A Student’s Guide to Writing A Buy-Side Equity Research Report

- via Research , Resources

Marina Chang

A career in finance can take on many different forms — from investment banking to equity research. Equity researchers conduct detailed analyses in order to offer well-supported investment recommendations. Their analyses are then compiled into what is referred to as an equity research report. These reports differ on the sell-side and buy-side, but they do have some overlaps. This guide will break down the key components and formats to help you successfully craft your own equity research report.

What is an equity research report? What is the purpose of a research report?

An equity research report is a document prepared by an analyst that gives an overview of a business, including the industry it operates in, its management team, its financial performance, risks, and its target price. The purpose of a research report is to provide a recommendation on whether investors should buy, hold, or sell shares of a public company.

What’s the difference between a buy-side and sell-side equity research report?

Sell-side reports are the most common type of equity research report. They are typically produced by investment banks for their clients to help guide investment decisions. Sell-side analysts issue the often-heard recommendations of “buy,” “hold,” “neutral,” or “sell” to help clients with their investment decisions. This is favorable for the brokerage firm as each time a client decides to trade the brokerage firm gets a commission on the transaction.

Buy-side reports are internal reports, produced for the bank itself, and are guided by differing perspectives and motivations. Buy-side analysts determine how promising an investment seems and how well it fits with the fund’s investment strategy. These recommendations are made exclusively for the benefit of the fund that employs them and are not available to anyone outside the fund.

What information should be included within your equity research report?

- Recommendation – Typically to buy, sell, or hold shares in the company. This section also usually includes a target price (i.e., $47.00 in the next 12 months).

- Company Update – New releases, quarterly or annual results, major contracts, management changes, or any other recent or important information about the company.

- Investment Thesis – A summary of why the analyst believes the stock will over or underperform and what will cause it to reach the share price target included in the recommendation. This is probably the most interesting part of the report.

- Financial Information & Valuation – A forecast of the company’s income statement, balance sheet, cash flow, and valuation. This section is often an output from a financial model built in Excel.

- Risk & Disclaimers – An overview of the risks associated with investing in the stock. This is usually a laundry list of all conceivable risks, thus making it feel like a legal disclaimer. The reports also have extensive disclaimers in addition to the risk section.

What information is needed for the industry pages?

- Competitive Rivalry – This looks at the number and strength of competitors. How many rivals does the company have? Who are they, and how does the quality of their products and services compare?

- Supplier Power – This is determined by how easy it is for suppliers to increase their prices. How many potential suppliers does the company have? How unique is the product or service that it provides, and how expensive would it be to switch from one supplier to another?

- Buyer Power – Here, you ask how easy it is for buyers to drive prices down. How many buyers are there, and how big are their orders? How much would it cost them to switch from the company’s products and services to those of a rival? Are buyers strong enough to dictate terms?

- Threat of Substitution – This refers to the likelihood of customers finding a different way to do what the company offers.

- Threat of New Entry – The company’s position can be affected by how easy it is for a new company to enter the industry. How much would it cost, and how tightly is the industry regulated?

How to create and forecast a financial model.

- Gather the company’s most recent 10-K and 10-Q SEC filings.

- For all three financial statements, copy and paste the line items that can be forecasted.

- Make income statement projections based on margins as a percentage of revenue.

- Create a depreciation schedule to account for the reduction of PP&E and intangible assets over time.

- Calculate working capital assumptions.

- Forecast current assets and liabilities on the balance sheet.

- Adjust net change in cash and cash equivalents (CCE) with the cash flow statement.

- Reconcile the cash flow statement with the balance sheet.

- Compute the dividend payout ratio if the company offers a dividend.

- Create the shares repurchase schedule if the company has a share buyback program.

- Construct the debt schedule.

- Calculate interest income and interest expense from the debt schedule.

- Run multiple scenarios – Wall Street Case, Bear Case, Bull Case.

- Sanity check your assumptions.

How many pages should your equity research report contain?

An equity research report should not be more than 10 to 15 pages long. Aim to be both concise and cohesive.

What kind of disclaimer should be included?

It is important for the report to have certain disclaimers to show that the analyst writing the report isn’t biased. Some typical disclaimers are as follows:

- Every ER report entirely reflects the views and personal opinions of the analyst as on the date of publication.

- The equity research analyst does not have an interest in the shares of the company.

- Compensation of the analyst is not linked directly to any specific research recommendations contained in the report.

- Financial analysts or equity research analysts working in brokerage firms or sell-side analysts write equity research reports.

With all these points in mind, you are now ready to write your own equity research report. Select a public company, use this guide as a reference, and see what results from your analysis. Congratulations in advance on completing your research report!

Romero Mentoring’s Analyst Prep Program

In just 15-weeks, you can become a world-class finance professional. The Romero Mentoring Analyst Prep Program is an all-inclusive internship, mentorship, and training experience like no other. Learn the in-depth principles of finance and apply what you learn through an extensive internship led by a finance professional with over 12 years of experience. Learn more here.

The Analyst Prep Program teaches the technical and practical skills that investment banks, hedge funds, and private equity & consulting firms look for in a candidate. Students begin with little to no technical skills and develop into fully prepared professionals who can perform as first-year analysts from day one.

About Romero Mentoring

Since 2016, Romero Mentoring investment banking training programs have been delivering career mentoring to job seekers, professionals, and college students pursuing careers in finance. We’ve helped over 400 students start their careers on Wall Street through our Analyst Prep and Associate Investment Banking Training Programs. Our graduates work at top-bulge bracket banks and consulting firms, including Goldman Sachs, JP Morgan, McKinsey, and many more.

References:

- https://www.financewalk.com/equity-research-report/

- https://corporatefinanceinstitute.com/resources/knowledge/valuation/equity-research-report/#:~:text=What%20is%20an%20Equity%20Research,distributes%20that%20research%20to%20clients.

- https://quickbooks.intuit.com/r/marketing/market-research-tips-how-to-conduct-an-industry-analysis/

About the Author

Marina Chang is a business student at New York University pursuing a double concentration in Finance and Data Science. She is currently an Investment Research Intern at Romero Capital. Marina is an Analyst at NYU's Smart Woman Securities, where she worked with a team of 5 to compete in a stock pitch. She is also a Staff Consultant at 180 Degrees Consulting. The organization provides affordable advising services for non-profits and social enterprises. Marina was a mentee of the Analyst Prep Program.

Recommendations For You

Securing A Financial Analyst Role & The Recruiting Process

The Cost of a College Education

Maximizing Your Networking Potential: Navigating the Finance and Investment Banking Industry

Free Career Consultation

Speak to a professional veteran with 15 years of experience, fill out the form below to request your appointment. learn how we can help you maximize your potential..

What is your highest level of education? High school student College/university student Master’s program student Working professional Other

What is your current annual income? $0-25,000 $26,000-50,000 $51,000-75,000 $76,000-100,000 $1000,000+

Upload Resume

By submitting this form, you agree to receive emails from or on behalf of Romero Mentoring. You understand that such emails may be sent using automated technology. You may opt out at any time. Please view our Privacy Policy or Contact Us for more details.

What is an Equity Research Report?

Contents of an equity research report, buy side vs sell side research, why do banks publish equity research reports, equity research report recommendations, different types of reports, equity research report example, additional resources, equity research report.

A recommendation to buy, sell, or hold shares of a public company

An equity research report is a document prepared by an Analyst that provides a recommendation on whether investors should buy, hold, or sell shares of a public company . Additionally, it provides an overview of the business, the industry it operates in, the management team, its financial performance , risks, and the target price.

To learn more, check out CFI’s Valuation Modeling Classes .

Let’s take a closer look at what’s included in an equity research report. Below is a list of the main sections you’ll find in one of these reports.

- Recommendation – Typically to either buy, sell, or hold shares in the company. This section also usually includes a target price (i.e., $47.00 in the next 12 months).

- Company Update – Any recent information, new releases, quarterly or annual results , major contracts, management changes, or any other important information about the company.

- Investment Thesis – A summary of why the analyst believes the stock will over or underperform and what will cause it to reach the share price target included in the recommendation. This is probably the most interesting part of the report.

- Financial Information & Valuation – A forecast of the company’s income statement , balance sheet, cash flow , and valuation. This section is often an output from a financial model built in Excel.

- Risk & Disclaimers – An overview of the risks associated with investing in the stock. This is usually a laundry list that includes all conceivable risks, thus making it feel like a legal disclaimer. The reports also have extensive disclaimers in addition to the risk section.

It’s important to distinguish between buy side and sell side research reports.

Buy side firms (asset management companies) have their own internal research teams that produce reports and recommendations on which stocks the firm and its portfolio managers should buy and sell. The reports are only used for internal investment decision making and not distributed publicly.

Sell side firms such as investment banks produce equity research reports to be disseminated to their sales and trading clients and wealth management clients. These reports are distributed for free for a variety of reasons (explained below) and have a specific recommendation to buy, sell, or hold as well as an expected target price.

Learn more about buy side vs sell side jobs.

The sell side publishes reports to generate fees, both directly and indirectly.

Direct: Trading Commissions

When an investment bank publishes valuable equity research for an institutional client, that client is then likely to use the bank to execute their trades for that stock. While there no actual agreement to do so, it’s an unspoken rule. The bank may also use the report to persuade the client to buy more shares in a holding they already have, to therefor further increase commissions.

Indirect: Investment Banking Relationships

All banks have a Chinese Wall between their investment banking teams and research departments, but there still remains an indirect incentive for research to be supportive of stocks the bank may provide investment banking services to. The fees that investment bankers earn on underwriting and mergers and acquisitions (M&A) are huge, and a bank would never want to miss out an opportunity to work with a CEO of a public company because the bank had a “Sell” rating on their stock.

For this reason, sell side research typically includes a disclaimer along the lines of, “Bank X seeks and does business with companies that are covered in its research reports. Because of this, investors should be aware that the firm may have a conflict of interest (due to these investment banking relationships) that could affect the objectivity of this report. Investors should consider this report as only a single factor in making their investment decision.”

Each bank has their own set of recommendations (terms) they use to rate a stock. Below is a list of the most common recommendations or rating analysts issue.

Ratings include:

- Buy, Outperform, Overweight

- Hold, Neutral, Marketweight

- Sell, Underperform, Underweight

To learn more, check out CFI’s Valuation Modeling Courses .

This guide has focused on a “typical” equity research report, but there are various other types that can take slightly different forms. Below is a list of other types.

Types of reports:

- Initiating Coverage – A long report (often 50-100+ pages long) that is released when a firm starts covering a stock for the first time.

- Industry Reports – General industry updates about a few companies in a sector.

- Top Picks – A list and summary of a firm’s top stock picks and their targeted returns.

- Quarterly Results – A report that focuses on the company’s quarterly earnings release and any updated guidance.

- Flash Reports – Quick 1-2 page report that comments on a new release from the company or other quick information.

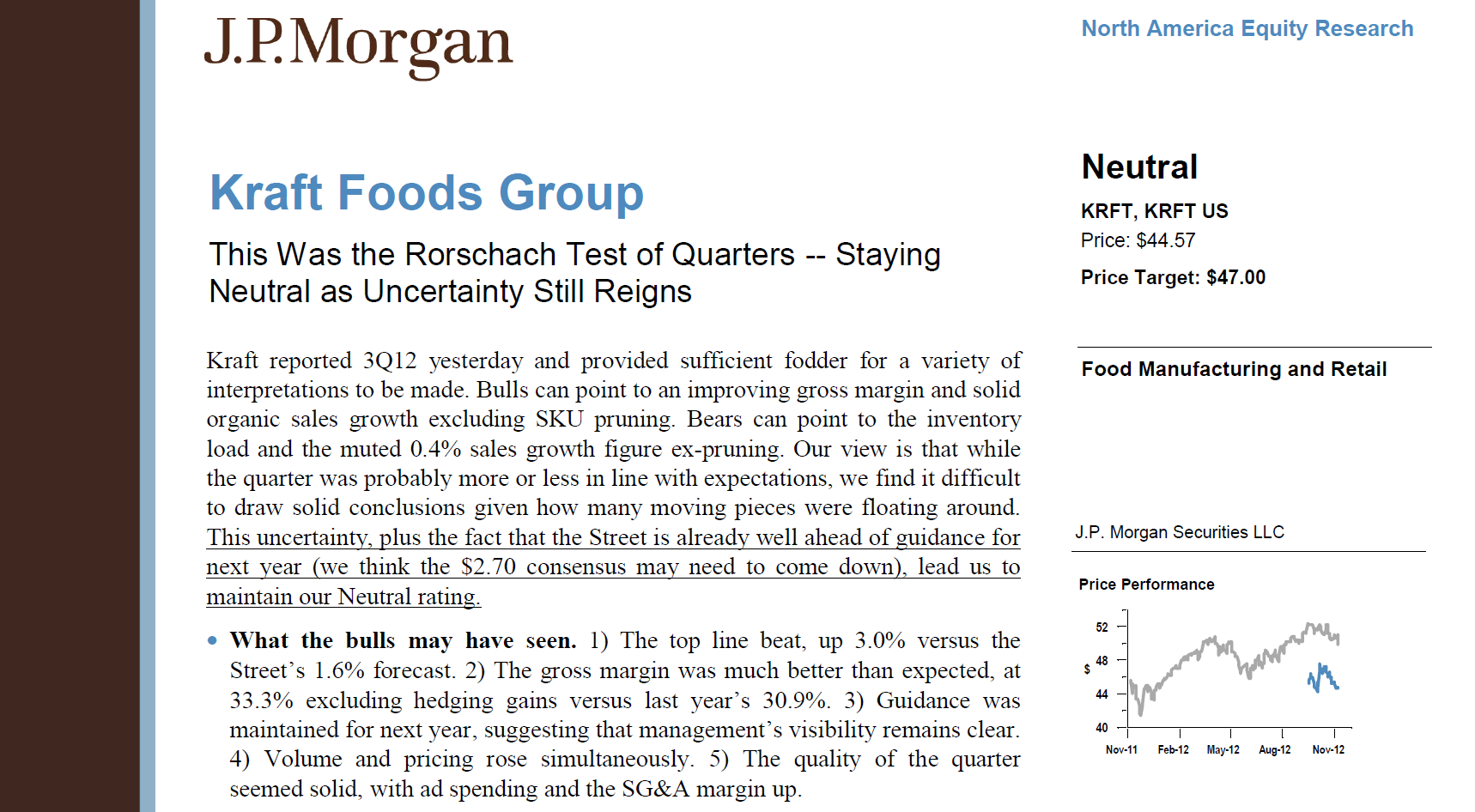

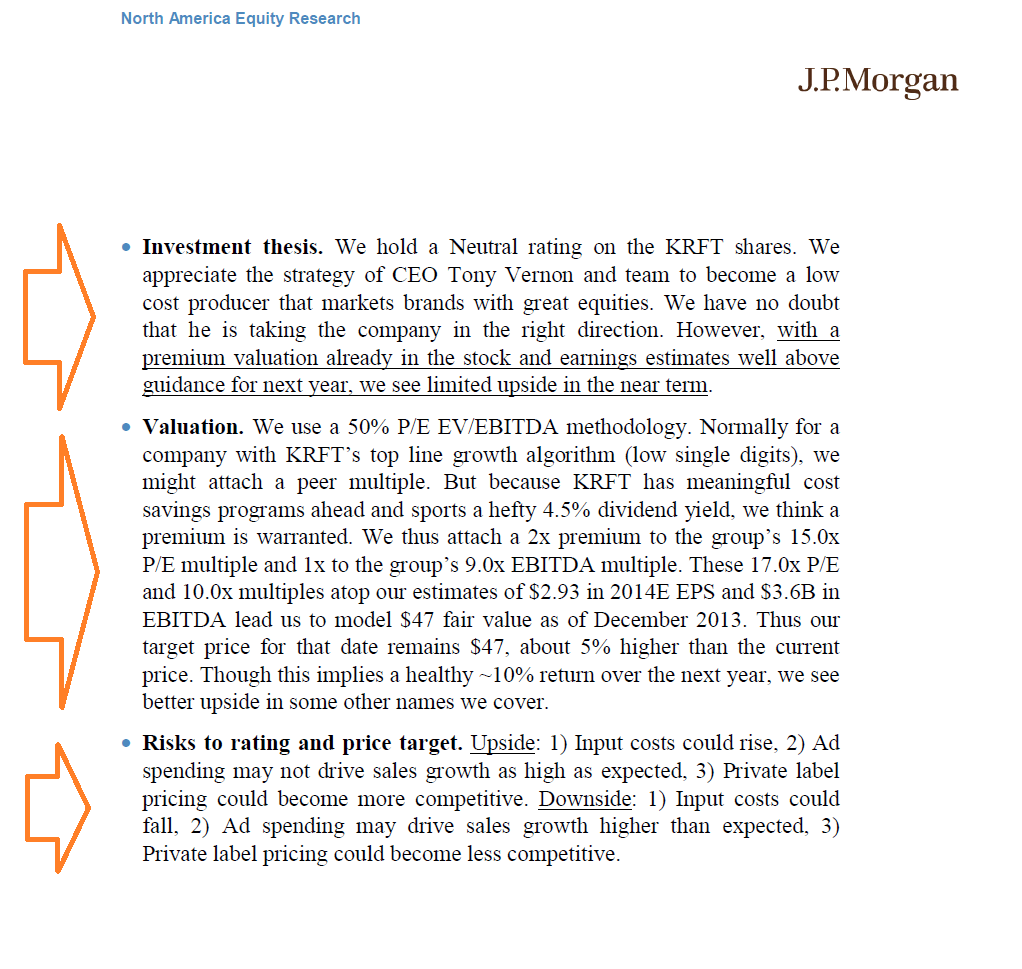

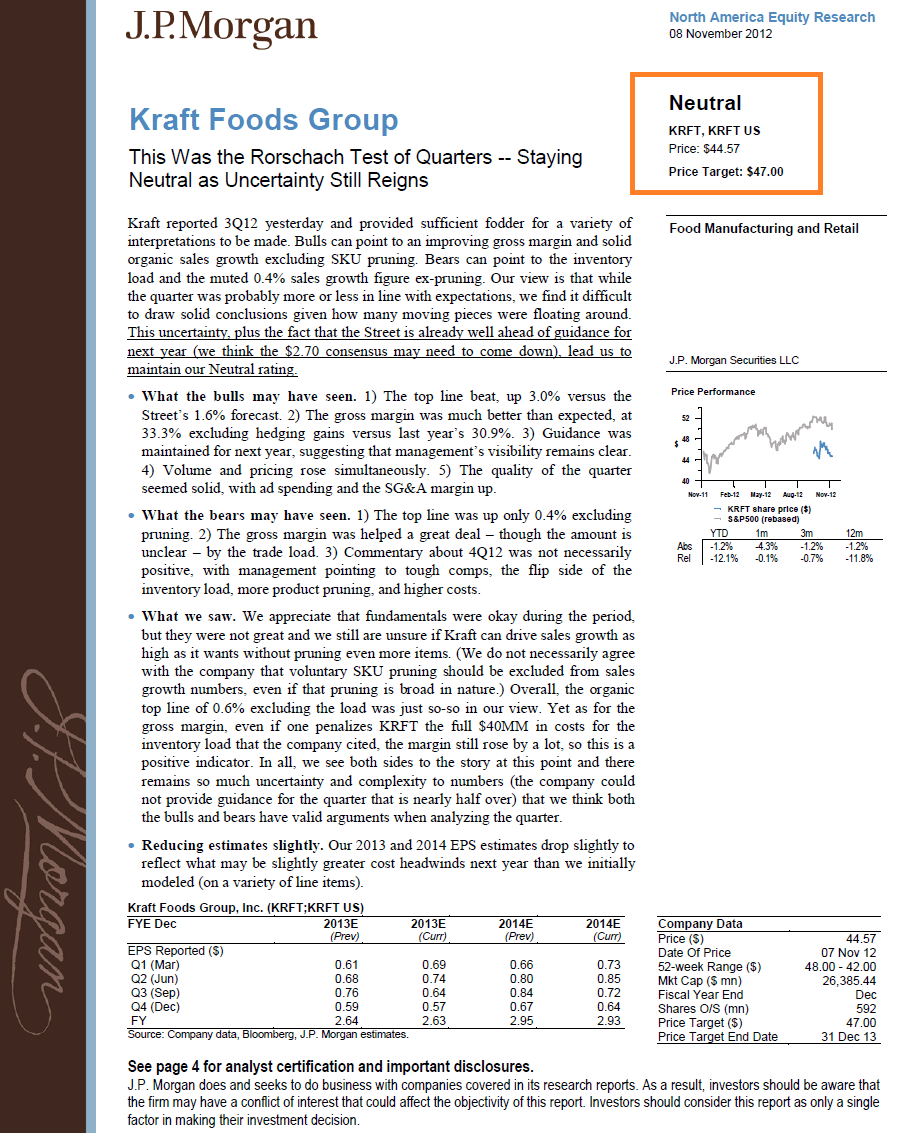

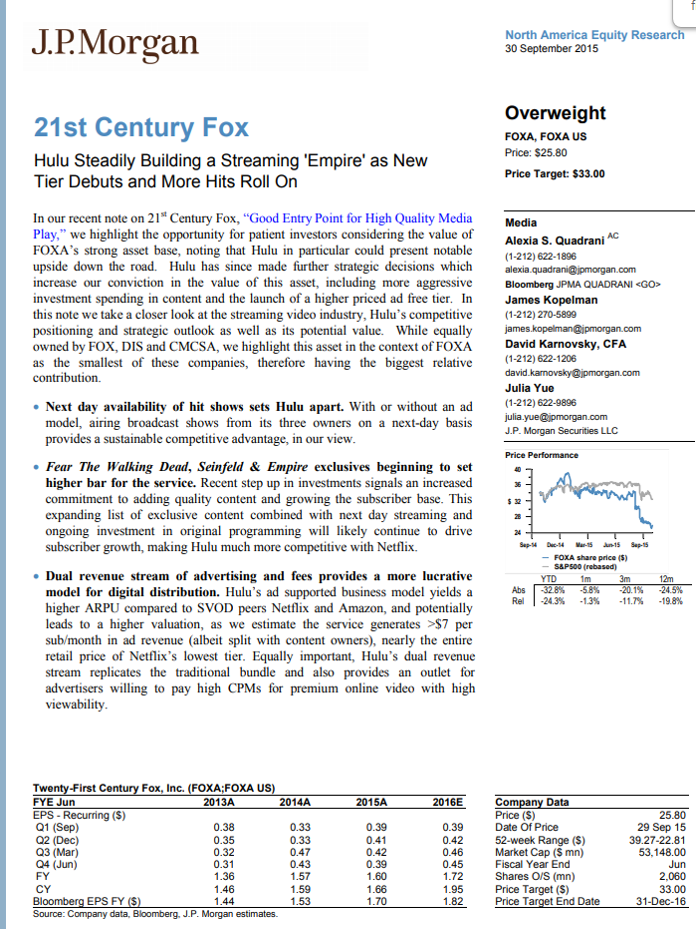

Below is an example of an equity research report on Kraft Foods. As you can see in the images below, the analyst clearly lays out the recommendation, target price, recent updates, investment thesis, valuation, and risks.

Thank you for reading CFI’s guide on Equity Research Report. To learn more, these additional resources will be helpful:

- Investment Research

- Types of Valuation Multiples

- DCF Modeling Guide

- Finance Salary Guides

- See all valuation resources

- See all capital markets resources

- Share this article

Create a free account to unlock this Template

Access and download collection of free Templates to help power your productivity and performance.

Already have an account? Log in

Supercharge your skills with Premium Templates

Take your learning and productivity to the next level with our Premium Templates.

Upgrading to a paid membership gives you access to our extensive collection of plug-and-play Templates designed to power your performance—as well as CFI's full course catalog and accredited Certification Programs.

Already have a Self-Study or Full-Immersion membership? Log in

Access Exclusive Templates

Gain unlimited access to more than 250 productivity Templates, CFI's full course catalog and accredited Certification Programs, hundreds of resources, expert reviews and support, the chance to work with real-world finance and research tools, and more.

Already have a Full-Immersion membership? Log in

Join 307,012+ Monthly Readers

Get Free and Instant Access To The Banker Blueprint : 57 Pages Of Career Boosting Advice Already Downloaded By 115,341+ Industry Peers.

- Break Into Investment Banking

- Write A Resume or Cover Letter

- Win Investment Banking Interviews

- Ace Your Investment Banking Interviews

- Win Investment Banking Internships

- Master Financial Modeling

- Get Into Private Equity

- Get A Job At A Hedge Fund

- Recent Posts

- Articles By Category

What’s in an Equity Research Report?

If you're new here, please click here to get my FREE 57-page investment banking recruiting guide - plus, get weekly updates so that you can break into investment banking . Thanks for visiting!

Even though you can easily find real equity research reports via the magical tool known as “Google,” we’ve continued to get questions on this topic.

Whenever I see the same question over and over again, you know what I do: I bash my head in repeatedly and contemplate jumping off a building…

…and then I write an article to answer the question.

To understand an equity research report, you must understand what goes into a stock pitch first.

The idea is similar, but an ER report is a “watered-down” version of a stock pitch.

But banks have some very solid reasons for publishing equity research reports:

Why Do Equity Research Reports Matter?

You might remember from previous articles that equity research teams do not spend that much time writing these reports .

Most of their time is spent speaking with management teams and institutional investors and sharing their views on sectors and companies.

However, equity research reports are still important because:

- You do still spend some time doing the required modeling work (~15%) and writing the reports (~20%).

- You might have to write a research report as part of the interview process.

For example, if you apply to an equity research role or an equity research internship , especially in an off-cycle process, you might be asked to draft a short report on a company.

And then in roles outside of ER, you need to know how to interpret reports quickly and extract the key information.

Equity Research Reports: Myth vs. Reality

If you want to understand equity research reports, you have to understand first why banks publish them: to earn higher commissions from trading activity.

A bank wants to encourage institutional investors to buy more shares of the companies it covers.

Doing so generates more trading volume and higher commissions for the bank.

This is why you rarely, if ever, see “Sell” ratings, and why “Hold” ratings are far less common than “Buy” ratings.

Different Types of Equity Research Reports

One last point before getting into the tutorial: There are many different types of research reports.

“Initiating Coverage” reports tend to be long – 50-100 pages or more – and have tons of industry research and data.

“Sector Reports” on entire industries are also very long. And there are other types, which you can read about here .

In this tutorial, we’re focusing on the “Company Update” or “Company Note”-type reports, which are the most common ones.

The Full Tutorial, Video, and Sample Equity Research Reports

For our full walk-through of equity research reports, please see the video below:

Table of Contents:

- 1:43: Part 1: Stock Pitches vs. Equity Research Reports

- 6:00: Part 2: The 4 Main Differences in Research Reports

- 12:46: Part 3: Sample Reports and the Typical Sections

- 20:53: Recap and Summary

You can get the reports and documents referenced in the video here:

- Equity Research Report – Jazz Pharmaceuticals [JAZZ] – OUTPERFORM [BUY] Recommendation [PDF]

- Equity Research Report – Shawbrook [SHAW] – NEUTRAL [HOLD] Recommendation [PDF]

- Equity Research Reports vs. Stock Pitches – Slides [PDF]

If you want the text version instead, keep reading:

Watered-Down Stock Pitches

You should think of equity research reports as “watered-down stock pitches.”

If you’ve forgotten, a hedge fund or asset management stock pitch ( sample stock pitch here ) has the following components:

- Part 1: Recommendation

- Part 2: Company Background

- Part 3: Investment Thesis

- Part 4: Catalysts

- Part 5: Valuation

- Part 6: Investment Risks and How to Mitigate Them

- Part 7: The Worst-Case Scenario and How to Avoid It

In a stock pitch, you’ll spend most of your time and energy on the Catalysts, Valuation, and Investment Risks because you want to express a VERY different view of the company .

For example, the company’s stock price is $100, but you believe it’s worth only $50 because it’s about to report earnings 80% lower than expectations.

Therefore, you recommend shorting the stock. You also recommend purchasing call options at an exercise price of $125 to limit your losses to 25% if the stock moves in the opposite direction.

In an equity research report, you’ll still express a view of the company that’s different from the consensus, but your view won’t be dramatically different.

You’ll spend more time on the Company Background and Valuation sections, and far less time and space on the Catalysts and Risk Factors. And you won’t even write a Worst-Case Scenario section.

If a company seems overvalued by 50%, a research analyst would probably write a “Hold” recommendation, say that there’s “uncertainty around several customers,” and claim that the company’s current market value is appropriate.

Oh, and by the way, one risk factor is that the company might report lower-than-expected earnings.

The Four Main Differences in Equity Research Reports

The main differences are as follows:

1) There’s More Emphasis on Recent Results and Announcements

For example, how does a recent product announcement, clinical trial result, or earnings report impact the company?

You’ll almost always see recent news and updates on the first page of a research report:

These factors may play a role in hedge fund stock pitches as well, but more so in short recommendations since timing is more important there.

2) Far-Outside-the-Mainstream Views Are Less Common

One comical example of this trend is how all 15 equity research analysts covering Enron rated it a “buy” right before it collapsed :

Sell-side analysts are far less likely to point out that the emperor has no clothes than buy-side analysts.

3) Research Reports Give “Target Prices” Rather Than Target Price Ranges

For example, the company is trading at $50.00 right now, but we expect its price to increase to exactly $75.00 in the next twelve months.

This idea is completely ridiculous because valuation is always about the range of possible outcomes, not a specific outcome.

Despite horrendously low accuracy , this practice continues.

To be fair, many analysts do give target prices in different cases, which is an improvement:

4) The Investment Thesis, Catalysts, and Risk Factors Are “Looser”

These sections tend to be “afterthoughts” in most reports.

For example, the bank might give a few reasons why it expects the company’s share price to rise: the company will capture more market share than expected, it will be able to increase its product prices more rapidly than expected, and a competitor is about to go bankrupt.

However, the sell-side analyst will not tie these factors to specific share-price impacts as a buy-side analyst would.

Similarly, the report might mention catalysts and investment risks, but there won’t be a link to a specific valuation impact from each factor.

So the typical stock pitch logic (“We think there’s a 50% chance of gaining 80% and a 50% chance of losing 20%”) won’t be spelled out explicitly:

Your Sample Equity Research Reports

To illustrate these concepts, I’m sharing two equity research reports from our financial modeling courses :

The first one is from the valuation case study in our Advanced Financial Modeling course , and the second one is from the main case study in our Bank Modeling course .

These are comprehensive examples, backed by industry data and outside research, but if you want a shorter/simpler example you can recreate in a few hours, the Core Financial Modeling course has just that.

In each case, we started by creating traditional HF/AM stock pitches and valuations and then made our views weaker in the research reports.

The Typical Sections of an Equity Research Report

So let’s briefly go through the main sections of these reports, using the two examples above:

Page 1: Update, Rating, Price Target, and Recent Results

The first page of an “Update” report states the bank’s recommendation (Buy, Hold, or Sell, sometimes with slightly different terminology), and gives recent updates on the company.

For example, in both these reports we reference recent earnings results from the companies and expectations for the next fiscal year:

We also give a “target price,” explain where it comes from, and give our estimates for the company’s key financial metrics.

We mention catalysts in both reports, but we don’t link anything to a specific valuation impact.

One problem with providing a specific “target price” is that it must be based on specific multiples and specific assumptions in a DCF or DDM.

So with Jazz, we explain that the $170.00 target is based on 20.7x and 15.3x EV/EBITDA multiples for the comps, and a discount rate of 8.07% and Terminal FCF growth rate of 0.3% in the DCF.

Next: Operations and Financial Summary

Next, you’ll see a section with lots of graphs and charts detailing the company’s financial performance, market share, and important metrics and ratios.

For a pharmaceutical company like Jazz, you might see revenue by product, pricing and # of patients per product per year, and EBITDA margins.

For a commercial bank like Shawbrook, you might see loan growth, interest rates, interest income and net income, and regulatory capital figures such as the Common Equity Tier 1 (CET 1) and Tangible Common Equity (TCE) ratios:

This section of the report explains how the analyst or equity research associate forecast the company’s performance and came up with the numbers used in the valuation.

The valuation section is the one that’s most similar in a research report and a stock pitch.

In both fields, you explain how you arrived at the company’s implied value, which usually involves pasting in a DCF or DDM analysis and comparable companies and transactions.

The methodologies are the same, but the assumptions might differ substantially.

In research, you’re also more likely to point to specific multiples, such as the 75 th percentile EV/EBITDA multiple, and explain why they are the most meaningful ones.

For example, you might argue that since the company’s growth rates and margins exceed the medians of the set, it deserves to be valued at the 75 th percentile multiples rather than the median multiples:

Investment Thesis, Catalysts, and Risks

This section is short, and it is more of an afterthought than anything else.

We do give reasons for why these companies might be mis-priced, but the reasoning isn’t that detailed.

For example, in the Shawbrook report we state that the U.K. mortgage market might slow down and that regulatory changes might reduce the market size and the company’s market share:

Those are legitimate catalysts, but the report doesn’t explain their share-price impact in the same way that a stock pitch would.

Finally, banks present Investment Risks mostly so they can say, “Well, we warned you there were risks and that our recommendation might be wrong.”

By contrast, buy-side analysts present Investment Risks so they can say, “There is a legitimate chance we could lose 50% – let’s hedge against that risk with options or other investments so that our fund does not collapse .”

How These Reports Both Differ from the Corresponding Stock Pitches

The Jazz equity research report corresponds to a “Long” pitch that’s much stronger:

- We estimate its intrinsic value as $180 – $220 / share , up from $170 in the report.

- We estimate the per-share impact of each catalyst: price increases add 15% to the share price, more patients from marketing efforts add 10%, and later-than-expected generics competition adds 15%.

- We also estimate the per-share impact from the risk factors and conclude that in the worst case , the company’s share price might decline from $130 to $75-$80. But in all likelihood, even if we’re wrong, the company is simply valued appropriately at $130.

- And then we explain how to hedge against these risks with put options.

The same differences apply to the Shawbrook research report vs. the stock pitch, but the stock pitch there is a “Short” recommendation where we claim that the company is overvalued by 30-50%.

And that sums up the differences perfectly: A Short recommendation with 30-50% downside in a stock pitch turns into a “Hold” recommendation with roughly equal upside and downside in a sell-side research report.

I’ve been harsh on equity research here, but I don’t want to disparage it too much.

There are many positives: You do get more creativity than in IB, it might be better for hedge fund or asset management exits, and it’s more fun to follow companies than to grind through grunt work on deals.

But no matter how you slice it, most equity research reports are watered-down stock pitches.

So, make sure you understand the “strong stuff” first before you downgrade – even if your long-term goal is equity research.

You might be interested in:

- The Equity Research Analyst Career Path: The Best Escape from a Ph.D. Program, or a Pathway into the Abyss?

- Private Equity Regulation : 2023 Changes and Impact on Finance Careers

- Stock Pitch Guide: How to Pitch a Stock in Interviews and Win Offers

About the Author

Brian DeChesare is the Founder of Mergers & Inquisitions and Breaking Into Wall Street . In his spare time, he enjoys lifting weights, running, traveling, obsessively watching TV shows, and defeating Sauron.

Free Exclusive Report: 57-page guide with the action plan you need to break into investment banking - how to tell your story, network, craft a winning resume, and dominate your interviews

Read below or Add a comment

15 thoughts on “ What’s in an Equity Research Report? ”

Hi Brian, what softwares are available to publish Research Reports?

We use Word templates. Some large banks have specialized/custom programs, but not sure how common they are.

Is it possible if you can send me a template in word of an equity report? It will help the graduate stock management fund a lot at Umass Boston.

We only have PDF versions for these, but Word should be able to open any PDF reasonably well.

Do you also provide a pre constructed version of an ER in word?

We have editable examples of equity research reports in Word, but we generally only share PDF versions on this site.

Hey Brian Can you please help me with coverage initiated reports on oil companies. I could not find them on the net. I need to them to get equity research experience, after which only I will be able to get into the field. I searched but reports could not be found even for a price. Thanks

We have an example of an oil & gas stock pitch on this site… do a search…

https://mergersandinquisitions.com/oil-gas-stock-pitch/

Beyond that, sorry, we cannot look for reports and then share them with you or we’d be inundated with requests to do that every day.

No worries. Thanks!

Hi! Brian! Do u know how investment bankers design and layout an equity research? the software they use. like MS Word, Adobe Indesign or something…? And how to create and layout one? Thanks

where can I get free equity research report? I am a Chinese student and now study in Australia. Is the Morning Star a good resource for research report?

Get a TD Ameritrade to access free reports there for certain companies.

How do you view the ER industry since the trading commission has been down 50% since 2007. And there are new in coming regulation governing the ER reports have to explicitly priced and funds need to pay for the report explicity rather than as a service comes free with brokerage?

In addition the whole S&T environment is becoming highly automated.

People have been predicting the death of equity research for over a decade, but it’s still here. It may not be around in 100 years, but it will still be around in another 10 years, though it will be smaller and less relevant.

Yes, things are becoming more automated, but the actual job of an equity research analyst or associate hasn’t changed dramatically. A machine can’t speak with investors to assess their sentiment on a company – only humans can do that.

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Learn Valuation and Financial Modeling

Get a crash course on accounting, 3-statement modeling, valuation, and M&A and LBO modeling with 10+ global case studies.

An Ultimate Guide to Equity Research

This post was originally published on August 15, 2019 and was updated for relevance on July 29, 2024.

Equity research is a specialized field within the finance industry that analyzes public companies, industries, and the overall economy. It helps investors make informed decisions about buying, holding, or selling investments.

In this guide, we’ll explore equity research, its definition, how to conduct research analysis, what goes into a research report, the various roles involved, key considerations when selecting an equity research firm, career pathways into the equity research industry, and more.

With that, let’s get started.

What is equity research?

Before we discuss equity research, it’s important to understand the concept of equity. Equity is the full ownership of an asset once its associated debts have been settled. Equity research, or “securities research,” refers to the process investment banks use to understand a company's overall equity or value.

Equity analysts, often working within an investment bank, lead this process. They create documents that delineate the equity in question within the context of the business, its management, the broader industry, and the economic landscape.

The larger the investment bank, the more reports an equity research team will tend to produce, and the analysis included will be more detailed. Examples of analysis include:

- Review of how the macroeconomic picture is likely to affect the company

- Operational changes or investments that are likely to affect the company’s performance

- Review the company’s financial statements and explanation of changes

- Projections on the status of the company’s revenue (and share price) and where it’s headed

- Recommendations on whether to buy, hold, or sell the company’s equity

How to conduct equity research analysis

Research is the name of the game. An Equity Research Analyst is responsible for providing vetted and trusted insights to make sound and informed investment decisions. This process is typically broken into four stages:

1. Thorough Research

Equity Research Analysts focus on specific regions and sectors. They leave no stone unturned in conducting extensive research, thoroughly reviewing financial reports, balance sheets in Excel, earnings releases, industry trends, regulatory changes, macroeconomic factors, and more that could impact the companies they are analyzing.

2. Financial Modelling & Valuation

Financial modeling involves creating mathematical representations of a company's financial performance by forecasting future results based on historical data and assumptions. Valuation is used to determine the fair value of a company's stock using methods such as discounted cash flow analysis and comparable company analysis. These tools help evaluate a company's financial health and growth potential to advise on investments.

3. Creating Equity Research Reports

Equity Research Analysts are responsible for condensing their findings into easily understandable reports for investors. We'll expand on this more in the next section.

4. Communication Skills & Publication

Equity Research Analysts in senior or lead positions often present their findings to their organization or client base. These individuals must be able to simplify complex financial data, so strong communication and presentation skills are essential.

What is an equity research report?

Buy-side or sell-side, an equity research report typically includes the following:

- An industry research overview that covers trends and news related to competing companies.

- A company overview that includes any recent business developments and quarterly performance results.

- The equity analyst provides an investment thesis explaining the reasons behind their prediction of the stock's performance. This section also includes the target share price, which many consider the most critical aspect of the report.

- A financial model-based forecast of the company's income, cash flow, and valuation.

- Risks associated with the stock.

Difference between a career in equity research and investment banking

Investment banking and equity research are similar but have clear distinctions in their intended outcome. Investment banking is all about helping companies raise money through stocks and bonds, offering mergers and acquisitions services, and managing significant financial deals.

Equity research involves evaluating individual stocks and providing investment advice based on their potential value and performance.

In essence, investment banking focuses on managing financial transactions, while equity research focuses on analyzing and valuing individual stocks.

When considering a career between the two, it's imperative to evaluate the following factors:

1. Educational Background

Both career paths require a bachelor's degree in economics, accounting, finance, or engineering. For career growth, a Chartered Financial Analyst (CFA) designation is often required for Equity Research Analysts, while investment banking can require a Master of Business Administration (MBA). Additionally, investment bankers must pass the Series 79 exam , which measures the knowledge needed to perform the critical functions of an investment banking representative.

2. Career Path

In investment banking, the career path is straightforward. It starts with being an analyst, then an associate, and climbing to higher positions. In equity research, the career path could be more transparent. Typically, it involves transitioning from associate to analyst, senior analyst, and then to the role of vice president or director of research. Investment bankers have better opportunities to reach top positions because of their involvement in making deals and managing clients. They often go on to work for private equity firms for venture capitalists. Research analysts are frequently seen solely as number crunchers and not thought of as being able to drive substantial business growth.

3. Skill Set

It should come as no surprise that Equity Research Analysts require strong analytical and mathematical skills to handle complex calculations, build predictive models, and prepare financial statements. They must also be proficient communicators capable of simplifying complex financial data. As for investment bankers, financial modeling and industry analysis are crucial early in their careers. However, as they advance, they transition to a sales-oriented mindset, excelling at closing deals and managing client relationships.

4. Work-Life Balance

Equity research is known for long hours, particularly during earnings season, but there are periods of relative calm. Investment banking is another beast, typically requiring brutal hours, often up to 100 hours per week. A recent article in Forbes highlighted that work-life balance has become a significant concern in investment banking. This is particularly after the reported deaths of two Bank of America employees who were said to be working up to 110 hours per week.

5. Recognition

Equity research reports offer visibility to associates and junior analysts. Senior analysts are sought after by the media for comments on the companies they cover. Junior investment bankers work in obscurity but gain visibility as they progress in their careers. Visibility for investment bankers significantly increases when they work on large, prestigious deals.

6. Compensation

Investment banking generally offers higher earning potential compared to equity research. For example, according to Wall Street Oasis (WSO), investment banking associates earn between $150,000 and $200,000 with substantial bonuses, while senior vice presidents or managing directors earn over $400,000 annually. WSO also says entry-level analysts start between $50,000 and $80,000 and have the potential to make up to $500,000 as they grow to leadership positions.

Roles in equity research

In the world of equity research, it is crucial to understand the distinction between a buy-side and sell-side Equity Research Analyst. Below, we'll outline their respective areas of focus and ultimate objectives.

1. Sell-side analysts

Sell-side Equity Research Analysts work for investment banks and provide their clients with sell-side research and recommendations on stocks and other financial instruments. Their primary goal is to generate trading commissions and investment banking business for their firm.

2. Buy-side analysts

A buy-side Equity Research Analyst works for institutions that buy and sell securities, such as mutual funds, hedge funds, and pension funds. Their role involves researching and making investment recommendations for their firm's portfolios.

Best Equity Research Firms

Below are some of the top-ranking equity search firms.

- JP Morgan —J.P. Morgan’s Research team uses state-of-the-art technologies and innovative tools to provide clients with top-notch analysis and investment advice.

- Barclays —The equity research teams cover hundreds of stocks across the Americas and Europe, delivering event analysis, stock ideas, and sector themes. They collaborate with other teams to offer clients unique, cross-asset perspectives on industries and markets.

- Credit Suisse AG —The team has original research on over 3,000 companies with thought-provoking thematic analysis, differentiated trading ideas, and coordinated global views.

- Bank of America Financial Center —The company offers comprehensive research and analysis for both institutional and retail clients. It encompasses over 4,000 companies across 35 global sectors in developed and emerging markets. Its research involves fundamental and technical analysis as well as hedging strategies.

- Morgan Stanley —Through timely, in-depth analysis of companies, industries, markets, and world economies, Morgan Stanley has earned its reputation as a leader in investment research.

Things to consider when hiring an equity research firm

When evaluating an equity research firm, it’s essential to consider the experience and reputation of its analysts, the firm’s track record of accurate stock picks and recommendations, the depth and quality of their research reports, the firm's access to company management and industry experts, their industry specialization, the firm's coverage universe, the timeliness of their research, and the overall transparency and integrity of their research process.

How to get into equity research

If you are considering entering the equity research space, you will likely need a finance, accounting, or economics background. Many professionals in this field begin with a bachelor's degree in finance or a related field. Those seeking career advancement often pursue a master's degree or a CFA designation to enhance their resume.

Research assistant, junior analyst, or equity research associate are common entry-level roles. Advancing in your career will require gaining experience in financial analysis, modeling, and report writing. Developing a solid network of connections within the industry is also crucial for discovering new opportunities in equity research. Like all areas of business, networking is critical.

Staying up to date on the latest trends and news within the equity research space is important for understanding the workings of the stock market and developing strong analytical and critical thinking skills. This is crucial for ensuring high-quality, long-lasting success in equity research.

The Importance of Equity Research

As we've discussed, equity research is essential for investors as it provides valuable information and investment recommendations. It involves digging into company finances, creating financial models, and meeting with industry experts.

Equity research supports investment decisions, evaluates securities, and guides investors and fund managers. For example, it helps predict the future growth potential of tech companies, find investment opportunities in the pharmaceutical industry, and understand how macroeconomic trends affect different sectors and stocks.

Final Thoughts

Equity research is crucial in empowering investors to make informed investment decisions. Through comprehensive analysis of financial data, market trends, and company performance, equity research provides valuable insights that enable investors to identify attractive opportunities and manage their portfolios effectively. By leveraging the expertise of research analysts and utilizing robust analytical techniques, investors can gain a deeper understanding of the risks and potential returns associated with specific investment opportunities. Ultimately, equity research is a fundamental tool for institutional and retail investors, helping them navigate the complexities of the financial markets with confidence and clarity.

Get your M&A process in order. Use DealRoom as a single source of truth and align your team.

Equity Research Report

- What is an Equity Research Report?

An equity research report is a document prepared by an equity analyst. It is a form of communication between financial experts and investors. The analyst conducts an in-depth analysis of a company, industry, or even an economy and explains his findings in the form of a report. The purpose of preparing such reports is to provide investment recommendations to the clients (buy, sell or hold).

- Who Produces Them?

As we are all aware, Buy-side firms conduct their own research on which stocks they should buy and sell. The reports are only used internally by their portfolio managers and are not available publicly.

Investment Rating / Recommendation

Company analysis, investment argument, financial performance and analysis, sample report, initiation of coverage, industry report, tips for preparing good reports.

Sell-side firms conduct equity research on behalf of their clients. Investment banks or brokerage houses sell their investment ideas to clients, expecting transaction costs and commissions in return (though there is no rule that clients have to buy). Hence, they produce reports to help them make better investment decisions. These reports are often available free for their clients. Examples of clients for such reports are pension funds, insurance companies, retail and institutional investors, etc.

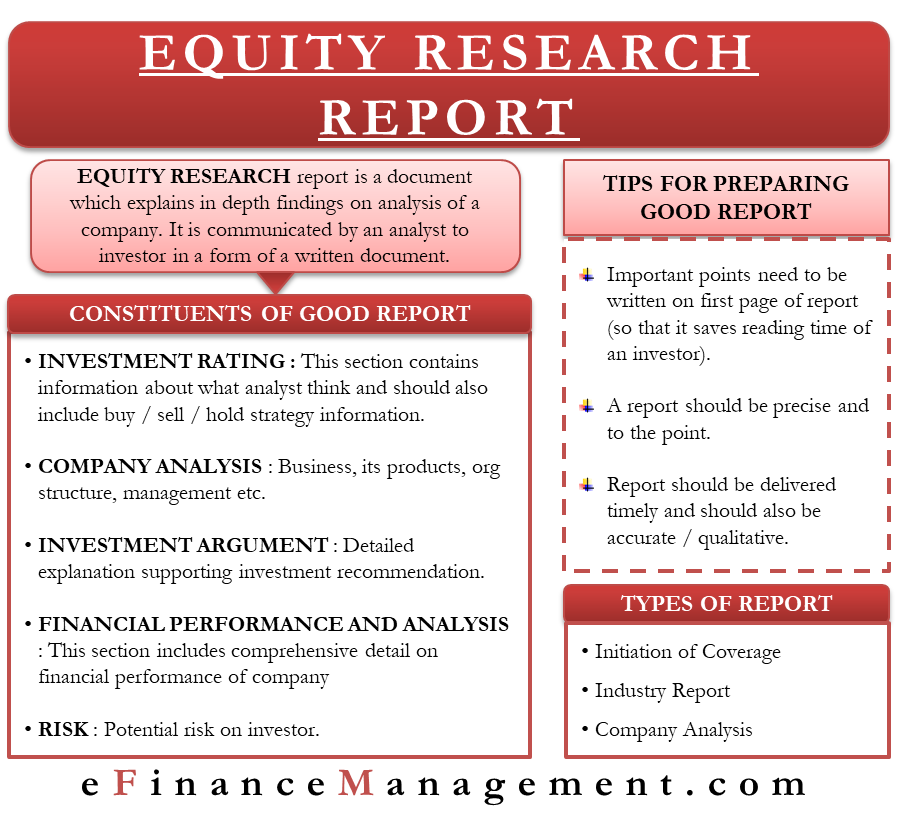

Constituents of an Equity Research Report

Let us take a sneak peek into an equity research report and understand what sections are required in the report. Most of the equity reports have the following in the list of sections.

Also Read: Equity Research

This section gives an idea of what the analyst thinks about the stock. It is usually either buy, sell, or hold. This section also includes a target price, which means the best price (as per the analysts’ view) to buy/sell a company.

Includes information regarding the company. This section covers the company’s business, its products, organizational structure, management, etc. It also consists of any recent information released by the company like major contracts, management changes, or any other important information about the company.

Here, the analyst provides a detailed explanation supporting his investment recommendation. This is the most important section of the report, and an analyst spends most of his time drafting this part.

Financial analysis is performed in excel using financial modeling , but its findings are presented here. This section provides comprehensive detail on a company’s financial performance, its historical performance, and current earnings. The analyst also presents the valuation of the company and his assumptions used to predict future earnings.

Also Read: Equity Research Analyst

This section addresses the potential risks an industry or a company poses to an investor. For instance, regulatory risks, operational risks, financial risks, etc., can significantly impact the stock price.

Following is a sample report published by one of the major financial centers.

Types of Equity Research Reports

Following are the three main categories of these reports:

When a broker or an analyst starts covering up the stock for the first time, he publishes this report. This means this is the first time an analyst gives a recommendation on a particular company. Therefore, this is a detailed report that explains many things about the company. For example, the report provides exhaustive information on the company’s business, its products, services, industry, and market data. It also provides other details, for example, the rationale behind the investment recommendation, valuation, information on competitors, etc.

This report provides deep insights into a particular industry. For example, the report covers topics like recent trends in the industry, updates on the recent regulations, competitors, etc. This type of report is also usually long because it covers an entire industry. An industry report also covers information on key drivers, risk factors, and overall valuation levels, followed by shorter sections on specific companies.

This report is a relatively shorter one. Analyst issues this report to update the existing ones that already have an investment recommendation. This covers events happening in the company. For instance, earnings releases, investor day, or any major announcements by the company affect its strategies, such as an acquisition or a new product launch.

- An investor often would not have enough time to read the complete report. Hence, all the important items like a recommendation, target price, and earnings estimates must be present on the first page.

- Too much information is poisonous. A good report is that when a reader gets the required insight for the first time, he reads it. Therefore, the report has to be precise and right to the point.

- Quality and quantity matter. It is necessary to provide accurate information and is also important to deliver the reports on time. Many brokerage firms come up with similar reports. Hence, our report gains significance only if it is the first in the market to report any updates on a particular company. For example, an earnings release update does not make sense after 3 to 4 days after the release.

RELATED POSTS

- Equity Research Firms

- Equity Research Buy-Side

- Equity Research Sell-Side

- Equity Research Vs. Credit Research

- Types of Financial Statements

- Advantages and Disadvantages of Equity Valuation

Sanjay Bulaki Borad

MBA-Finance, CMA, CS, Insolvency Professional, B'Com

Sanjay Borad, Founder of eFinanceManagement, is a Management Consultant with 7 years of MNC experience and 11 years in Consultancy. He caters to clients with turnovers from 200 Million to 12,000 Million, including listed entities, and has vast industry experience in over 20 sectors. Additionally, he serves as a visiting faculty for Finance and Costing in MBA Colleges and CA, CMA Coaching Classes.

1 thought on “Equity Research Report”

Thank You For Sharing

Leave a Comment Cancel reply

Save my name, email, and website in this browser for the next time I comment.

Sign me up for the newsletter!

- All Self-Study Programs

- Premium Package

- Basic Package

- Private Equity Masterclass

- VC Term Sheets & Cap Tables

- Sell-Side Equity Research (ERC © )

- Buy-Side Financial Modeling

- Real Estate Financial Modeling

- REIT Modeling

- FP&A Modeling (CFPAM ™ )

- Project Finance Modeling

- Bank & FIG Modeling

- Oil & Gas Modeling

- Biotech Sum of the Parts Valuation

- The Impact of Tax Reform on Financial Modeling

- Corporate Restructuring

- The 13-Week Cash Flow Model

- Accounting Crash Course

- Advanced Accounting

- Crash Course in Bonds

- Analyzing Financial Reports

- Interpreting Non-GAAP Reports

- Fixed Income Markets (FIMC © )

- Equities Markets Certification (EMC © )

- ESG Investing

- Excel Crash Course

- PowerPoint Crash Course

- Ultimate Excel VBA Course

- Investment Banking "Soft Skills"

- Networking & Behavioral Interview

- 1000 Investment Banking Interview Questions

- Virtual Boot Camps

- 1:1 Coaching

- Corporate Training

- University Training

- Free Content

- Support/Contact Us

- About Wall Street Prep

- Investment Banking

- Private Equity

Buy Side vs. Sell Side

Guide to Understanding Buy-Side vs. Sell-Side

View Modeling Courses

Table of Contents

What is Buy-Side vs. Sell-Side?

Sell side: investment banking industry and firms, what is the sell side function, what is the buy side function, what are examples of buy side firms, what are buy side vs. sell side mandates in investment banking.

You’ll often hear finance professionals describe their role as being either on the “sell side” or on the “buy side.” As is the case with a lot of finance jargon, what this exactly means depends on the context.

- Sell Side refers primarily to the investment banking industry . It refers to a key function of the investment bank, namely to help companies raise debt and equity capital, and then sell those securities to investors such as mutual funds, hedge funds, insurance companies, endowments and pension funds.

- Buy Side refers to institutional investors, or in simple terms, the investors who buy the securities.

On that note, a related function by the sell side is to facilitate buying and selling between investors of securities already trading on the secondary market .

While we describe the various functions of the investment bank here , we can briefly outline its capital raising and secondary markets roles:

- Primary capital markets: Investment banks work with companies to help them raise debt and equity capital. Those bonds and stocks are sold directly to institutional investors and are arranged through the investment bank’s equity capital markets (ECM) and debt capital markets (DCM) teams, who, along with the investment bank’s sales force, market via roadshows (see examples of roadshows ) and distribute the securities to institutional clients.

- Secondary capital markets: In addition to helping companies raise capital, the investment bank’s sales & trading arm facilitates and executes trades on behalf of institutional investors in the secondary markets, where the bank matches up institutional buyers and sellers.

Learn More → Buy Side and Sell Side Infographic

The investment bank has several key functions that make its role as a seller of corporate securities to investors possible. Those roles include:

- Investment banking (M&A and corporate finance) : The investment banker is the primary relationship manager interfacing with corporations. The banker’s role is to probe and understand its corporate clients’ capital raising needs and to identify opportunities for the bank to win business.

- Equity capital markets: Once the investment banker has established that a client is considering raising equity capital, ECM begins its work. ECM’s job is to usher corporations through the process. For IPOs, for example, the ECM teams are the key hub in determining structure, pricing and reconciling the clients’ objectives with current conditions in the capital markets.

- Debt capital markets: The DCM team plays the same role that ECM plays, but on the debt capital side.

- Sales and trading: Once a decision to raise capital is made, the sales & trading floor begins its job to contact investors and actually sell the securities. The sales & trading function not only works on helping initial debt and equity offerings get subscribed, they are central to the investment bank’s intermediary function in secondary capital markets, buying and selling already trading securities on behalf of clients (and sometimes for the bank’s own account “prop trading”).

- Equity research : Equity research analysts are also known as sell-side research analysts ( in contrast to buy side research analysts ). The sell side research analyst supports the capital raising process as well as sales and trading in general, by providing ratings and other hopefully value-adding insights on the firms they cover. These insights are directly communicated through the investment bank’s sales force and through equity research reports. While sell side equity research is objective and separated from the investment bank’s capital raising activities, questions about the function’s inherent conflicts of interest were brought to the fore during the late ’90s tech bubble and still linger today.

The buy side broadly refers to money managers, or “institutional investors”.

Examples of institutional investors include private equity firms (PE) and hedge funds .

These firms raise outside capital from investors – otherwise known as limited partners (LPs) – and invest their contributed capital across various asset classes using a variety of different investing strategies.

Before getting into the specific types of institutional investors, let’s establish whose money these institutional investors are playing with. As of 2014, there were $227 trillion in global assets ( cash , equity, debt, etc) owned by investors.

- Nearly half of that ($112 trillion) is owned by high net worth, affluent individuals and family offices.

- The rest is owned by banks ($50.6 trillion), pension funds ($33.9 trillion) and insurance companies ($24.1 trillion).

- The remainder ($1.4 trillion) is owned by endowments and other foundations.

So how are these assets invested?

- 76% of assets are invested directly by owners 1 .

- The remaining 24% of assets is outsourced to third part managers that act on behalf of the owners as fiduciaries. These money managers constitute the buy side .

- Mutual Funds and ETFs: Mutual funds are the largest type of investment fund, with over $17 trillion in assets. These are actively managed funds, in other words, their portfolio managers and analysts analyze investment opportunities, rather than passive funds like ETFs and index funds. Currently, 59% of mutual funds focus on stocks (equities), 27% are bonds (fixed-income), while 9% are balanced funds and the remaining 5% are money market funds 2 . Meanwhile, ETF funds are a fast-growing competitor to mutual funds. Unlike mutual funds, ETFs are not actively managed, enabling investors to get the same diversification benefits without the hefty fees. ETFs now have $4.4 trillion in assets 3 .

- Hedge Funds: Hedge funds are a type of investment fund. While mutual funds that are marketed to the public, hedge funds are private funds and are not allowed to advertise to the public. In addition, in order to be able to invest with a hedge fund, investors must demonstrate high wealth and investment criteria. In exchange, hedge funds are largely free from regulatory restrictions on trading strategies that mutual funds face. Unlike mutual funds, hedge funds can employ more speculative trading strategies, including short selling and taking highly leveraged (risky) positions. Hedge funds have $3.1 trillion in global assets under management 4 .

- Private Equity: Private equity funds pool investor capital and take significant stakes in businesses and focus on achieving returns to investors through altering the capital structure, operational performance and management of the businesses they own. This strategy lies in contrast to hedge funds and mutual funds that focus more on larger public companies and take smaller, passive stakes in a larger group of companies. Private equity now has $4.7 trillion in assets under management 5 . Read more about the career of a private equity associate .

Other buy side investors: Insurance, pensions and endowments

As we mentioned earlier, life insurance companies, banks, pensions and endowments outsource to the institutional investors described above, as well as directly investing. This group represents the bulk of the rest of the professional investor universe.

Learn More → Hedge Fund Primer

To complicate matters a bit, the terms “sell side” and “buy side” mean something completely different in the investment banking M&A context. Specifically, sell-side M&A refers to investment bankers working on an engagement where the investment bank’s client is the seller. Working on the buy-side simply means the client is the buyer. This definition has nothing to do with the broader sell side/buy side definition described previously.

As a side note, investment bankers generally prefer to work on sell-side engagements. That’s because when a seller has retained an investment bank, they usually decide to sell, increasing the likelihood that a deal will happen and that a bank will collect its fees. Meanwhile, investment banks often pitch to buy side clients, which doesn’t always materialize into deals.

1 Blackrock. Read the survey .

2 ICI and mutualfunds.com. http://mutualfunds.com/education/how-big-is-the-mutual-fund-industry/.

3 Ernst & Young. Read the report .

4 Prequin. Read the report. 5 McKinsey. Read the report.

The Wharton Online and Wall Street Prep Private Equity Certificate Program

Level up your career with the world's most recognized private equity investing program. Enrollment is open for the Sep. 9 - Nov. 10 cohort.

- 100+ Excel Financial Modeling Shortcuts You Need to Know

- The Ultimate Guide to Financial Modeling Best Practices and Conventions

- What is Investment Banking?

- Essential Reading for your Investment Banking Interview

Great read! I also love this definition I have found on DealRoom: Essentially, sell-side is the sector of the financial market that is all about creation, promotion, and selling traded securities to the public. On the other end, buy-side deals with purchasing and investment of large portions of securities for … Read more »

Great points!

Cheers, Jeff

We're sending the requested files to your email now. If you don't receive the email, be sure to check your spam folder before requesting the files again.

The Wall Street Prep Quicklesson Series

7 Free Financial Modeling Lessons

Get instant access to video lessons taught by experienced investment bankers. Learn financial statement modeling, DCF, M&A, LBO, Comps and Excel shortcuts.

What is an Equity Research Report?

One of the most powerful tools at investors’ disposal is equity research reports. Wall Street firms employ some of the sharpest minds in the industry who study companies with publicly traded stocks. These analysts delve into every aspect of the company, from its financial statements to its management team and competitors. Equity research reports provide solid analysis and the opinions of the analysts who follow the companies and their stocks extremely closely.

What Is an Equity Research Report?

An equity research report is a detailed report written by an analyst at a sell-side firm or independent investment research firm that analyzes the company’s business and finances and gives the analyst’s opinion of the company’s prospects and future stock price.

Analysts are experts in the companies’ businesses, finance, and industries they follow. They research a company’s financials, performance, and competitive landscapes. They also create models to predict metrics like future earnings per share, sales, and a target price for the stock.

Analysts keep a close eye on every move of the companies they follow and update their equity research reports at least once a quarter after the company issues its quarterly earnings report. If significant material changes occur mid-quarter, the analyst will write an update to their research report in a flash report.

An example of an equity research report is a report on Apple written by a sell-side analyst from Argus. This report includes the analyst’s analysis and opinions about the company’s financials and future revenue and earnings predictions. The report also provides the analyst’s target price estimate and rating.

Important Components of a Typical Equity Research Report

The typical equity research report includes components that dig into the company’s financials, industry landscape, risks, and other vital aspects that can materially affect the company’s future business performance and stock price.

Recent Results & Company Announcements

Shortly after a company announces its quarterly results, an analyst will issue a new equity research report. This report will include an analysis of the recent quarterly results, including EPS, sales, and various financial metrics like EBITDA and profit margins.

When releasing quarterly results, a company often makes announcements in a press release or through a conference call between management and the analyst community. The equity research report will include an analysis of these company announcements.

Organizational Overview and Commentary

An equity research report typically summarizes the company’s organizational structure. This summary outlines the management structure and the company’s major divisions.

If the company makes any significant structural changes, such as appointing a new CEO or shutting down a division, the analyst will discuss the implications of these changes in the equity research report.

Valuation Information

Perhaps the most impactful part of an equity research report is the valuation analysis provided by the research analyst. The analyst provides an overview of the company’s performance through this analysis.

The valuation information included within an equity research report includes margin analysis, EPS and sales estimates, the stock’s target price estimate, and other valuation and financial metrics calculated through a deep dive into the company’s financial statements.

An analyst uses a company’s reported results and their own research into the company’s operations and the industry to calculate various estimates. The most prominent estimate is the EPS estimate, the analyst’s estimate for earnings per share for future quarters and fiscal years. Analysts also calculate forecasts for sales, margins, and other financial metrics.

Many equity brokerage reports include a target price estimate, which is a short-term estimate for the stock’s price. An analyst may also issue a rating for the company’s stock, such as buy, sell, or hold.

Financial Histories

An equity research report typically contains financial data going back several years on both a quarterly and fiscal year basis. The analyst uses this financial data to perform an analysis of the company’s financial health and create projections.

While research reports typically do not include complete financial statements, the reports often include important line items, valuation ratios, and financial metrics in tables which the analyst will reference in the commentary.

Evaluating trends is a big part of an analyst’s job; equity research reports discuss these trends. The report includes trends like year-over-year and quarter-over-quarter growth rates for metrics such as EPS, sales, and margins.

The trend analysis gives an excellent overview of the growth of the company. For example, suppose sales significantly grew year-over-year, but EPS was stagnant. In this case, the company may be facing higher expenses, and the analyst will dive into the financial results and attempt to uncover the cause of the problem.

Many equity research reports include a section that describes the risks the company and investors may encounter. These risks may include economic headwinds, an increasingly competitive landscape, and company-specific risks like failed product launches or management changes.

In-Depth Industry Research

While analysts are experts on the companies they follow, they are also experts on the companies’ industries. Equity research reports include the analyst’s evaluation of the industry trends, the competitive landscape, and how the company’s prospects align with changes within the industry.

Buy Side vs. Sell Side: What Role Do Both Sides Play?

Buy-side and sell-side firms play different roles in financial markets, and it is vital to understand the role of each.

Buy-side firms, such as hedge funds, pension funds and asset managers, have money to invest. They buy stocks and other investments and are fiduciaries of their client’s money. Sell-side firms, such as brokerage houses, sell investments to their clients, including buy-side firms.

Sell-side firms employ analysts that write equity research reports. The sell-side firms provide these equity research reports to their buy-side clients. Buy-side firms use these equity research reports to help make investment decisions.

Other Types of Research Reports

Analysts produce several types of equity research reports. These include initiation of coverage reports, quarterly results reports, flash reports, and sector and industry reports.

Initiating Coverage Reports

When a sell-side firm begins covering a stock, the first analyst report is called an initiation of coverage report. This report gives the analyst’s first take on a company and its stock. Many investors pay attention to initiation of coverage reports because they provide a fresh perspective on a stock.

Quarterly Results Reports

After a company reports its earnings, an analyst will issue a new research report incorporating recent results. The analyst discusses the results and what went wrong and right in the last quarter. The analyst will also calculate new financial projections based on the results, company guidance, and management commentary.

Related Resource: Portfolio Management: What it is and How Visible Can Help

Related Resource: How To Write the Perfect Investor Update (Tips and Templates)

Flash Reports

Analysts issue flash reports when significant material changes involving the company, or the company’s industry, occur. An analyst may issue a flash report if the company’s CEO resigns, the company initiates a significant stock buyback program, or other major news breaks. In a flash report, the analyst will discuss the relevant news and how it may impact the company and its stock price.

Sector Reports

Sell-side firms also issue sector reports. The sector reports will dive into trends within the sector, a high-level analysis of the top companies in the sector, and past and future predicted performance of the stocks within the sector.

Industry Reports

Like sector reports, industry reports discuss the competitive landscape and major players within an industry. An industry is a subset of a sector. For example, the technology sector includes the semiconductor, personal computer, and cloud computing industries. Industry reports focus on a narrower industry rather than a broader sector.

Equity Research Report Example

Although each sell-side firm has a unique style for presenting analysts’ research in equity research reports, most contain similar types of information. Let’s conclude our discussion of equity research reports by looking at a recent Microsoft report written by Argus analyst Joseph Bonner after the company issued its fourth quarter 2022 results.

The report starts with several tables of key statistics, such as financial and valuation ratios and the analyst’s investment thesis. The table also includes the analyst’s rating and target price for the stock.

The report continues with the analyst’s investment thesis for Microsoft stock. This thesis briefly explains the analyst’s rationale for his Buy rating on MSFT stock.

A section detailing recent developments within the company, which the analyst derives from the company’s earnings report and conference call, is followed by a look at select financial data. An analysis of growth rates for several key metrics like revenue and margins leads to an overview of risks that investors of Microsoft may face.

Equity research reports offer investors a great way to harness the power of Wall Street analysts. These analysts live and breathe the companies they follow. Investors can use their expertise to advise them in the investing process.

Start my free trial

Please fill out the form below and an AlphaSense team member will be in touch within 20 minutes to help set up your trial.

Search Broker Reports From 1,000+ Sources In Seconds with AlphaSense

Explore the many ways broker research and reports on the AlphaSense platform can power faster, smarter insights and decision-making for your organization.

of the top consultancies

of the top asset management firms

largest pharmaceutical companies

of the S&P 100

Traditionally considered a source of insight for sell-side firms, broker research and reports now provide critical insight for corporate and consulting professionals . In addition, corporate strategy professionals are increasingly turning to broker research to analyze market landscapes and better understand analyst assessments of market and industry trends, as well as performance of competitive peers.

However, manually finding broker reports and extracting the insights they contain requires significant time and effort—think multiple search engine queries and hours of combing through countless documents to identify important information. And even when you locate the right reports, broker research is often stuck behind frustrating paywalls.

The AlphaSense platform transforms the research experience by providing you with access to top broker research and other premium content and data sources , such as Wall Street Insights® , all within a single, centralized platform.

With AI search technology supporting your research, you’ll also be able to quickly identify insights to uncover new opportunities, stay one step ahead of your market competitors, and deliver exceptional results for your clients.

Wall Street Insights®

AlphaSense provides global reports from 1,000+ research providers (comprised of sell-side analysts, strategists, and research teams) that cover companies, industries, asset classes, and economies.

Our default proprietary offering Wall Street Insights® features equity research from the world’s leading brokerage firms including, but not limited to:

- Goldman Sachs

- Morgan Stanley

- Credit Suisse

Wall Street Insights® showcases both real-time and after-market research, is sourced from both broker partnerships and vendors, and covers North America, EMEA, APAC, and LATAM regions.

With Wall Street Insights®, you can conduct more comprehensive competitive analysis , improve client interactions, enhance internal research and strategy, and save your organization time and money with AI and automations.

Broker Reports You Can Access on the AlphaSense Platform

On the AlphaSense platform, users can access several critical types of equity research reports, including:

- Upgrades/downgrades: published when a stock analyst changes their opinion of a stock, and subsequently, their investment recommendation

- Estimate / price target revisions: published when an analyst revises their previous price target (their prediction of the future price of a security)

- Initiation reports: published when a broker first begins covering a company

- Credit research

- All other company reports

- Industry reports – Analyze a set of companies within the same industry

- Fixed income reports – Demonstrate maturity distribution of portfolios

- Economic/macro reports – Shares analysts’ views on growth expectations, inflation, stock market volatility, and global market trade

- Commodities reports – Provide analysis of commodities within a particular industry, published weekly or monthly

Unlock Market Moving Insights Faster with AI & Automation

When you rely on an equity research platform that utilizes the power of AI search technology, you can be more confident in your research, knowing you are no longer at the mercy of human error. AlphaSense also allows you to automate certain research processes that previously would have required hours of manual work, streamlining your entire process so you can take action and make mission-critical decisions faster than ever.

Here’s how our semantic search and smart automations can transform your workflow:

Smart Search