Updated Website Design for Convenience

Updated Website Design for Convenience

- Model Letters

- Speak with Alan

- Being “Managed Out?”

- Share Website

Expatriate Assignments – The 18 Mandatory Requests

- Post author: Alan L Sklover

- Post published: 01/18/06

“Some travel advice, from one who knows: take twice the cash, and half the clothes.” – Anonymous

ACTUAL CASE HISTORY: Dennis was considered a rising star in the field of financial management software. At 39, he’d risen steadily over the years, and now worked for the third largest financial management software distributor in the U.S. As his company’s National Sales Manager, he had taken company sales higher and higher for four years straight. He’d also expanded sales into the area of financial management for non-profit organizations, a fast-growing niche. His future seemed very bright.

His company’s sales in Europe, though, had lagged repeatedly. Despite several changes in their European sales leadership, sales volume continued to disappoint. When the company’s CEO asked Dennis if he’d consider a two-year stay in Germany to rebuild the European software sales team from the ground up, Dennis was receptive. His wife was supportive, and since the kids were just 5 and 8, they seemed still young enough to be very adaptable. Dennis and his wife viewed the assignment as a great career opportunity, as well as a great family adventure. And that it was.

Four months later, Dennis, his wife and the kids had arrived in Dusseldorf, Germany, a charming yet vital city. They’d leased their home in Dallas for the two-years they were to be away. The kids were in an English-speaking school attended by other elementary-age sons and daughters of other expatriate parents. Their Dusseldorf house was leased for them, and even the household help were arranged by the company’s local representatives. Dennis planned to revamp the European sales team from the bottom up, one by one, with local salespeople to be identified by local executive recruiters. Initial hiring efforts were promising.

Then came the truly unexpected: seven months into the new assignment, with little warning of any kind, the company was sold to a French conglomerate, with their own ideas about European software sales, and their own Director of Sales, too. Dennis was notified that his services were no longer needed, but that he would be given a fair and reasonable severance package. Dennis inquired about arrangements for his family’s return to Dallas, including such things as return flights home, shipping the family’s belongings, and finding his family a home in the Dallas area. He was assured that all of his concerns would be addressed.

The rest was, as we say, “not nice.” Dennis was presented with a separation agreement that, he was told, had to be signed before he could find out what assistance he and his family would receive in returning home. When Dennis balked at signing it, his salary payments were halted. Then tuition payments stopped. Even their housekeeping services were withdrawn. The people who’d assured him he’d always be treated like “family” were, themselves now “divorced” from the company. HR representatives who he knew for years told him they were powerless to intervene. Dennis was now dealing with people at the new parent company he’d never worked with before. Unfortunately, he had nothing in writing that would give him a legal right to anything.

LESSON TO LEARN: An overseas, “expatriate” assignment can be a “feather in your cap,” a step in the path toward being assigned greater responsibilities. But going “expat” involves a multitude of risks, and unusual ones at that. If there’s ever a time to “fold your parachute first,” it’s before you “fly away” on an overseas assignment, taking your family, your household, and your career with you. While the vast number of expatriates who travel overseas come home with fair, reasonable and proper treatment, those who get into difficulties in this regard find themselves in some of the most difficult and harrowing circumstances you might imagine. Before you make the move to an overseas assignment, there are certain requests you must make, and certain written assurances you shouldn’t leave home without. Whether your company has a comprehensive expatriate program or none whatsoever, before agreeing to take the overseas assignment offered to you, consider our “Expatriate’s18 Mandatory Requests.”

WHAT YOU CAN DO: These are the items we suggest our clients raise, and hopefully resolve in a written agreement of some kind, before agreeing to take an overseas assignment.

A. Finance and Career-Related

1. Salary Differential: You may find that, while your present salary suffices to provide you and your family with a comfortable lifestyle stateside, that same salary wouldn’t provide anywhere near that standard of living in, say, Singapore, Hong Kong or Tokyo. Your best bet is to speak with other American “expats” presently living in your country of assignment to get their view of the comparison, and necessary differential.

2. Tax Equalization: How would you like to be hit with income tax bills based on your compensation from each of two different countries? That may happen unless someone with expert knowledge makes sure it doesn’t, and will be there in case it does. Most companies provide “tax equalization,” which means that they’ll make sure that your after-tax income – no matter what – is equal to what it would have been if you’d stayed stateside. These are very tricky calculations, made only by very few accountants with special knowledge and expertise in this field, who need to be familiar with the laws of many countries. Only three or so large firms do this kind of work. It’s doubtful your own personal accountant can help you here. Remember that for the calendar year 2006, for example, you may need this specialized assistance – at the company’s expense, hopefully – for a tax audit in 2010.

3. Minimum Term and/or Notice: Knowing that you will be employed for at least a minimum period of time, and/or knowing that you will have at least a certain amount of notice before termination, are two important “risk-limiters” we always seek. Nowhere are they more important than in expatriate assignments. Whether it’s until the end of your children’s semester at private school, or the time you think it might take to find a new position – from 5,000 miles away – you should seek these.

4. Currency Swing Risk: Do your remember the Russian bond default of 1998, or the Asian currency crisis of 1997? They each wreaked havoc in currency markets around the globe. If such things do happen again – and you can depend on that happening, sooner or later – who is more capable of absorbing the risk of your salary becoming insufficient to pay your bills in another country: your family or your employer? This substantial risk should be addressed before you venture overseas.

5. A Job When You Return: This is one of the most difficult requests to make, and to get written assurances about, but nonetheless the largest risk you face in taking an overseas assignment. Once you’re “out of sight,” you tend to become “out of mind,” and at times available positions become few and far between. Will a position be found for you, no matter what? That’s the question.

Before you even consider “leaping” to another country, get a copy of our 138-Point Master Guide and Checklist for Employees Contemplating Expatriate Assignments . Everything you forgot to ask about, and for, and then some! To obtain a copy, just [ click here .] Delivered by Email – Instantly!

B. Travel and Moving Related

6. Flights, etc.: Necessary flights you may need include (a) for initial house hunting, (b) your actual relocation, (c) flights home 2 or 3 times a year for holidays and the like, (d) flights home for family and medical emergencies, (d) flights home for reverse house hunting, and (e) for your return, preferably to the U.S. city of your choice (as your next job may be in a different city than you came from.) Your flight-rights will need to cover your immediate family, at the least. For those with kids in college, you may need to arrange special trips for them to come to visit you. Will you fly first class or red-eye in coach? Will you be provided tickets, or reimbursement one year later?

7. Shipping and Storage of Household Goods: Beware of limits to be placed upon the extent of your moving household goods. Expect that you won’t be provided any assistance for storage, unless you ask. Consider seriously requesting either a greater allotment for shipping, an allotment for storage, or simply a budget for purchasing new household goods in your country of assignment.

8. Home Sale Expense and Loss Protection: It is not unusual at all for an employer to cover the home-sale costs and potential losses an employee may suffer in taking an overseas assignment. These commonly include realtor fees, legal costs, and local transfer taxes. For senior executives, in particular, these may include the increased price of buying an equivalent home after repatriation.

9. Emergency Leave Policy: Over the course of a year or two, you can expect emergencies of one type or another to arise that require that you travel to your home. These may include family illnesses, deaths of friends or loved ones, even lawsuits. Some companies cover the cost of travel in these circumstances, some subsidize such travel, and some don’t help at all. Don’t be shy about asking about your company’s policy, if any, and don’t be shy, again, if it is not to your liking.

C. Local Life and Housing Related

10. Housing Allowance: It’s uncommon for a temporarily-assigned executive to purchase a home during a relatively short-term assignment. Some companies own homes they provide to “expat” executives, but most expect their executives to find and rent their own housing. Especially for a family with children, this often proves prohibitive. In addition to outright salary differential, a specified housing allowance is preferable, and should be requested.

11. Tuition Allowance: Those with school-age children need to make arrangements for local schooling. Most cities of significant size have English-speaking private schools for expatriate children. In smaller cities, private tutoring may be the only education alternative. Both of these alternatives will require sufficient tuition allowance.

12. Local Club Memberships: In locales where the local culture is very different than your own, or security is a grave concern, it’s not uncommon to see social clubs set up for the international expatriate community. One good example is Saudi Arabia, where socializing in “public” is really not feasible. The social clubs are often quite expensive; their dues should either be paid for you, or at the least subsidized.

Look Before You Leap! We offer a Model Memo Requesting All Necessary Clarifications and Protections When Considering an Expatriate Assignment that you can adapt for your own use. “What to Say and How to Say It.”™ To get your copy, just [ click here .] Delivered by Email – Instantly!

13. Local Critical Care and Support: If a problem of a critical nature arises, will your company provide you with (a) local legal help, (b) local medical help, (c) emergency flight for distant medical help, (d) private security if appropriate, (e) evacuation in tense political, weather or earthquake situations? We often forget how fortunate we are in the U.S., and how those in other countries have daily concerns like these.

D. Legal and Technical Matters

14. Immigration Matters: When crossing borders, visas, work permits and the like can be maddening. In some countries, under certain visas you cannot remain in the country more than 24 hours after you’ve lost your job. Will the company provide you with immigration attorneys BOTH when you leave and when you come home? Will they reimburse you for your own immigration expense? Don’t ever expect sympathy or flexibility from border guards, or immigration officials.

15. Identity of Employer: This issue usually surprises people, because it is just so unanticipated. Many companies operate overseas through local subsidiaries for tax, regulatory and legal reasons. To accomplish this, expatriated executives are sometimes “assigned” or “seconded” to the local subsidiary, who employs them. This can have profound consequences to the executive, including the loss of protection of U.S. laws, the cessation of stock and stock option vesting, and removal from the parent company’s other benefit plans (such as long term disability, pension, and bonus.)

16. Continuing Obligations: In our efforts to limit risks, we request that the matters noted in this memo be raised with employers sending employees on overseas assignments. Certain of the obligations that we ask employers to assume are different than the others, in that they need to expressly continue past any possible employment termination. This is so because after employment ends, unless it is agreed otherwise, all obligations from employer to employee, and vice versa, cease; there’s no implied agreement to continue providing services or fulfilling obligations. As just two examples, (a) if your employment is terminated by your employer, will your employer pay for the accountants to prepare your “equalized” tax returns in the following year?, and (b) if your employment is terminated by your employer, will your employer pay for the costs of breaking a local apartment lease? The items in this list that, more than others, need to expressly survive employment termination are 2, 6, 7, 8, 10, 11, 12, 14, 15 and 17.

17. Binding on Successors and Assigns: In most every commercial agreement, the parties provide that the obligations are binding on the parties’ successors and/or assigns. That means that, if a company buys your employer, or even its assets, then the purchasing company is responsible for the obligations of the purchased company. In these days of mergers and acquisitions, this is a very important risk limiter for expats.

There are many rewards to taking on, experiencing and fulfilling overseas assignments. But in every transaction, there’s something more than “rewards” that we need to focus on: “risks.” In our employment negotiations, a critical part of our efforts is always devoted to “risk limitation.” That’s why it’s always a central part of our negotiating Method, SkloverWorkingWisdom™. Those considering expatriate assignments must pay special attention to risk limitation, and this is how they need to do that.

These are not all of the risks faced by expatriate executives, but they are the primary ones that we’ve seen cause our clients the most serious problems. Every person, every assignment, every company and every transition has unique problems. You should try to customize your solutions to the particular concerns you have about your particular circumstances.

P.S.: Stuck Far Away and Under Trying Circumstances? We offer a Model Letter to Senior Management and Board of Directors regarding Untenable Expat Circumstances that you can adapt for your own situation. “What to Say and How to Say It.”™ To obtain a copy, just [ click here .] Delivered by Email – Instantly!

SkloverWorkingWisdom™ emphasizes smart negotiating – and navigating – for yourself at work. Moving upward in salary and in position over time take more than luck, and even more than success. It takes care and prudence in avoiding costly errors and mistakes, too.

Always be proactive. Always be creative. Always be persistent. And always do what you can to achieve for yourself, your family, and your career. Take all available steps to increase and secure employment “reward” and eliminate or reduce employment “risk.” That’s what SkloverWorkingWisdom™ is all about.

Share this article:

- Click to share on Facebook (Opens in new window)

- Click to share on Twitter (Opens in new window)

- Click to share on LinkedIn (Opens in new window)

- SUGGESTED TOPICS

- The Magazine

- Newsletters

- Managing Yourself

- Managing Teams

- Work-life Balance

- The Big Idea

- Data & Visuals

- Reading Lists

- Case Selections

- HBR Learning

- Topic Feeds

- Account Settings

- Email Preferences

5 Tips for Managing Successful Overseas Assignments

- Andy Molinsky

- Melissa Hahn

Stay in constant touch and have a plan for their return.

Sending talented employees overseas can be a promising way to leverage the benefits of a global economy. But expatriate assignments can be extremely expensive: up to three times the cost of a person’s typical annual salary, according to some statistics. And despite the investment, many organizations lack the know-how for optimizing the potential benefits, leaving them disappointed with the results. The unfortunate reality is that even companies providing well-crafted relocation packages (including the all-important cultural training) may not have the talent management mechanisms in place to truly leverage the valuable skills expatriate employees gain during their assignments.

- Andy Molinsky is a professor of Organizational Behavior and International Management at Brandeis University and the author of Global Dexterity , Reach , and Forging Bonds in a Global Workforce . Connect with him on LinkedIn and download his free e-booklet of 7 myths about working effectively across cultures .

- Melissa Hahn teaches intercultural communication at American University’s School of International Service. Her new book, Forging Bonds in a Global Workforce (McGraw Hill), helps global professionals build effective relationships across cultures.

Partner Center

| Please enter a username |

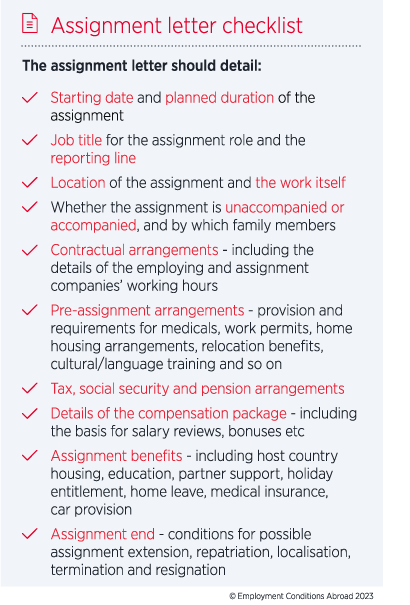

Writing an assignment letter

So, how detailed should an assignment agreement be? The answer is as detailed as possible. The assignment letter should be a legally binding document, confirming the agreement between the company and the assignee with respect to the terms and conditions of the assignment. In reality, the most common approach is that the assignee remains employed with the home company and the home employment contract remains in place. However, the assignment letter serves as an addendum to the employment contract and confirms the terms and conditions which vary from the normal contract while on assignment. Any terms and conditions not specifically varied therefore remain as per the home employment contract.

Most of the checklist items opposite will require considerable scoping – particularly if no assignment policy exists, but making well outlined provisions will prove worthwhile. The extent to which each item should be explained is illustrated below for three key areas.

Compensation, tax and pension arrangements

This is possibly the most complex and important part of the assignment letter and must clearly explain how the assignee will be compensated while on assignment. If the company uses a build-up or balance sheet approach, this section of the agreement will confirm details such as the home notional salary, cost of living adjustments, assignment and location allowances and, of course, the assignment salary. It should be confirmed whether the assignment salary is guaranteed net or gross, as well as where and how it will be delivered, i.e. through which payroll, in which currency, details of split pay arrangements, exchange rates, etc. If the company has a variable pay structure details of how bonus and incentive payments will be calculated and delivered while on assignment must also be included. The process for salary reviews must also be explained, as well as the treatment of assignment compensation for tax and social security. Assignees will normally remain in home country social security plans while on assignment, subject to the relevant regulations, and this should also be confirmed in the assignment letter. This section of the agreement will also give details of the tax services provided to the assignee, e.g. departure and arrival meetings, tax return preparation, etc. And finally, the pension arrangements should be confirmed. Of course, if the assignee is to be compensated according to a different approach, e.g. the assignment salary is based on the local compensation levels of the host location as opposed to the build-up method, similar details to the ones described above should be given, which confirm the assignment compensation and tax treatment

Assignment benefits

The most significant benefits, both in terms of cost to the company as well as value to the assignee, are education allowances for the assignee’s children and host country accommodation. The assignment letter should clearly explain the level of benefits provided and how they are delivered, i.e. in-kind or in cash, bearing in mind the most tax effective form of delivery for the company depending on host country tax legislation. Tax charged on assignment benefits can be considerable, sometimes up to 50% of total assignment costs. With education benefits it is important to state the type of schooling for which the company will provide assistance. If there are limits on the amount up to which the company will pay for education, or limitations on the choice of schools, this should be confirmed. Similarly, the limits up to which the company will pay for host country accommodation must be set out clearly. The letter should also clarify what happens if the assignee chooses accommodation below or above the set rental limits.

End of assignment

If there is the possibility of an assignment extension beyond the initially-agreed term, the applicable policy should be detailed here. Most importantly, a maximum duration beyond which the assignment will not be extended should be indicated. This avoids situations where employees become “permanent” assignees, remaining on assignment terms and conditions well beyond five years, which is generally the most common maximum assignment duration. It is also good practice to give details of the company’s localisation policy in this section. It may well suffice to confirm that a localisation policy may be applied once the maximum assignment duration has been reached, without having to give too many details on the actual process. But by mentioning the possibility of localisation in the letter, assignees’ expectations are managed and they are aware that assignment terms will not continue indefinitely. In the repatriation section the agreement should confirm the relocation assistance provided; e.g. shipping, temporary accommodation, relocation lump-sums, etc. Furthermore, this section should confirm the process and time scales for finding a suitable position for the assignee upon returning home. Finally, assignment letters rarely differentiate between terminating or resigning from the assignment, as opposed to terminating or resigning from the actual employment with the company. It is good practice to include the relevant terms and notice periods for each of these scenarios here and to differentiate accordingly. Terminating the employment of an assignee can be complicated and this section of the agreement should be very well thought through. Unfortunately, the governing labour law is often unclear or not straightforward to determine. A company should always seek legal advice should a labour dispute arise.

Need help with assignment letters? ECA's Consultancy & Advisory team are on hand to critique your company's assignment letters or create assignment letter templates in line with your policy, as well as offer expert advice and guidance on content so that your assignment letters accurately manage the expectations of the employee and the company. If you'd like to speak with one of our Consultants, you can request a callback here .

- Practical Law

Expatriate Secondment Letter of Assignment

Practical law standard document 4-525-9389 (approx. 12 pages), get full access to this document with a free trial.

Try free and see for yourself how Practical Law resources can improve productivity, efficiency and response times.

About Practical Law

This document is from Thomson Reuters Practical Law, the legal know-how that goes beyond primary law and traditional legal research to give lawyers a better starting point. We provide standard documents, checklists, legal updates, how-to guides, and more.

650+ full-time experienced lawyer editors globally create and maintain timely, reliable and accurate resources across all major practice areas.

83% of customers are highly satisfied with Practical Law and would recommend to a colleague.

81% of customers agree that Practical Law saves them time.

- Contracts of Employment

- Immigration

- Pay and Benefits

- ACC Communities

The Association of Corporate Counsel (ACC) is the world's largest organization serving the professional and business interests of attorneys who practice in the legal departments of corporations, associations, nonprofits and other private-sector organizations around the globe.

Expatriate Assignment Agreement

This is a sample expatriate assignment agreement between a US company and an employee, including clauses pertaining to expatriation such as salary, employee benefits, mobility premium, housing and utilities allowance, goods and services allowance, language training allowance, furnishings and appliances allowance, pre-move trip allowance, household goods transportation and storage expenses, relocation travel expenses, relocation allowance, temporary housing, vacation, home leave air fare reimbursement, repatriation, immigration/visa assistance, will preparation, compensation leave, tax equalization, and tax preparation. This sample is in connection with the context of an employment agreement.

Members-only access

Not an acc member, you may also be interested in, related events.

View our open positions

Read our latest Insights

View all our Services

Expat tax focus: sending a us employee to germany, part 2 of 2.

In my last post, I described a typical scenario involving a US company sending a US national to Germany on an assignment lasting between one and two years. I also gave an overview of German tax-residency laws under the US-Germany double tax treaty. In part two of this two-part series, I’ll discuss drafting an expat assignment letter and how to ensure that your company fulfills both its US and German tax obligations during your expat’s stay in Germany.

The assignment letter

Before sending an employee to Germany, your company should set out all the terms and conditions of the assignment in writing. This document is commonly known as an assignment letter, and it should include:

- The period of the assignment.

- The names and addresses of all parties to the contract.

- The annual gross salary and benefits of the expat, along with any housing allowance, relocation costs, and travel costs.

- The period of notice of the assignment agreement (in case either party wishes to terminate the assignment before the scheduled/initially agreed completion date).

- Annual vacation allowance.

- Work schedule.

- Place of work.

- Any applicable collective labor agreements.

- Assistance with tax forms (if your company intends to provide it).

- Confirmation that health coverage in Germany will be provided (or not).

The above list is by no means exhaustive. For example, other provisions of an assignment letter might include terms and conditions related to: payments to a foreign bank account; salary paid in a foreign currency; and the taxation of bonuses paid in one country for services performed while in another country.

A reminder that in part one of this series, I listed the assumptions of our expat scenario. Those included following a tax-equalization policy, so your company will be on the hook for compensating the expat for any tax losses he or she incurs while on assignment (relative to what the expat would have paid in taxes had he or she stayed home). Given this, your company should carefully review the tax effectiveness of the expat’s remuneration package when drafting the assignment letter. In addition to the expat’s base salary, the following items may influence the tax burden of the package:

- Fringe benefits.

- A bonus and/or premium (e.g., foreign service premium).

- Allowances (e.g., for cost of living or housing).

- Reimbursements (e.g., for language training or home leave).

US federal, state and hypo taxes

When your expat is on assignment in Germany, you may stop remitting federal taxes to US authorities for those amounts regarded as “foreign-earned income,” provided our initial assumptions are met and the expat is considered to have established a “tax home” in Germany. In such cases, the employee will be required to provide the company with a completed IRS Form 673.

To determine if your company may stop remitting taxes to US state (as opposed to federal) authorities for your expat’s foreign-earned income, you’ll need to consult applicable state law, as each state has its own related rules. In some cases, state remittance (like federal) may cease for the duration of the assignment.

US employers should note that though federal and state tax remittances may be stopped in some scenarios for the duration of the expat’s assignment in Germany, this does not mean that tax withholding on the expat’s pay will also stop. The tax-equalized expat in our scenario will continue to have his or her state and federal taxes withheld at source, and your company will use these tax withholdings to cover the liabilities arising in Germany. This process is also known as hypothetical tax withholdings — or more simply as “ hypo taxes ” — since the taxes are not actually being remitted to US authorities but are used instead to pay for taxes due in the host location (Germany). Finally, it’s a virtual certainty that the hypo taxes collected will not equal the amounts actually due in Germany. As a result, when following a tax-equalization policy, your company will likely have to make up for tax burdens incurred by the expat employee, as tax rates in Germany are typically higher than those in the US.

Taxes for FICA (social security and Medicare) and 401(k) plans

In addition to the tax treaty in place between the US and Germany (mentioned in part one), the US and Germany have also entered into a social security treaty (known as a “Totalization Agreement”). As long as the expat abides by the provisions of the agreement and obtains a Certificate of Coverage, he or she will not be liable for paying German social security taxes to German authorities. The expat will continue to make US FICA and 401(k) contributions while on assignment. Your company can place the FICA and 401(k) contributions in US accounts, while simultaneously paying the expat’s salary in German currency to a German bank.

German taxes

In our scenario, your expat employee will likely need to file a German tax return and go on a payroll run by your German entity. This kind of payroll is usually called a “shadow” payroll. That is, the US expat will remain on the US payroll, and an additional “shadow” payroll will be established in the host country to track the expat’s compensation and make tax payments to local authorities. In some situations, a shadow payroll may not be necessary and the liabilities due in Germany can be settled via quarterly prepayments (which may also turn out to be a most cost-effective solution than running a “shadow” payroll).

It should be clear by now that there are myriad expat taxation scenarios, whether you’re sending an employee to Germany or to virtually any other country. And almost any company, regardless of size or industry, will benefit from consulting with an expert prior to sending an employee abroad. An expert on global mobility issues will not only ensure you minimize compliance risks and maximize company tax benefits, they’ll also help you protect your valuable employees from potential tax penalties and provide them with a competitive compensation package. This in turn will help you retain and attract top talent in an increasingly competitive global marketplace.

Read part one of this series.

Related services

The contents of this article are intended for informational purposes only. The article should not be relied on as legal or other professional advice. Neither Vistra Group Holding S.A. nor any of its group companies, subsidiaries or affiliates accept responsibility for any loss occasioned by actions taken or refrained from as a result of reading or otherwise consuming this article. For details, read our Legal and Regulatory notice at: https://www.vistra.com/notices . Copyright © 2024 by Vistra Group Holdings SA. All Rights Reserved.

Got a question?

Get in touch.

- Vistra on Twitter

- Vistra on LinkedIn

- Vistra WeChat

Register for our monthly Insights newsletter

Get regular updates on developments shaping global business, private equity and more.

Expatriate Agreement: Definition & Sample

Jump to section, what is an expatriate agreement.

An expatriate agreement is a contract between a company and a foreign or migrant worker where the employer offers an international job to the worker. In other words, an expatriate agreement involves a company relocating a worker from one country to another for business purposes. Typically, the expatriate agreement includes details about how many employees are to be hired, what their compensation will be, and whether they are contracted to work for a certain period of time or not.

This type of agreement ensures that the expatriate and employer understand the terms of the agreement. It also gives each party recourse in the event that any terms of the contract are violated.

Common Sections in Expatriate Agreements

Below is a list of common sections included in Expatriate Agreements. These sections are linked to the below sample agreement for you to explore.

Expatriate Agreement Sample

Reference : Security Exchange Commission - Edgar Database, EX-10.29 2 dex1029.htm EXPATRIATE EMPLOYMENT AGREEMENT , Viewed September 15, 2022, View Source on SEC .

Who Helps With Expatriate Agreements?

Lawyers with backgrounds working on expatriate agreements work with clients to help. Do you need help with an expatriate agreement?

Post a project in ContractsCounsel's marketplace to get free bids from lawyers to draft, review, or negotiate expatriate agreements. All lawyers are vetted by our team and peer reviewed by our customers for you to explore before hiring.

ContractsCounsel is not a law firm, and this post should not be considered and does not contain legal advice. To ensure the information and advice in this post are correct, sufficient, and appropriate for your situation, please consult a licensed attorney. Also, using or accessing ContractsCounsel's site does not create an attorney-client relationship between you and ContractsCounsel.

Meet some of our Expatriate Agreement Lawyers

Brad is a business attorney with experience helping startup and growing companies in a variety of industries. He has served as general counsel for innovative companies and has developed a broad knowledge base that allows for a complete understanding of business needs.

I am an attorney located in Denver, Colorado with 13 years of experience working with individuals and businesses of all sizes. My primary areas of practice are general corporate/business law, real estate, commercial transactions and agreements, and M&A. I strive to provide exceptional representation at a reasonable price.

Dani is a trusted legal professional with expertise in contracts and corporate legal operations. Dani supports customers in reviewing and negotiating both buy and sell side agreements, including but not limited to Master Services Agreements, Licensing Agreements, SaaS Agreements, Supply Agreements, Commercial Contracts, Healthcare Contracts, IT Contracts, Vendor Contracts and Non-Disclosure Agreements. She also assists with negotiation strategy, contract lifecycle, privacy issues, legal policy setting, process improvement, corporate governance, force majeure clauses and template harmonization and playbook development. Dani has proven success drafting, negotiating and advising executive leadership on contracts to drive outcomes in line with defined strategic objectives. Dani is based in Georgia and holds a law degree from Western Michigan University’s Cooley Law School.

Christopher S.

Chris Sawan is a JD/CPA who practices in the area of business law, contracts and franchising in the State of Ohio.

Elizabeth C.

As an experienced contracts professional, I offer an affordable method to have your contracts reviewed! With my review of your contract, you can understand and reduce risks, negotiate better terms, and be your own advocate. I am an Attorney, Board Member, and Freelance Writer with a Bachelor of Arts degree, magna cum laude, in Film, Television and Theatre (“FTT”) from The University of Notre Dame. I was awarded The Catherine Hicks Award for outstanding work in FTT as voted on by the faculty. I graduated, cum laude, from Quinnipiac University School of Law, where I earned several awards for academics and for my work in the Mock Trial and Moot Court Honor Societies. Additionally, in my career, I have had much success as an in-house Corporate Attorney with a broad range of generalist experience and experience in handling a wide variety of legal matters of moderate to high exposure and complexity. My main focus in my legal career has been contract drafting, review, and negotiation. I also have a background in real estate, hospitality, sales, and sports and entertainment, among other things.

Elizabeth R.

Elizabeth is an experienced attorney with a demonstrated history of handling transactional legal matters for a wide range of small businesses and entrepreneurs, with a distinct understanding of dental and medical practices. Elizabeth also earned a BBA in Accounting, giving her unique perspective about the financial considerations her clients encounter regularly while navigating the legal and business environments. Elizabeth is highly responsive, personable and has great attention to detail. She is also fluent in Spanish.

Abby is an attorney and public policy specialist who has fused together her experience as an advocate, education in economics and public health, and passion for working with animals to create healthier communities for people and animals alike. At Opening Doors PLLC, she helps housing providers ensure the integrity of animal accommodation requests, comply with fair housing requirements, and implement safer pet policies. Abby also assists residents with their pet-related housing problems and works with community stakeholders to increase housing stability in underserved communities. She is a nationally-recognized expert in animal accommodation laws and her work has been featured in The Washington Post, USA Today, Bloomberg, and Cosmopolitan magazine.

Find the best lawyer for your project

Quick, user friendly and one of the better ways I've come across to get ahold of lawyers willing to take new clients.

How It Works

Post Your Project

Get Free Bids to Compare

Hire Your Lawyer

Employment lawyers by top cities

- Austin Employment Lawyers

- Boston Employment Lawyers

- Chicago Employment Lawyers

- Dallas Employment Lawyers

- Denver Employment Lawyers

- Houston Employment Lawyers

- Los Angeles Employment Lawyers

- New York Employment Lawyers

- Phoenix Employment Lawyers

- San Diego Employment Lawyers

- Tampa Employment Lawyers

Expatriate Agreement lawyers by city

- Austin Expatriate Agreement Lawyers

- Boston Expatriate Agreement Lawyers

- Chicago Expatriate Agreement Lawyers

- Dallas Expatriate Agreement Lawyers

- Denver Expatriate Agreement Lawyers

- Houston Expatriate Agreement Lawyers

- Los Angeles Expatriate Agreement Lawyers

- New York Expatriate Agreement Lawyers

- Phoenix Expatriate Agreement Lawyers

- San Diego Expatriate Agreement Lawyers

- Tampa Expatriate Agreement Lawyers

Contracts Counsel was incredibly helpful and easy to use. I submitted a project for a lawyer's help within a day I had received over 6 proposals from qualified lawyers. I submitted a bid that works best for my business and we went forward with the project.

I never knew how difficult it was to obtain representation or a lawyer, and ContractsCounsel was EXACTLY the type of service I was hoping for when I was in a pinch. Working with their service was efficient, effective and made me feel in control. Thank you so much and should I ever need attorney services down the road, I'll certainly be a repeat customer.

I got 5 bids within 24h of posting my project. I choose the person who provided the most detailed and relevant intro letter, highlighting their experience relevant to my project. I am very satisfied with the outcome and quality of the two agreements that were produced, they actually far exceed my expectations.

Want to speak to someone?

Get in touch below and we will schedule a time to connect!

Find lawyers and attorneys by city

Best Practices for Writing a Global Assignment Letter Of Understanding

By Laura Wilkins, CRP, GMS

Those who have relocated globally can attest to the life-changing nature of an overseas assignment—often requiring that the employee sell a home in addition to moving their family to a new country and changing many of their typical routines. Your employee letter of understanding must cover a number of important topics sensitively but clearly—without increasing already high stress levels.

A letter of understanding outlines the details and benefits of an international assignment. This legally binding document, which all parties must sign, serves as an addendum to the employee’s regular employment contract and lays out any differing terms that apply. In addition to the assignment start and end date, job title, and location, the letter of assignment must specify all contractual agreements, a code of conduct, compensation, assignment-specific benefits such as moving expenses, and any repatriation allowance or tax equalization provided.

The letter of understanding should specify all pertinent details without leaving any room for interpretation. Lack of clarity can lead to misunderstandings and costly mistakes which drain resources and distract the employee, impacting the success of the assignment.

The key to drafting effective letters of understanding begins with knowing your employees and focusing on their needs and their families’ needs. You may find sample templates online to help you draft a letter of understanding, but unfortunately, many of them begin like this:

Dear Mr. Jones,

This letter is to inform you that you will be transferred effective [date] to our location in…

Considering the upheaval a relocation will cause in your employee’s life, this approach may come across as overly abrupt. Here are some best practices to help you write an effective letter of understanding.

Discuss the Global Relocation or Assignment First

Having a detailed discussion provides an opportunity to create enthusiasm about a new role by:

- Providing a platform to discuss your global mobility policy and company-provided financial assistance

- Clarifying the specific skill-building and learning opportunities available in the new role

- Showing that the company values the employee and wants to make an investment in his or her future

- Demonstrating that the employee is important to the growth of the business

Holding a preliminary discussion shows respect for the employee and allows you to craft a letter tailored to that individual. In turn, this will likely increase loyalty and productivity and reduce the chance of a declined relocation offer.

Outline the New Role

Your employee’s job title and responsibilities may remain the same in the new location. If so, make sure the letter of understanding includes the name of the person to whom the employee will report and the duration of the transfer or assignment. For employees taking on new responsibilities, you’ll also want to include the following:

- The employee’s new job title or position

- A description of any increased benefits, salary or bonuses

Similar in some ways to an employment offer letter, this portion of the letter of understanding focuses on the specifics of the new role. It documents the job title, salary, and related benefits to eliminate misunderstandings. The appropriate manager should sign and date the letter, and it should include the:

- Employee’s full name and current home address.

- Department names — both the current department and the new destination department.

- Effective date the employee should report to the new location.

- Anticipated end date in the case of an assignment.

- Name of the employee’s new manager.

- Expiration date for the individual’s relocation and assignment benefits.

After you provide this information, you can delve into the specifics of your company’s global mobility policy and explain the benefits the employee will receive. If you’re looking for additional resources on transfer notices, check out our page on 12 Employee Transfer Letter Tips.

- Share on Facebook

- Share on Twitter

- Share on LinkedIn

- Share with Email

Insights + Resources

How much is the average relocation package in 2024, gross-up: a guide to employer-paid relocation tax assistance, proper handling of relocation on w-2 forms: a comprehensive guide, what is an executive relocation package.

The Forum for Expatriate Management

Short-term international assignments: How to achieve consistency

Share this post

Choose a social network to share with, or copy the shortened URL to share elsewhere

Share with...

...or copy the link.

www.forum-expat-management.com

This article looks at how to structure employment arrangements and ensure the right policies and processes are in place to effectively manage short-term assignments.

We previously discussed how in today's fast-paced business environment, the need to deploy employees to work outside of their home country can sometimes lead to many short-term assignees travelling on a business visa to avoid the expense and bureaucratic process of getting work authorisation. In addition, many managers may inadvertently create ‘stealth’ expats by asking short-term assignees to stay on for another month or two, thereby creating host country tax and social security withholding requirements, and possibly immigration infringements too.

ECA has also observed more ‘floating employees’ sent to work in countries where the employer has no registered entity and this potentially could create a corporate tax presence for the non-resident employer. To account for these risks and to keep pace with an internationally mobile workforce, companies need to rethink how they structure employment arrangements, policies and processes accordingly.

Important issues to consider include:

Contractual arrangements

When an employee is sent on a short-term assignment, the individual is typically issued with an 'assignment letter', or 'assignment agreement'. This letter outlines the benefits (allowances, reimbursements, etc) that the employee is entitled to receive during the period of assignment to the host entity. However, it is important to consider how any underlying employment contract, with the home company, interplays with the separate assignment letter. In general, an employee on a short-term assignment remains an employee of their home company during the length of the assignment, but with certain rights and benefits suspended/hibernated and replaced by relevant terms and conditions contained within an assignment letter. Hibernating a home country contract can, however, complicate potential dismissals as the home country contract has not been terminated, but will ‘spring back to life’ at the natural end of an assignment or once an assignment has been terminated.

The role of an assignment letter (agreement)

Short-term assignments are highly complex. Hence, it is crucial to have proper documentation in place to clarify and provide guidance. An effective assignment letter not only benefits the employee, but also the employer (HR, legal, tax and payroll, for instance). The assignment letter should clearly spell out the compensation and benefits (per diems, reimbursements, serviced accommodation costs etc) that the employee would receive during the short-term assignment, thus making all parties aware of assignment entitlements and mitigating any dispute or retroactive negotiations in the future.

An appropriately drafted assignment letter can also minimise potential financial or reputational risk for non-compliance and help mitigate potentially adverse corporate tax implications. So, it is important that the assignment letter documents the responsibilities of the home and host country companies if the economic employer principles discussed below are to be avoided. Hence, it should address such issues as:

- The assignment start and intended end date;

- The employee’s specific duties while on assignment;

- The employing entity while on assignment;

- To whom does the employee report while on assignment?

- Who determines the holidays and work hours of the employee?

- Who will be responsible for any disciplinary issues during the assignment?

- Who can terminate the contractual arrangements entered into with the employee?

How long an assignment is anticipated to last has an important bearing on immigration and tax compliance regulations. For example, in the United States, it is possible to exclude certain travel, meals and accommodation expenses from federal tax if an assignment is expected to last less than 12 months. However, should the assignment length change from less than one year to greater than one year, the expenses previously considered non-taxable would be deemed taxable from the date of the change in ‘intent’. Consequently, the anticipated or intended assignment duration should be supported through appropriate language in the assignment letter.

The choice of language used in an assignment letter can also have implications for the taxability of certain allowances and benefits. For example, there is a distinction between an employee sent to Japan for business travel and one sent under a secondment arrangement. An employee ‘seconded’ on a short-term assignment to Japan cannot exempt income from taxation under the 183-day rule, whereas a ‘business traveller’ or ‘visitor’ can potentially do so based on facts and circumstances. An assignment/secondment agreement for employees sent to Japan for short-term projects should therefore use consistent terminology to qualify for the preferential tax treatment.

Cost allocation

Who picks up the costs of a short-term assignment can be a source of much debate in many organisations when an employee is temporarily assigned to work in another country. This is because costs need to be borne in the correct location to ensure that the appropriate tax deductions can be claimed by the group.

Consider the potential tax risks when an employee is being assigned internationally to another company within a group. Certain tax authorities adopt an ‘economic employer’ approach to interpreting Article 15 of the OECD model treaty which deals with the Dependent Services Article (economic employer is discussed further here). One of the conditions of Article 15 states that if the assignee’s salary and costs are recharged to the host entity, then the host country tax authority will treat the host entity as being the ‘economic employer’ and therefore the employer for the purposes of interpreting Article 15. In this case, tax relief would be denied and the employee would be subject to tax in the host country even if the individual spends less than 183 days there. Short-term assignments can also create a corporate tax liability in the host jurisdiction if cost allocation is not carefully managed.

To help minimise any unexpected tax surprises, it is advisable to put an agreement in place, which specifies how costs will be managed during an assignment. An inter-entity agreement should be drawn up between the host company and the assignee’s home company. This agreement governs how costs associated with the assignment will be funded. An inter-entity agreement is in addition to the assignment letter (agreement) between the employee and the home company.

Short-term assignments now take all shapes and forms, with short-term projects, weekly commuters, and extended business trips becoming more common. A written short-term policy can be a cost-effective tool as it provides discipline and a framework that enables equity of treatment amongst assignees and reduces the number of employees negotiating their own packages. It can set out logically the steps to be taken in any relocation and the procedures to be followed.

It is advisable that each category of short-term assignment be housed in a separate policy document, as there is a possibility that employees will attempt to leverage off the best parts of other packages to suit their particular circumstances. Additionally, a short-term policy should be regularly evaluated against the current industry trends as well as the company’s business goals to make sure it is fit for purpose.

The short-term policy should address the following key issues:

- Should any host country tax liability arise, will the assignee receive any tax assistance?

- Will the assignee be on the host country payroll, home country payroll, an international assignee payroll, or multiple payrolls?

- Will the assignee’s pay be protected from exchange rate volatility?

- What happens when short-term assignments are extended and change from one assignment category to another?

- Managing exceptions

Exceptions to policy can be difficult to manage, requiring negotiations between the mobility team, the assignee and the business line for approval. They can also be costly, triggering unaccounted-for expenses and untracked ‘budget creep’, the impact of which is rarely calculated or consolidated across the business functions.

Exceptions should only be granted under very limited circumstances and require written explanations and approval of the executive board or HR director. If carefully monitored, the number of exception requests can indicate that a particular process or policy component requires re-design or further instruction to a vendor.

To ensure global equity and minimise budget creep, consider:

- Creating a detailed policy governance process for identifying and capturing deviations to policy or process with a view to reducing or eliminating exceptions;

- Setting up a centralised system to manage and approve exceptions to help minimise expenses;

- Establishing a process owner for short-term assignments, someone with responsibility and authority to monitor and report on trends in exceptions;

- Creating a formal short-term assignment policy, as mentioned above, to minimise exceptions and foster consistency and clear communications.

Tracking potential risks

Tax and immigration irregularities are common for employees on short-term assignments. Accordingly, it is important to develop an education programme for employees and their managers to inform them about the risks of cross-border work and the consequences of non-compliance.

Work permit and immigration infringements should not be underestimated as the penalties for individuals working outside their home country without the appropriate work authorisation can be harsh. Not all short-term assignees need immigration approval, but then again, some do. It is important to note that just because an employee may not trigger any host country tax liability it doesn’t follow that they are exempt from immigration requirements. Indeed, staying on the home payroll is one of the most common areas of risk for short-term assignees and it is not an indication that immigration approval is not required.

For many companies, technology has become the key to achieving and maintaining compliance. Without proper monitoring, an employer may unwittingly be exposed to tax and social security risks. Diligent tracking of short-term assignees and a solid process to be able to identify risks up-front are key to ensuring compliance.

Once a company’s short-term population reaches a certain size, manual tracking of policy exceptions using Excel spreadsheets is unlikely to be sufficient to ensure compliance with now greater information sharing among tax and immigration authorities. So, if companies want to be ahead of the curve in managing short-term assignees, they need to start tracking them. This will require communications to be established between the business units, tax, HR, legal, payroll, etc early in the assignment planning process, as well as when any assignment extension is contemplated.

Coordination with payroll

At the heart of the administration process is the payroll team and it is essential that the appropriate home and host country payroll personnel are involved in planning for short-term assignments. They are ultimately responsible for ensuring the accurate and timely delivery of the assignment package to employees, while managing the local jurisdiction compliance requirements with regard to tax and social security withholding.

The home country payroll must be informed of the intended assignment duration and assignment package to be paid to the employee. The home payroll will need to understand whether the allowances and benefits will or will not be considered taxable to the employee.

Assignment income, such as a short-term allowance or per diems, is often paid through the home country payroll to comply with standard tax treaty rules. Typically, if income is to be exempt of host taxes, the payroll costs should not be borne by a permanent establishment in the host country.

If an employee triggers a tax liability, many host countries will require withholding of income taxes through a local payroll. Consequently, the host country payroll will need to be informed of the assignment package the employee is receiving to understand if these may be considered taxable in the host country, even if they are not taxable in the home country. The host payroll will also need the relevant social security applications to be made to ensure that contributions are paid to the appropriate tax authorities.

Our three-part series of articles on short-term assignments has highlighted some of the complexities in structuring short-term assignments, and some of the challenges concerning immigration, payroll reporting and tax compliance. With proper planning and administration, short-term assignments can be an effective and efficient means of increasing the pool of potential employees for the international assignment programme.

If you haven't already done so, you can read the first two articles of this three-part series on short-term international assignments:

- Key considerations when structuring short-term packages

- Compliance challenges involved with short-term assignments

Please sign in or register for FREE

If you are a registered user on The Forum for Expatriate Management, please sign in

Recommended Content

Gm in 2023: what will your biggest challenges be.

Mobility Basics - How to calculate hypotax

Hot rental markets on both sides of the Atlantic

How to get started with making your GM programme more inclusive

How is provision of relocation benefits changing?

We and selected partners, use cookies or similar technologies as specified in the cookie policy and privacy policy .

You can consent to the use of such technologies by closing this notice.

Cookie Control

Customise your preferences for any tracking technology

The following allows you to customize your consent preferences for any tracking technology used to help us achieve the features and activities described below. To learn more about how these trackers help us and how they work, refer to the cookie policy. You may review and change your preferences at any time.

These trackers are used for activities that are strictly necessary to operate or deliver the service you requested from us and, therefore, do not require you to consent.

These trackers help us to deliver personalized marketing content and to operate, serve and track ads.

These trackers help us to deliver personalized marketing content to you based on your behaviour and to operate, serve and track social advertising.

These trackers help us to measure traffic and analyze your behaviour with the goal of improving our service.

These trackers help us to provide a personalized user experience by improving the quality of your preference management options, and by enabling the interaction with external networks and platforms.

- Book a Speaker

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Vivamus convallis sem tellus, vitae egestas felis vestibule ut.

Error message details.

Reuse Permissions

Request permission to republish or redistribute SHRM content and materials.

Managing Termination Risk During Expat Assignments

NEW YORK—Organizations should manage employee termination risk long before an expatriate assignment comes to an end, to avoid potential claims under home- or host-country protection.

“Expats should always have a shadow HR person from their home country or a very savvy local HR person who understands what the risks are associated with expats,” said Laura L. Becking, a partner in compensation and benefits who leads the global equity and employment team at Orrick Herrington & Sutcliffe in New York, speaking March 25, 2014, at the New York Totally Expat Show.

Additional issues to be aware of include employees becoming localized without ending a contract, people becoming “accidental expats,” and tax liabilities that remain after an employee is terminated.

Claims Under Home-Country Protection

Here’s an example of how potential claims might arise under home-country protection:

Pat, a long-term employee in the London office, is sent on a two-year expat assignment to New York. As part of the process, the U.S.-based vendor conducts a standard background check. Pat is asked to work much longer hours than she does in the U.K. and isn’t paid overtime since her manager considers her an exempt employee in the U.S.

Pat’s performance goes downhill. Her N.Y.-based manager and HR team move some of her reports to another manager. A U.S. performance improvement plan is put in place. Pat’s manager warns her that if her performance doesn’t improve within a month, she’ll be terminated. Pat fails the plan and is fired, then claims unfair dismissal protection under U.K. law.

What went wrong? Becking said the company should have done the following:

In advance of the assignment: Briefed the host-country manager and HR and included a home-country HR person in major HR decisions so they understand “that this person is not your plain-vanilla U.S. employee,” Becking said. For example, they could have discussed whether a background check itself may give rise to a claim since checks “are far more limited outside the U.S.,” and Pat may have a potential claim under the laws of the U.K.

During the assignment: Included the home-country HR person in major HR decisions and assessed whether negative actions such as a demotion, change in reporting line or change in duties could be viewed as disciplinary. It also should have assessed whether home-country performance management rules should apply. When the N.Y.-based manager and N.Y.-based HR team decided to move some reports away without first discussing the action with Pat, that could be viewed as a disciplinary action and give rise to claims under U.K. law.

At termination: Followed the home-country termination process, if required. Also, if a separation or release agreement is entered into, make sure it covers and is effective in both the host and home countries. When Pat was terminated, she filed an unfair dismissal claim under U.K. law. Among other things, she cited that the company did not put a disciplinary procedure in place that gave her a fair opportunity to improve her performance. “The regime [under U.K. law] is very clear,” Becking said. “You have to go through a series of two to three disciplinary procedures.”

Claims Under Host-Country Protection

Potential claims can arise under host-country protection as well. The key is at what point does the “nexus” between the home and host countries become tight enough that the person can bring claims.

Rob is sent from the U.S. on a one-year assignment to France. At Rob’s request, his contract is extended for another two years, which is not unusual. Rob is fully integrated into the French office and reports to a manager in France.

He follows the French holiday schedule but continues to receive expat perks (e.g., housing allowance, school allowance for children, home visits and tax equalization). Rob requests and is given an extension for another two years.

But before long, the business changes and Rob’s skills are no longer needed in the U.S. or France. He’s terminated with six weeks’ severance, based on applicable U.S. rules. He claims protection under French laws and seeks compensation for wrongful termination based on his total compensation, including equity compensation grants, under his expat package, which is “usually quite big,” Becking noted.

In advance of the assignment: Established a localization policy that clearly documented home-country choice of law and jurisdiction, as well as clearly delineated between base salary, perks and variable compensation.

“You should not have the Robs of the world say, ‘I think I’ll do another year, I think I’ll do another year,’ ” Becking explained. When base salary, perks and variable compensation are lumped together, “it’s more likely you will be paying the severance and damages on the basis of total compensation,” she added.

During the assignment: Tracked whether the link with the home country was being lost and re-established it where possible, as well as followed a localization policy or implemented one as requests for extensions came. Rob’s example is not uncommon. Because he has been in France for about six years, although he may still be able to make claims under his home-country jurisdiction, “he certainly will be able to make claims under his host-country jurisdiction,” Becking said.

At termination: Considered repatriation, although that’s not without risks because in this example, an employee might turn around and say it’s a de facto termination. The company also should have assessed its risk for host-country claims and managed the exit negotiation accordingly, Becking said.

Localization Without Ending the Expat Contract

Claims also can arise when an employee is localized without an expatriate contract first being ended.

For example, Niek takes a two-year expat assignment from Brussels to the Houston office. Two months into the assignment, his dream job opens up in Houston. He applies and gets the position.

At Niek’s request, and with his new manager and HR’s agreement, his expat assignment is amended to apply to this local role and he stays on his expat package. But four months later, there’s a performance issue and the manager is upset about the high cost associated with Niek.

It’s important to remember that Niek is a local hire at this point; this is not an expat role. If he’d been properly localized, as he should have been for a local position, “we’d be under U.S. law and everything would be good,” Becking said. It won’t be easy to terminate Niek. The company will have to follow procedures that apply in Belgium, which aren’t going to be as straightforward, she explained.

Accidental Expats

Some people can become accidental expats.

Take Gerard, a long-term employee who works out of the London office, but is originally from the Netherlands. His employer doesn’t have a corporate presence in the Netherlands. For the past two years, he’s frequently worked remotely from Amsterdam, eventually spending 80 percent of his time doing so. He has been productive, and his manager agrees that he can continue working remotely. Gerard continues to be processed through U.K. payroll. But five years later, things aren’t going well and Gerard’s employer wants to terminate him. He claims full protection under Dutch labor laws and flags tax compliance issues and corporate permanent establishment risk.

There may be tax compliance issues since Gerard has been processed through U.K. payroll and has had taxes withheld in the U.K. Although he hasn’t had all the expat perks, he has the ability to “shop” for claims where he’d like to be protected. And the Netherlands would offer far better protection than the U.K., Becking said.

Decisions like the ones made in this case “shouldn’t be made on an individual manager level,” she noted. “There should be company policy on remote working across borders” and very clear guidelines on income and corporate tax issues, she said.

Trailing Tax Liabilities

Trailing tax liabilities after an employee is terminated are another problem. Employers should clearly document what tax responsibilities will exist at the end of an assignment, including in case of termination. At the end of an assignment, post-employment obligations of both parties should also be clear.

“We see that quite a lot with tax-equalization deals in place,” Becking noted. “Twelve months after termination, there may be funds owed back to the company by the individual and we find those are hard to recoup because people have moved on.”

Pamela Babcock is a freelance writer based in the New York City area.

Quick Links:

SHRM Online Global HR page

Related Content

Why AI+HI Is Essential to Compliance

HR must always include human intelligence and oversight of AI in decision-making in hiring and firing, a legal expert said at SHRM24. She added that HR can ensure compliance by meeting the strictest AI standards, which will be in Colorado’s upcoming AI law.

A 4-Day Workweek? AI-Fueled Efficiencies Could Make It Happen

The proliferation of artificial intelligence in the workplace, and the ensuing expected increase in productivity and efficiency, could help usher in the four-day workweek, some experts predict.

Advertisement

Artificial Intelligence in the Workplace

An organization run by AI is not a futuristic concept. Such technology is already a part of many workplaces and will continue to shape the labor market and HR. Here's how employers and employees can successfully manage generative AI and other AI-powered systems.

HR Daily Newsletter

News, trends, analysis and breaking news alerts to help HR professionals do their jobs better each business day.

Success title

Success caption

IMAGES

VIDEO

COMMENTS

SUBJECT: LETTER OF UNDERSTANDING- EXPATRIATE ASSIGNMENT. This letter confirms our mutual understanding of the terms and conditions applicable to your assignment effective April 1, 2005. This letter shall be read in conjunction with your offer letter dated February 1, 2005 (the Offer Letter ). To the extent any term herein conflicts with a term ...

Four Possible Scenarios. Dowling provided details on at least four ways expatriate assignments can be set up: Foreign office. The person is employed by, paid by and renders services for the home ...

Secondment. An expatriate remains an employee of the home country employer entity but is assigned to render services to a host country entity, usually the employer's affiliate or business partner ...

5. A Job When You Return: This is one of the most difficult requests to make, and to get written assurances about, but nonetheless the largest risk you face in taking an overseas assignment. Once you're "out of sight," you tend to become "out of mind," and at times available positions become few and far between.

An international assignment agreement that outlines the specifics of the assignment and documents agreement by the employer and the expatriate is necessary. Topics typically covered include ...

xpat, or misclassifying a non-expat as an expat, increases costs and introduces complications.Expatriate postings come in many forms but ultimately fit into or among four categories: fo. eign correspondent, secondment, temporary transferee (localized) an. co-/dual-/joint-employee. Structure each expat.

5 Tips for Managing Successful Overseas Assignments. Sending talented employees overseas can be a promising way to leverage the benefits of a global economy. But expatriate assignments can be ...

The assignment letter should clearly explain the level of benefits provided and how they are delivered, i.e. in-kind or in cash, bearing in mind the most tax effective form of delivery for the company depending on host country tax legislation. Tax charged on assignment benefits can be considerable, sometimes up to 50% of total assignment costs.

A sample cross-border secondment letter to be used in the expatriate context when a US employee is temporarily assigned to work abroad while remaining employed by the original (actual) employer. This Standard Document has integrated notes with important explanations and drafting tips. ... Expatriate Secondment Letter of Assignment Practical Law ...

Assignment letter This is a critical step in the overseas assignment process. The assignment letter should spell out the agreement between employer and staff, with clear explanations of position and duties, the period of assignment, and the terms of compensation. Know and comply with local employment and immigration laws

Expatriate Assignment Agreement. March 29, 2023. This is a sample expatriate assignment agreement between a US company and an employee, including clauses pertaining to expatriation such as salary, employee benefits, mobility premium, housing and utilities allowance, goods and services allowance, language training allowance, furnishings and ...

Expatriate Letter Agreement. Exhibit 10.43. December 12, 2011. Robin S. Heller. 9489 South Bellmore Lane. Highlands Ranch, CO 80126. Dear Robin: This Letter Agreement will serve to confirm our mutual understanding of the terms and conditions applicable to your assignment ( Assignment ) to London, UK (the Host Country ) where you will continue ...

This document is commonly known as an assignment letter, and it should include: The period of the assignment. The names and addresses of all parties to the contract. The annual gross salary and benefits of the expat, along with any housing allowance, relocation costs, and travel costs. The period of notice of the assignment agreement (in case ...

Before structuring any expatriate assignment, first verify whether the candidate really is a business expatriate. ... other than perhaps a side-letter or e-mail addressing post-assignment ...

An expatriate agreement is a contract between a company and a foreign or migrant worker where the employer offers an international job to the worker. In other words, an expatriate agreement involves a company relocating a worker from one country to another for business purposes. Typically, the expatriate agreement includes details about how ...

it appears in an employment agreement, expatriate assignment letter, employee benefits program or compensation plan? These three questions get asked—or, certainly, they should get asked—when an employer recruits, hires, employs, rewards and dismisses an employee in any cross-border employment arrangement.

The letter of understanding should specify all pertinent details without leaving any room for interpretation. Lack of clarity can lead to misunderstandings and costly mistakes which drain resources and distract the employee, impacting the success of the assignment. The key to drafting effective letters of understanding begins with knowing your ...

When an employee is sent on a short-term assignment, the individual is typically issued with an 'assignment letter', or 'assignment agreement'. This letter outlines the benefits (allowances, reimbursements, etc) that the employee is entitled to receive during the period of assignment to the host entity. However, it is important to consider how ...

In addition, the Company will continue to provide you a housing and education allowance thru June 30, 2009 pursuant to the terms of your Expatriate Assignment Letter between us dated September 23, 2005 (the "Expatriate Assignment Letter") as detailed in Exhibit "B" attached hereto.

Upon assignment completion the company will arrange and pay for the Ex-pat's cargo shipment. An Ex-pat with 3 or more children will be eligible for a 40-foot container insured for up to $40K (US ...

This letter of assignment (the "Agreement") is to confirm a mutual understanding between you and Align Technology, Inc (the "Home Company") of the terms and conditions applying to your long-term international assignment (the "Assignment") to Align Technology Switzerland GmbH (the "Host Company") as outlined below:

Global Expatriate Assignment — Letter of Understanding . On behalf of Global Mobility, I am pleased to confirm the terms and conditions relating to your expatriate assignment to Asia Pacific Region including Japan in Hong Kong. Your assignment is scheduled to commence on 1st May 2008, subject to your obtaining the appropriate work permit/visa ...

NEW YORK—Organizations should manage employee termination risk long before an expatriate assignment comes to an end, to avoid potential claims under home- or host-country protection. "Expats ...