the financial analysis clearly and concisely. Highlight key findings, trends, and any significant financial situation factors. Use graphs, charts, or tables to present data effectively.

- Discuss alternative solutions: Propose different options or strategies to address the financial problem or achieve the objective. Determine the advantages and drawbacks of each solution and provide supporting evidence or calculations to justify your recommendations.

- Make recommendations: Make clear and actionable recommendations based on analyzing and evaluating the alternative solutions. Support your recommendations with logical reasoning and explain how they can improve the financial situation or achieve the desired outcome.

- Provide a conclusion: Summarize the main points of the case study and restate the recommendations. Highlight any potential risks or challenges associated with implementing the proposed solutions.

- Include references and citations: If you have used external sources or references, provide proper citations to give credit to the authors and avoid duplicity or redundancy.

- Edit and proofread: Review the case study for clarity, coherence, and accuracy. Check for any grammatical or spelling errors. Ensure that the document is well-structured and easy to understand.

What is finance study?

Finance study refers to the field of knowledge and an academic discipline that focuses on managing, creating, and allocating financial resources. It involves studying various aspects of financial systems, instruments, markets, and institutions. Finance encompasses the theory and practice of managing money, investments, and financial decision-making.

The study of finance covers a wide range of topics, including:

- Corporate Finance: This area focuses on financial decisions and strategies within corporations. It includes capital budgeting, investment analysis, financial planning, risk management, and corporate valuation.

- Investments: This field examines allocating money to different financial assets including, stocks, mutual funds, real estate, and other derivatives. It involves analyzing risk and return, portfolio management, asset pricing models, and investment strategies.

- Financial Institutions and Markets: This area explores the functioning of financial institutions (such as banks, insurance companies, and investment firms) and financial markets (such as stock markets, bond markets, and foreign exchange markets). It involves studying the role of these institutions and markets in facilitating the flow of funds, managing risks, and pricing financial assets.

- International Finance: This branch focuses on financial transactions and relationships between countries and across borders. It covers foreign exchange rates, international investment, multinational corporations, and global financial markets.

- Personal Finance: This area focuses on individual or household financial management. It involves budgeting, saving, investing, retirement planning, taxation, and managing personal debt.

Related posts:

- How Financial Management Templates Can Make a Money Master Out of You

- Top 5 Capital Budgeting Templates with Samples and Examples

- The Ultimate Spokes Diagram Templates to Enhance Business Presentation

- Top 5 One-page Quarterly Report Templates with Examples and Samples

Liked this blog? Please recommend us

Top 5 Daily Appointment Templates with Samples and Examples

Top 5 Portfolio Project Status Report Templates with Examples and Samples

2 thoughts on “must-have financial case study examples with samples and templates”.

This form is protected by reCAPTCHA - the Google Privacy Policy and Terms of Service apply.

--> Digital revolution powerpoint presentation slides

--> Sales funnel results presentation layouts

--> 3d men joinning circular jigsaw puzzles ppt graphics icons

--> Business Strategic Planning Template For Organizations Powerpoint Presentation Slides

--> Future plan powerpoint template slide

--> Project Management Team Powerpoint Presentation Slides

--> Brand marketing powerpoint presentation slides

--> Launching a new service powerpoint presentation with slides go to market

--> Agenda powerpoint slide show

--> Four key metrics donut chart with percentage

--> Engineering and technology ppt inspiration example introduction continuous process improvement

--> Meet our team representing in circular format

Budgeting Case Studies

New to ngpf.

Save time, increase student engagement, and help your students build life-changing financial skills with NGPF's free curriculum and PD.

Start with a FREE Teacher Account to unlock NGPF's teachers-only materials!

Become an ngpf pro in 4 easy steps:.

1. Sign up for your Teacher Account

2. Explore a unit page

3. Join NGPF Academy

4. Become an NGPF Pro!

Want to see some of our best stuff?

Spin the wheel and discover an engaging activity for your class, your result:.

PROJECT: Who Aced the Interview Challenge?

Sending form...

One more thing.

Before your subscription to our newsletter is active, you need to confirm your email address by clicking the link in the email we just sent you. It may take a couple minutes to arrive, and we suggest checking your spam folders just in case!

Great! Success message here

Teacher Account Log In

Not a member? Sign Up

Forgot Password?

Thank you for registering for an NGPF Teacher Account!

Your new account will provide you with access to NGPF Assessments and Answer Keys. It may take up to 1 business day for your Teacher Account to be activated; we will notify you once the process is complete.

Thanks for joining our community!

The NGPF Team

Want a daily question of the day?

Subscribe to our blog and have one delivered to your inbox each morning, create a free teacher account.

Complete the form below to access exclusive resources for teachers. Our team will review your account and send you a follow up email within 24 hours.

Your Information

School lookup, add your school information.

To speed up your verification process, please submit proof of status to gain access to answer keys & assessments.

Acceptable information includes:

- a picture of you (think selfie!) holding your teacher/employee badge

- screenshots of your online learning portal or grade book

- screenshots to a staff directory page that lists your e-mail address

- any other means that can prove you are not a student attempting to gain access to the answer keys and assessments.

Acceptable file types: .png, .jpg, .pdf.

Create a Username & Password

Once you submit this form, our team will review your account and send you a follow up email within 24 hours. We may need additional information to verify your teacher status before you have full access to NGPF.

Already a member? Log In

Welcome to NGPF!

Take the quiz to quickly find the best resources for you!

ANSWER KEY ACCESS

Thank you for visiting nature.com. You are using a browser version with limited support for CSS. To obtain the best experience, we recommend you use a more up to date browser (or turn off compatibility mode in Internet Explorer). In the meantime, to ensure continued support, we are displaying the site without styles and JavaScript.

- View all journals

- Explore content

- About the journal

- Publish with us

- Sign up for alerts

- Open access

- Published: 15 August 2024

Financial network communities and methodological insights: a case study for Borsa Istanbul Sustainability Index

- Larissa M. Batrancea 1 ,

- Ömer Akgüller 2 ,

- Mehmet Ali Balcı ORCID: orcid.org/0000-0003-1465-7153 2 &

- Anca Nichita 3

Humanities and Social Sciences Communications volume 11 , Article number: 1046 ( 2024 ) Cite this article

Metrics details

- Complex networks

- Operational research

This study investigates the influence of Environmental, Social, and Governance (ESG) scores on the clustering and community formation of companies within various network models. Using daily closing prices of 78 companies operating in the Borsa Istanbul Sustainability Index, we constructed correlation, mutual information (both continuous and discrete), and causality (both linear and nonlinear) networks to analyse intercompany relationships. We performed community detection using the Leading Eigenvector and Girvan–Newman methods, which revealed that companies within the same sector, particularly in the financial and manufacturing sectors, tend to form tight-knit communities. These intra-sectoral clusters reflect strong market behaviour correlations driven by sector-specific factors. Additionally, mixed-sector communities highlighted the presence of significant inter-sector dependencies. To assess the impact of ESG scores on these communities, nonparametric tests such as the Kruskal–Wallis, Conover, and log-rank were applied. Results showed that specific ESG factors, including emission, CSR strategy, innovation, and human rights, significantly influenced community formation. For instance, companies with strong performance in emission reduction and CSR strategies were found to form more cohesive communities, emphasizing the role of sustainability in shaping financial networks. Study findings underscore the critical role of ESG factors in financial market dynamics, promoting sustainable investment practices by highlighting the importance of integrating ESG considerations into investment decisions. These results suggest that sustainability metrics not only affect individual company performance but also contribute to the formation of interconnected communities with shared sustainability practices.

Similar content being viewed by others

Assessments of the environmental performance of global companies need to account for company size

A multilevel analysis of financial institutions’ systemic exposure from local and system-wide information

Measuring system resilience through a comparison of information- and flow-based network analyses

Introduction.

Understanding market dynamics requires a deep knowledge of financial networks, which offer a comprehensive and detailed view of the relationships and interactions between various market entities such as stocks, industries, and organizations. We construct these networks by discovering and evaluating the connections between different financial instruments and entities using measures such as price correlations, trade volumes, and other relevant financial data. By undertaking this action, they reveal the market structure and provide significant insight into the interplay between different factors (Chi et al., 2010 , Guo et al., 2018 , Karpman et al., 2023 , Shirokikh et al., 2022 ).

Through the analysis of financial networks, researchers and analysts can identify patterns of connectivity that are not immediately apparent from raw data alone. For example, they can detect clusters of highly interconnected stocks that tend to move together, known as communities or modules, which often correspond to specific sectors or industries. These clusters can highlight sectoral interdependencies and information flow within and between different parts of the market (Raddant and Kenett, 2021 , Pazitka et al., 2021 , Upadhyay et al., 2020 ). Additionally, financial networks can reveal key nodes or hubs, which are entities with a high degree of connectivity that play a significant role in the overall stability and functionality of the market. Identifying these influential nodes is crucial for understanding systemic risk and potential points of vulnerability within the financial system.

The analysis of financial networks also enables the study of information flow and influence among market participants. By examining how information or shocks propagate through the network, analysts can gain insights into the mechanisms of market reactions and the spread of financial contagion. This understanding is critical for predicting market behaviours, as it allows for the anticipation of how different parts of the market may respond to various stimuli, such as economic news, policy changes, and geopolitical events.

In recent years, Environmental, Social, and Governance (ESG) factors have emerged as vital considerations in financial decision-making. ESG factors encompass a wide range of criteria that assess a company’s performance beyond traditional financial metrics. Environmental factors include a company’s impact on the environment, such as carbon emissions and resource usage. Social factors evaluate how a company manages relationships with employees, suppliers, customers, and the communities in which it operates. Governance factors examine a company’s leadership, executive pay, audits, internal controls, and shareholder rights.

The growing prominence of ESG factors in financial analysis reflects a broader shift towards sustainable and responsible investing. Investors are increasingly aware that companies with strong ESG performance are better positioned to manage risks, capitalize on opportunities, and achieve long-term financial success. Studies have shown that integrating ESG metrics into financial analysis can lead to more resilient investment portfolios (Ma 2023 , Naffa and Fain 2020 ). Companies with high ESG ratings tend to have lower volatility, higher profitability, and better long-term returns compared to their peers with poor ESG performance. Moreover, the integration of ESG metrics is recognized for promoting sustainable investment practices. By considering ESG factors, investors can identify companies that are committed to sustainability and ethical practices, which can lead to positive social and environmental outcomes. This approach not only aligns with the growing demand for corporate responsibility but also enhances the resilience of financial markets. Sustainable investment practices can help mitigate risks associated with environmental degradation, social unrest, and poor governance, thereby contributing to the stability and health of the financial system.

Despite the extensive research on financial networks, there remains a significant gap in understanding how ESG factors influence the formation and dynamics of networks. Traditional financial network studies primarily focus on metrics such as price correlations, trading volumes, and return dependencies to analyse market structures and predict behaviours. While these studies provide valuable insights into the interconnectedness and risk propagation within financial markets, they often overlook the integration of ESG metrics, which can offer a more comprehensive understanding of market dynamics.

Existing studies frequently miss the critical role that ESG factors play in shaping the relationships between market entities. ESG metrics encompass a range of non-financial factors that reflect a company’s long-term sustainability and ethical practices, such as carbon footprint, labour practices, board diversity, and transparency. By excluding these factors, current research may fail to capture the full spectrum of influences that drive market behaviours and interdependencies. For instance, companies with strong environmental practices might be more interconnected due to shared sustainability goals, leading to distinct community structures that are not apparent when only financial data are considered.

The integration of ESG metrics into financial network analysis can provide insights into how sustainability practices affect market interconnectivity and community structures. Companies that prioritize ESG criteria may exhibit different connectivity patterns, forming clusters based on shared environmental initiatives, social responsibilities, or governance standards. This can reveal hidden dependencies and relationships that traditional financial metrics might miss, such as the tendency for companies with robust ESG practices to be more resilient during economic downturns or crises due to better risk management and ethical governance. Furthermore, understanding the impact of ESG factors on financial networks can enhance the predictive power of these models. Incorporating ESG metrics can help identify systemic risks and opportunities that are not evident through financial data alone. For example, a network analysis that includes ESG factors might reveal that companies with poor environmental practices are more susceptible to regulatory changes or public backlash, leading to greater market volatility and risk of contagion. Additionally, the integration of ESG metrics into financial network analysis can inform more sustainable investment strategies. Investors increasingly seek to align their portfolios with ethical and sustainable practices, and understanding the role of ESG factors in financial networks can guide them in identifying companies and sectors that are not only financially robust but also committed to long-term sustainability. This can lead to more informed investment decisions that support both financial returns and positive societal impacts.

This study aims to bridge the gap in existing research by investigating the impact of ESG scores on clustering and community formation within various financial network models. The primary objective is to integrate sustainability metrics into the analysis of financial networks to provide a more comprehensive understanding of market dynamics. By incorporating ESG factors, the study seeks to uncover how environmental, social, and governance considerations influence intercompany relationships and the formation of distinct communities within these networks.

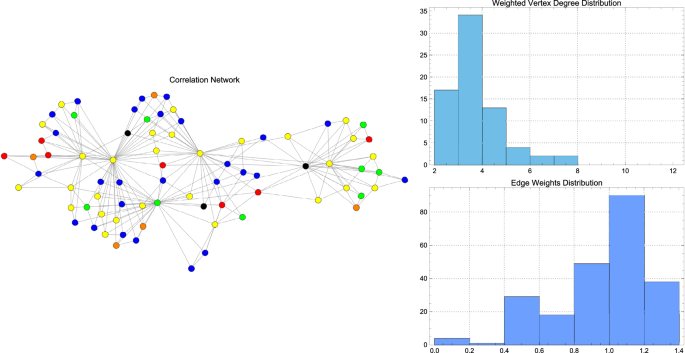

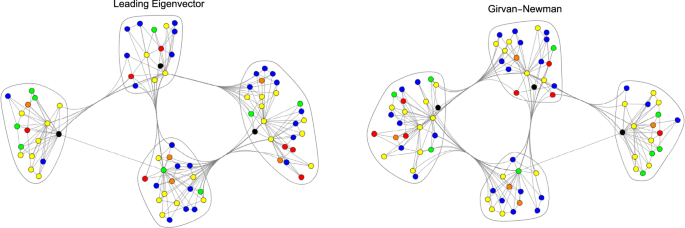

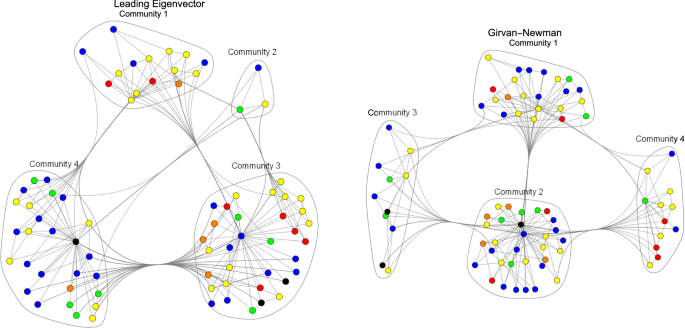

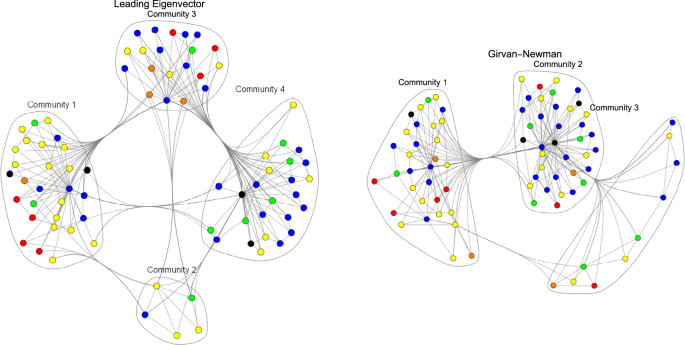

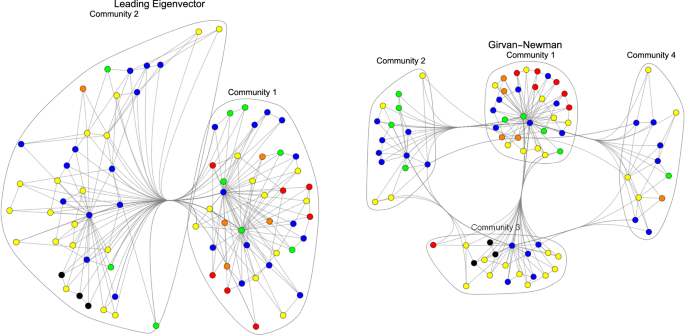

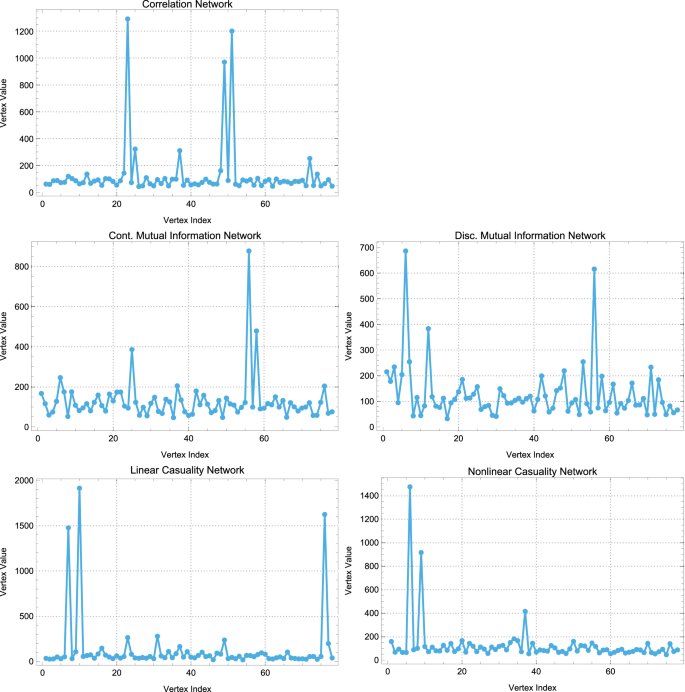

To achieve this, the study employs several sophisticated network models, each offering a unique perspective on intercompany relationships. First, correlation network models will be utilized to identify how company stock prices move in relation to one another. In these models, edges represent the degree of correlation between the daily closing prices of different companies, with higher correlations indicating stronger connectivity. This approach will help detect sectoral clusters where companies within the same sector, such as finance or manufacturing, exhibit similar stock price movements due to shared economic factors.

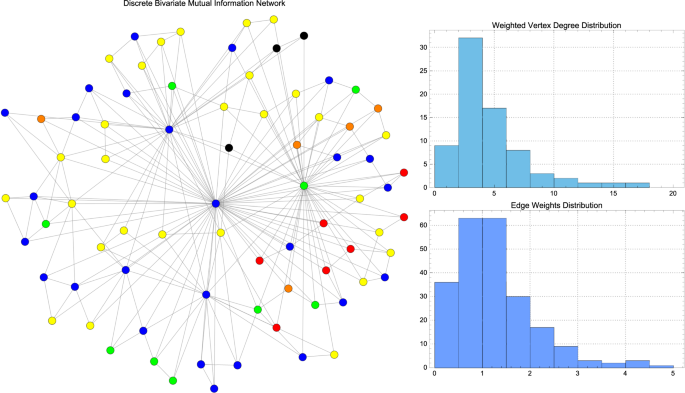

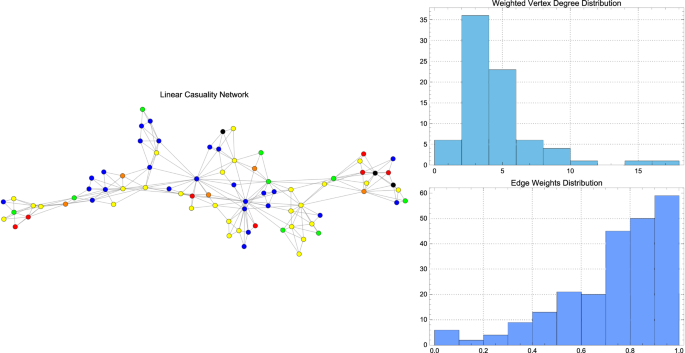

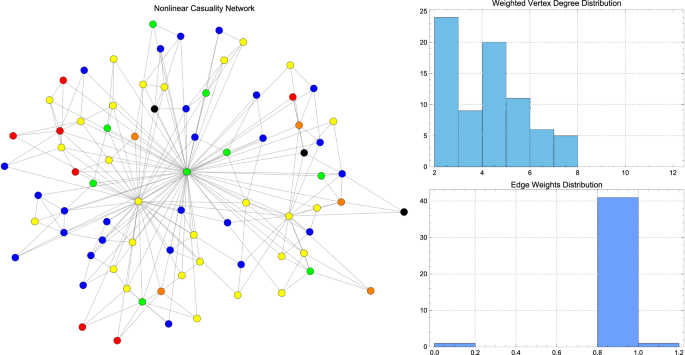

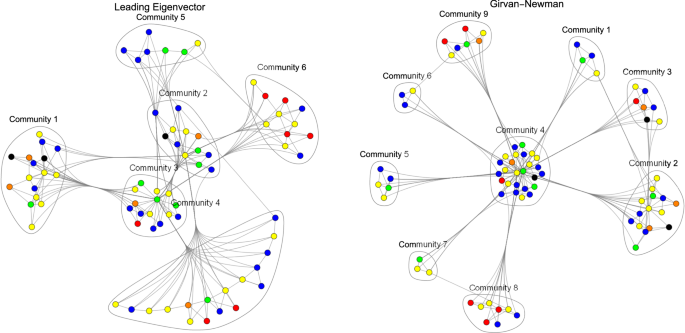

Subsequently, the study will utilize mutual information network models to collect and analyse both linear and nonlinear connections among stock values of different companies. By employing both continuous and discrete mutual information, these networks will surpass basic linear correlations to uncover intricate interdependencies and information exchanges among organizations. This approach seeks to reveal insights into the impact of information flow and common market behaviours on community structures, potentially showing important inter-sectoral linkages. Furthermore, causality network models will be utilized to comprehend the directional effects among stock values of different organizations. These models will illustrate how fluctuations in the stock price of one firm can forecast those of another firm, thus capturing the cause-and-effect interactions within the market. We will conduct both linear and nonlinear causality analyses to obtain a full understanding of these interdependencies.

To assess the influence of ESG metrics on community structures, the study will employ nonparametric tests, including the Kruskal–Wallis, Conover, and log-rank tests. These tests are particularly suitable for this analysis as they do not assume a specific distribution for the data, making them robust tools for evaluating relationships between ESG scores and community formation.

Through this multifaceted approach, the study aims to provide valuable insights into the role of ESG factors in shaping financial networks. By understanding how sustainability metrics influence market connectivity and community structures, the findings of this study can inform more sustainable investment practices and contribute to the development of resilient and responsible financial markets.

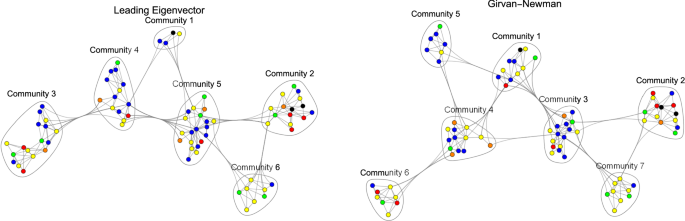

Study findings reveal distinct patterns of interconnectivity among companies across different network models. Correlation networks highlight strong sectoral linkages, particularly within the finance and manufacturing sectors. Mutual information networks provide insights into both intra- and inter-sector dependencies, while causality networks demonstrate predictive relationships in stock price movements. The nonparametric test results indicate that ESG factors such as Emission, CSR Strategy, Innovation, and Human Rights significantly influence community formation, suggesting that companies with strong performance in these areas tend to form more cohesive communities.

The remainder of this paper unfolds as follows: section “Literature review” embarks on a comprehensive literature review, laying the groundwork for our study. Section “Methodology” delves into the methodology, detailing the construction of network models and the application of community detection methods. In the section “Results”, we introduce the dataset and provide an in-depth analysis of the influence of ESG sub-scores on overall ESG performance. This section then transitions into a detailed presentation and discussion of network and community results. Section “Discussions” explores the nonparametric tests employed to evaluate the impact of ESG scores, offering a detailed analysis of findings. Finally, the section “Conclusions” ends the study with a summary of key insights and thoughtful suggestions for future research directions.

By integrating ESG factors into financial network analysis, this study not only enhances understanding of market dynamics but also promotes sustainable investment practices. The insights gained from this research can guide investors and policymakers in fostering more resilient and socially responsible financial markets.

Literature review

Understanding the role of Environmental, Social, and Governance (ESG) factors in financial networks is essential for grasping the complexities of market dynamics and sustainable investment practices. This literature review synthesizes insights from recent studies on the integration and impact of ESG metrics within financial networks.

Kim and Li ( 2021 ) explored the relationship between ESG factors and corporate financial performance, showing that higher ESG scores were linked to increased profitability and better credit ratings, particularly in large firms and those with strong governance practices. Similarly, Sinha et al. ( 2019 ) conducted a meta-analysis of 100 studies, confirming that ESG integration generally led to improved financial performance across different geographic domains. Aybars et al. ( 2019 ) demonstrated a significant positive relationship between ESG scores and return on assets for S&P 500 firms, highlighting the importance of ESG factors in enhancing operational performance. Additionally, Caporale et al. ( 2022 ) analysed the impact of ESG factors on financial performance and found that ESG scores significantly enhanced financial stability and resilience against market shocks. Luo et al. ( 2024 ) examined the integration of ESG metrics into portfolio management and found that ESG-oriented portfolios outperformed traditional ones, particularly in volatile markets.