- Investment Advisor Support

- Knowledge Center

Plan Document

Plan Compliance

Defined benefits services, mergers, aquisitions & related company analysis.

Plan Corrections

Government Audits

DWC has a long history of successfully partnering with investment advisors.

We bring decades of experience, supported by the resources to deliver comprehensive solutions for your clients. Our consultants understand the importance of your relationships and will work seamlessly alongside your team.

Articles & Insights

Fiduciary Duties & Due Dilligence

Plan Distributions

Retirement Plan Design

Retirement Plan Investment Menu

Plan Sponsor Requirements

Corporate Structure / M&A

Qualified Plan Compliance

401(k) q&a blog, visit the full blog, question of the week, correction of the quarter, in the news, cash balance corner, downloadable resources, ebooks & guides.

Reference Materials

Join the 401k Experts

New eDisclosure Rules: Maybe This Whole Internet Thing is Going to Stick

Hardship distributions.

Plan sponsors have the option to allow participants to access their accounts while still employed via a plan loan or an in-service distribution . However, some companies prefer to limit that access so that accounts remain in the retirement plan to be used as intended—at retirement. A hardship distribution can be a compromise between the two, allowing participants access to their accounts only in times of financial hardship.

What is a hardship withdrawal?

The hardship withdrawal provision is an optional feature that can be included in a retirement plan to allow participants to access all or a portion of their account to satisfy an “immediate and heavy financial need.” There are several criteria that are used to determine whether the financial hardship is sufficient to qualify for a withdrawal using this feature.

You said it is an optional provision. Does that mean we can allow hardship withdrawals “on the fly”?

No. In order for a plan to grant hardship distributions, the plan document must specifically include the feature and spell out the parameters that apply.

What types of situations qualify for a hardship distribution?

The regulations have two different standards that can be applied – the safe harbor standard and the non-safe-harbor standard. Due to the extremely subjective nature of the words "financial hardship" many plans apply the safe harbor standard since it spells out the situations that qualify.

There are six of them. They are payment of …

- Expenses for a medical care that is tax-deductible (under Tax Code section 213(d)) to the individual and is not reimbursable by insurance.

Usually medical expenses must exceed a certain percentage of a person’s income before they are deductible; however, that percentage requirement is ignored for this purpose. Also, medical expenses incurred by a participant’s spouse and dependents qualify as a financial hardship.

It is important to note that if the expense is subject to reimbursement by an insurance company at a later date, it does not qualify as a hardship even if the participant is required to make payment up front and await reimbursement.

- Costs related to the purchase of a principal residence.

This must be the participant’s primary home; it cannot be a vacation home. The hardship withdrawal is not restricted to the purchase price and can include other items that are directly tied to the transaction such as closing costs. In addition, if a participant will immediately build a house, a hardship withdrawal can be taken for the purchase of the land on which the house will be built.

- Expenses for up to 12 months of post-secondary education.

This includes tuition, related educational fees, and room and board for the participant, spouse, and/or other dependent.

- Amounts necessary to prevent eviction or foreclosure from a principal residence.

Generally speaking, the participant must have received notice of a pending eviction or foreclosure in order to qualify under this criterion. Simply being a week behind on rent or wanting to avoid a late payment fee from the mortgage company is not sufficient.

- Burial or funeral expenses for the participant’s deceased parents, spouse, children, and/or dependents.

- Expenses for the repair of damage to the participant’s principal residence that are tax-deductible to the participant (under Tax Code section 165) as a casualty loss.

These expenses are similar to medical expenses in a couple of ways. One is the income percentage for tax-deductibility is ignored, and the other is that expenses subject to reimbursement by insurance do not qualify.

It is also important to note that the expenses must be due to casualty loss. For example, if a participant must replace his or her roof because a tree fell on it during a storm, that is a casualty loss and would potentially qualify. On the other hand, if the roof has to be replaced simply because it’s old and worn out, that would not qualify.

- Expenses incurred due to a federally-declared disaster.

The IRS did clarify that the intent is to make expenses related to certain disasters (e.g. hurricanes, floods, wildfires, etc.) safe harbor items, thereby eliminating any delays waiting for the official announcement declaring the emergency – which we all know is not as quick a process as we might prefer. Again, the common theme throughout the regulations is easy access to retirement funds in a time of true financial need. One point worth noting, however, is that unlike previous disaster relief, these new regulations do not allow hardship distributions as a result of a participant’s relatives or dependents incurring disaster-related expenses. It is now limited only those expenses incurred by a participant who either lives or works in the disaster area.

A plan can, but is not required to, expand the definition of hardship to include any of the above situations that are incurred by a participant’s designated primary beneficiary .

Now that we have covered the reasons, how is the amount determined?

The maximum amount of the hardship distribution is basically the actual amount of the applicable expense minus whatever amounts a participant can access from sources outside the plan. That means a participant is generally required to first exhaust any savings accounts, outside investment accounts, credit card cash advances, loans, etc. that are available to him or her. However, this does not include taking a loan from the retirement plan to the extent loans are permitted. Any qualified expenses that remain are eligible for hardship.

Obviously, a participant cannot withdraw more than he or she has available in the plan. We will touch on that in a little more detail later in this FAQ.

What happens if using up all of those other resources only makes the financial hardship worse?

There is an exception for this type of situation, but it should be applied with caution. One of the most clear-cut examples where this would come into play is with the purchase of a primary residence. Draining all savings and maxing out cash advances from credit cards would likely cause the mortgage company to reconsider. As a result, the participant would only be required to use other resources to the extent it would not jeopardize his or her ability to obtain the mortgage.

If using other resources is just inconvenient or carries a fee, that is not enough to get out of it.

Are hardship distributions subject to individual income tax?

Yes, the participant must claim the hardship distribution amount as income on his or her individual tax return. In addition, the amount of the withdrawal is subject to an early withdrawal penalty equal to 10% if the participant is under the age of 59 ½.

Hardship withdrawals are not eligible to be rolled over to an IRA or other plan, so they are subject to a voluntary tax withholding at the time of distribution. The default withholding rate is 10%, but the participant can elect to increase or decrease it, or waive it altogether.

It seems like the tax ramifications might add to the hardship. Can a participant increase the amount of the distribution to cover the expected tax burden?

Yes, any reasonably anticipated federal, state, or local tax that will be payable by the participant as a result of the hardship withdrawal can be added to the amount request. In addition, the participant can add any distribution fees that might be charged by the plan’s recordkeeper keeper or other service provider for processing the request.

Who verifies all of this? I don’t really want to get involved in all of those personal details for my participants.

There are two elements of a hardship distribution – the reason and the amount. Plan sponsors do have an obligation to obtain documentation that supports the reason for the request. More on that later.

As for the amount, there are also two elements to be considered. One is the “principal” amount of the request and the other is the ancillary stuff (taxes, fees, other resources, etc.). Plan sponsors should obtain some basic documentation that supports the principal amount requested; however, they can rely on statements from the participant on the amount needed to gross-up for taxes and fees as well as the availability (or lack, thereof) of outside resources.

In other words, sponsors do not have to undertake a financial investigation of the participant. There is one important exception. If the sponsor knows (or reasonably should know) that a participant is being less than completely truthful about his or her financial situation, the sponsor cannot turn a blind eye and should request more documentation. An example of this might be a request to cover medical expenses that the sponsor knows are covered by the company-provided medical plan.

What sort of documentation is required to substantiate the reason and principal amount?

Back in 2015, the IRS provided informal guidance indicating that plan sponsors are required to obtain and keep the following items to document hardship distributions:

- Documentation of the hardship request, review, and approval.

- Financial information and documentation that substantiates the employee’s immediate and heavy financial need.

- Documentation to support that the hardship distribution was properly made according to applicable plan provisions and the Internal Revenue Code.

- Proof of the actual distribution made and related Forms 1099-R.

That guidance indicated that either paper or electronic format is acceptable but that it is not enough for participants to self-certify.

Then , in October 2019, the IRS clarified its audit process for hardship distributions with the introduction of the Summary Substantiation Method. In order for a plan sponsor to satisfy the requirements, participants must self-certify their immediate and heavy financial need through the consistent and proper completion of the IRS self certification form.

Per this process, an IRS agent - and not the plan sponsor - will request any additional information and/or documentation needed in the event the self certification is incomplete or the participant has received more than two hardships during the same plan year (without adequate explanation).

You can download a sample self-certification form here .

Are there any limits on which plan accounts are available for hardship distribution?

The IRS issued new regulations in 2019 that eliminated most of the restrictions that were previously in place. That means that all money sources are generally available for hardship distributions; however, each plan sponsor can further restrict availability ion its plan document as it deems appropriate.

There is one key exception. Any investment gains on 403(b) deferrals are not available – the deferral basis (the amount actually contributed) is available, just not any investment gains on those amounts. This rule used to apply to 401(k) plans also but was eliminated by the 2019 regulations, so it appears that the continued application to 403(b) plans is more of an oversight than anything intentional.

Other than that, a plan can permit hardship withdrawals from any contribution source in the plan, but it is not uncommon for sponsors to limit hardships only to deferral accounts and/or other accounts in which the participant is fully vested.

Can a participant keep making/receiving plan contributions after taking a hardship withdrawal?

Yes. Previous rules required participants to suspend their contributions for six months following a hardship withdrawal, but that requirement was eliminated by the 2019 regulations.

You May Also Like

401(k) Plan Loan Guide

In-Service Distribution FAQs

Only the Best Retirement Industry Content

- Phone: 651.204.2600

- Privacy Policy

As Featured In

Sign up to receive insights from DWC

What Documents Are Needed to Support an Educational Hardship Withdrawal?

You can tap your IRA without penalty for qualifying education expenses.

PhotoObjects.net/PhotoObjects.net/Getty Images

More Articles

- 1. Can I Withdraw Funds From My IRA for Educational Expenses?

- 2. IRA Distribution: Can I Give to a Child While I am Alive?

- 3. Deductions From Federal Income Tax for Children Attending College

College expenses, including tuition and room and board, averaged $13,600 a year for an undergraduate degree at a public university in 2012, according to the National Center for Education Statistics. These costs increased to $36,300 at a private, not-for-profit university. You can look to your individual retirement account to help fund these expenses, without tax penalties for early withdrawals. You must document your expenses with receipts, and by declaring your withdrawals on your tax forms.

Proof of Expenses

While you do not have to pay the education expenses directly with money from your IRA, you must keep a record of any qualified education expenses. This includes tuition statements from the college, which show the name of the qualified person you are paying expenses for. In addition, if the student is enrolled at least half-time, room and board expenses are qualifying education expenses. Save any statements showing room and board with the college, as well as rent receipts if the student lives off campus.

You will receive an IRS Form 1099-R from your IRA trustee detailing any withdrawals from your account. This information is also passed on to the Internal Revenue Service, so you need to account for this when you file your income tax returns. Declare the amount of your withdrawal that is used for qualified education expenses on line 2 of Form 5329. Enter the code "08" as the exemption number. If any of your withdrawal is not for education expenses and you are not at least age 59 1/2, you must calculate the additional tax penalty from Form 5329 on line 58 of Form 1040.

Other Nontaxable Education Benefits

Making a withdrawal from your IRA for qualifying education expenses does not guarantee the entire amount of your withdrawal is not subject to penalties. You must consider any other tax-free education benefits that you or the student have received. This includes Pell grants, educational IRA benefits and any employer tax-free education benefits. For example, if you have incurred $3,000 in qualified education expenses and you received $2,000 from your employer in tax-free education benefits, you can withdraw up to $1,000 from your IRA to pay for education expenses without penalties. If you withdraw $2,000 from your IRA, you will need to pay any applicable penalties on the additional $1,000 in withdrawals.

Considerations

Unless you are withdrawing Roth IRA contributions, or nondeductible traditional IRA contributions, the amount you withdraw from your IRA for education expenses will increase your taxable income. This can affect your eligibility for other forms of financial aid, such as student loans or other grants. If possible, you can avoid any problems with this by withdrawing from your IRA during the qualifying student's senior year, when all financial aid is already in place and cannot be affected by changes in income.

- IRS: Publication 970, Tax Benefits for Education

- Bankrate.com: IRA Withdrawal for Kids' Education Expenses

- Kiplinger: Tax Breaks for Education Expenses

- National Center for Education Statistics: Fast Facts

- IRS: Form 1040 -- U.S. Individual Income Tax Return

- IRS: Instructions for Form 5329

Craig Woodman began writing professionally in 2007. Woodman's articles have been published in "Professional Distributor" magazine and in various online publications. He has written extensively on automotive issues, business, personal finance and recreational vehicles. Woodman is pursuing a Bachelor of Science in finance through online education.

Related Articles

Can i withdraw funds from my ira for educational expenses, ira distribution: can i give to a child while i am alive, deductions from federal income tax for children attending college, how to use a roth ira for college tuition, can you borrow from your retirement account to pay for college, do i need a 1099-r form when i withdraw my ira, can i withdraw from my sep-ira to pay for my kids' college, how to claim ira money used to pay medical bills, can early distributions from retirement plans be used to pay college tuition, when can i withdraw from my ira without penalties, the effect of roth iras on pell grants, medical ira rules.

Zacks Research is Reported On:

Zacks Investment Research

is an A+ Rated BBB

Accredited Business.

Copyright © 2024 Zacks Investment Research

At the center of everything we do is a strong commitment to independent research and sharing its profitable discoveries with investors. This dedication to giving investors a trading advantage led to the creation of our proven Zacks Rank stock-rating system. Since 1986 it has nearly tripled the S&P 500 with an average gain of +26% per year. These returns cover a period from 1986-2011 and were examined and attested by Baker Tilly, an independent accounting firm.

Visit performance for information about the performance numbers displayed above.

NYSE and AMEX data is at least 20 minutes delayed. NASDAQ data is at least 15 minutes delayed.

Can You Withdraw from a 401K for Education?

Written by Shannon Vasconcelos on January 10th, 2023

- paying for college ,

- Employers can limit access to 401ks while you are still employed by the company sponsoring the plan. While tuition payments generally qualify for an in-service hardship withdrawal, you may be required to document that you’ve exhausted all other college funding options.

- Traditional 401k withdrawals are subject to taxation at your ordinary income tax rate. When your children are in college, you are likely in your peak earning years and in a higher tax bracket than you will be in during retirement.

- If you are not yet 59 ½ years old, 401k withdrawals are also subject to a 10% early withdrawal penalty. While IRAs offer an exception to the early withdrawal penalty for college expenses, early 401k withdrawals are always subject to a 10% penalty—no exceptions.

- Traditional 401k withdrawals are reported as income in the year that you make the withdrawal, increasing your Adjusted Gross Income (AGI). This income increase may not only bump you into a higher tax bracket, but could also reduce financial aid eligibility in a future academic year. To minimize the impact on financial aid, limit 401k withdrawals to your child’s last 2 ½ years of college.

- Most 401k loan programs only allow you to have one loan outstanding at a time. Therefore, you must borrow whatever you need to cover all four years of college all at once (up to a maximum of $50,000 or half the account value, whichever is lower).

- Furthermore, most 401k loans must be paid back within five years. If you’re borrowing enough to cover four years of costs and paying it off in five years, you’re actually not saving much in terms of monthly cash flow over simply paying the four years of costs as they arise over four years. If you can afford to pay back your 401k loan in a five-year time frame, you can probably afford to pay for college out-of-pocket and don’t need to borrow at all.

- If you separate from your employer while your 401k loan is outstanding, the full balance of the loan becomes due by the following tax deadline. If not paid in full by this date, the loan is converted to a distribution, with all tax and penalty repercussions listed in the withdrawal section above.

- In addition, the benefit to utilizing a traditional 401k is that you get to set aside money on a pre -tax basis. If you borrow a 401k loan, you pay yourself back interest with after -tax money. A 401k provides no separation of after-tax interest payments from pre-tax contributions, so when you begin withdrawing from your account in your golden years, you have to pay taxes on the after-tax portion of your withdrawals again! This is one of the very rare occasions in the U.S. tax code where you actually pay taxes on the same money twice. However necessary they may be to the operation of our civil society, most of us don’t particularly enjoy paying taxes. We certainly don’t want to pay them twice!

Meet our team of college finance experts, former financial aid officers who know the ins and outs of college financing.

amet, adipisicing elit sed do eiusmod tempor incididunt?

Follow these pre-application steps to help your student stay on track for admissions success., related resources.

Read | Posted on September 4th, 2024

Colleges that Offer the Most Financial Aid

Read | Posted on July 17th, 2024

Everybody Pays: College Costs Beyond Tuition

Read | Posted on July 10th, 2024

Net Price Calculators: The Good and the Bad

Browse categories.

- Applying For Financial Aid

- Choosing The Right College

- College Admissions Consulting

- College Applications

- College Coach Mentionables: News & Events

- College Entrance Exams

- College Essays

- College Loan Advice

- College Visits

- Finding Scholarships

- How To Pay For College

- Meet a College Finance Expert

- Meet An Admissions Counselor

- Uncategorized

Interested?

Call 877-402-6224 or complete the form for information on getting your student started with one of our experts.

Personal investors

Workplace retirement

Employers and plan sponsors

Financial professionals

Friday , September 06, 2024

How a 401(k) hardship withdrawal works

By Kyle Ryan

We all know that 401(k) accounts are meant for retirement savings. But we also all know that once in a blue moon, a situation arises — a big unexpected medical bill, or a down payment on a home — where we wish we could tap some of those funds in our 401(k) .

Before we dive in, I’m going to say this right upfront: it’s never a good idea to take money from your retirement fund if you can help it. Early withdrawals can carry hefty penalties and taxation, and you can rob yourself of the power of compounding earnings if you take funds out of your 401(k) that could otherwise potentially be growing.

If you do find yourself in a situation where it’s unavoidable to withdraw funds from your 401(k) early, there is something called a 401(k) hardship withdrawal that might allow you to access your contributions.

It’s up to the plan sponsor to decide whether to allow hardship withdrawals from the plan; however, most 401(k) plans do allow participants to make these kinds of withdrawals.

What is a hardship withdrawal?

As the name implies, 401(k) hardship withdrawals are designed to let participants withdraw money from their retirement plans if they’re facing certain financial hardships. But the IRS’ definition of hardship is rather broad. Hardship withdrawals are currently allowed for one of the following reasons:

- Medical expenses incurred by the participant or the participant’s spouse, dependents or beneficiaries.

- The purchase of a home if the home will serve as a primary residence, not an investment property.

- To prevent eviction from or foreclosure on a primary residence.

- Funeral expenses for the participant or the participant’s spouse, dependents or beneficiaries.

- Tuition and related expenses (such as fees and room and board) for the next year of post-secondary education for the participant or the participant’s spouse, dependents or beneficiaries.

- Expenses that are necessary to repair damage to the participant’s primary residence that would qualify for a casualty deduction.

Empower research shows that new hardship withdrawals stacked up to $9,926 in 2023. More than a quarter of surveyed Americans say they are very likely (10%) or somewhat likely (17%) to take out a loan or hardship withdrawal in the next six months.

Drawbacks of making hardship withdrawals

Keep in mind that just because you are facing one of these financial hardships doesn’t mean that taking out a hardship withdrawal is the best financial move. There are several potential drawbacks to making hardship withdrawals.

Perhaps the biggest disadvantage is that regular income taxes will be due on the funds taken out during the year in which they’re withdrawn. And if you’re under age 59½, a 10% early withdrawal penalty may also apply. There are a few exceptions to the early withdrawal penalty , including medical debt that exceeds 7.5% of your adjusted gross income (AGI).

If you don’t qualify for one of these exceptions and you are under 59½, you could receive significantly less money than the amount you take out via a hardship withdrawal. For example, if you’re in the 22% tax bracket and make a hardship withdrawal of $10,000, you’ll only retain $6,800 after subtracting $3,200 in taxes and penalties.

Another big drawback to making hardship withdrawals is that this could jeopardize your ability to enjoy a financially comfortable retirement. Every dollar withdrawn from your 401(k) early is a dollar that isn’t there for retirement. In addition, you lose the opportunity for these funds to grow on a tax-deferred basis over the long term, which could potentially grow your nest egg even more.

Our take: A last resort financing option

In most instances, 401(k) hardship withdrawals should be considered a last resort for obtaining funds, even if a particular situation qualifies as a hardship. The taxes and penalties associated with hardship withdrawals and the impact such withdrawals may have on your retirement finances can make them an expensive source of funds.

Need help navigating your finances?

Our free money tools bring your accounts together in one place so you can monitor your investments and plan for your big financial goals.

RO2576291-1122

Want to stay in the know?

Power up with the latest money news, sent every week to your inbox.

*If you’re already registered with Empower, please use the same email address as your existing account.

Email Subscribe

Recent Articles

The upgrade economy: Spending surges as crowds level up entertainment

Companies are offering new layers of comfort for splurge experiences. Check out the upgrades up for grabs for those who choose to level up.

Money comes, money goes: Are we in an age of “Fast Spending”?

In an era of overnight packages, same-day shipping, and busy lives on the go, consumers seem to have a need for speed — and the digital age is here to deliver.

The backpack math: Cost of school supplies up 24%

The cost of school supplies is up 24% as parents plan to spend an average of $875 on back-to-school items this year.

Contributor

Kyle Ryan is the Executive Vice President, Personal Wealth Advisory at Empower. A CERTIFIED FINANCIAL PLANNER™ professional, he is responsible for delivering an industry leading asset growth and retention wealth management client experience.

The content contained in this blog post is intended for general informational purposes only and is not meant to constitute legal, tax, accounting or investment advice. You should consult a qualified legal or tax professional regarding your specific situation. No part of this blog, nor the links contained therein is a solicitation or offer to sell securities. Compensation for freelance contributions not to exceed $1,250. Third-party data is obtained from sources believed to be reliable; however, Empower cannot guarantee the accuracy, timeliness, completeness or fitness of this data for any particular purpose. Third-party links are provided solely as a convenience and do not imply an affiliation, endorsement or approval by Empower of the contents on such third-party websites.

Certain sections of this blog may contain forward-looking statements that are based on our reasonable expectations, estimates, projections and assumptions. Past performance is not a guarantee of future return, nor is it indicative of future performance. Investing involves risk. The value of your investment will fluctuate and you may lose money.

Certified Financial Planner Board of Standards Inc. (CFP Board) owns the certification marks CFP®, CERTIFIED FINANCIAL PLANNER™, CFP ® (with plaque design), and CFP ® (with flame design) in the U.S., which it authorizes use of by individuals who successfully complete CFP Board's initial and ongoing certification requirements.

- Book a Speaker

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Vivamus convallis sem tellus, vitae egestas felis vestibule ut.

Error message details.

Reuse Permissions

Request permission to republish or redistribute SHRM content and materials.

IRS Final Rule Eases 401(k) Hardship Withdrawals, Requires Amending Plans

Changes free up funds for emergencies but could hurt workers' savings

Making hardship withdrawals from 401(k) and 403(b) retirement plans soon will be easier for plan participants, and so will starting to save again following a hardship withdrawal.

On Sept. 23, the IRS published in the Federal Register a final rule that relaxes several existing restrictions on taking hardship distributions from defined contribution plans. Some of these changes are mandatory, requiring employers to make the changes by Jan. 1, 2020, while others are optional.

Unlike loans, hardship withdrawals are not repaid to the plan with interest, so they permanently reduce the employee's account balance. Hardship withdrawals also are subject to income tax and, if participants are younger than age 59½, a 10 percent early withdrawal penalty. For these reasons, withdrawals should be a last-ditch option for employees facing financial hardship.

"While many loan-takers default, at least there's a good chance that the loan will be repaid," said Aaron Tabela, chief marketing officer at Custodia Financial, which provides retirement savings loan insurance. "With hardship withdrawals, the leakage is permanent."

The IRS had issued a proposed regulation on Nov. 9, 2018, and the agency described the final regulations as "substantially similar to the proposed regulations" although some points were clarified.

The rule does not change that a 401(k) plan may, but is not required to, provide for hardship distributions.

What's Changing

Among its key provisions, the final rule will do the following:

• Eliminate the six-month contribution-suspension requirement.

As called for in the Bipartisan Budget Act passed in February 2018, the final rule eliminates the suspension period that barred participants who take a hardship distribution from making new contributions to the plan for six months. Starting Jan. 1, 2020, plans will no longer be able to suspend contributions following a hardship distribution.

Eliminating the contribution suspension "could have a mixed effect on leakage from 401(k) plans" by encouraging more hardship withdrawals but letting those who take distributions rebuild their savings sooner, said Lori Lucas, president and CEO of the nonprofit Employee Benefit Research Institute in Washington, D.C.

Employees often "do not continue saving for their retirement [after the six-month suspension] and often miss out on the company match," said Robyn Credico, practice leader of defined contribution consulting at Willis Towers Watson, an HR advisory firm.

The new rule removes a requirement that participants first take a plan loan, if available, before making a hardship withdrawal. Unlike the elimination of the six-month suspension period, this change is not mandatory, so plans can continue to require participants to take a plan loan before being eligible for a hardship withdrawal.

"Many plan sponsors view [the loan-first requirement] as desirable, since it minimizes plan leakage," said Michael Webb, vice president at Cammack Retirement Group, a benefits consultancy in New York City.

• Make earnings available for withdrawal.

Effective in 2020, earnings on 401(k) contributions can be distributed for hardships, as can profit-sharing and stock-bonus contributions. Previously, employees could only withdraw contributions, not earnings.

Earnings on 403(b) contributions would remain ineligible for hardship withdrawals because of a statutory prohibition that Congress didn't amend.

• Ease hardship verification.

Under the rules currently in place, plan administrators must take into account "all relevant facts and circumstances" to determine if a hardship withdrawal is necessary. The new rule requires only that a distribution not exceed what an employee needs and that employees certify that they lack enough cash to meet their financial needs. Plan administrators can rely on that certification unless they have knowledge to the contrary. Plans are required to apply this standard starting in 2020.

"The IRS retained the requirement from the proposed regulations that the plan administrator may rely on the employee's representation, unless the plan administrator has actual knowledge of the contrary ," Webb noted. Beginning in 2020, "an employee can make a representation that he or she has insufficient cash or other liquid assets reasonably available to satisfy a financial need, even if the employee does have cash or other liquid assets on hand, provided that those assets are earmarked to pay an obligation in the near future" such as rent, he explained.

Employee self-certifications of need for a hardship withdrawal can be made over the phone, provided that the call is recorded, the final rule clarified, or can be made in writing or by e-mail, for instance. "Plan administrators who self-administer hardship distributions may want to establish an electronic process for receiving employee representations such as through e-mail or an intranet site ," attorneys at law firm Bradley advised.

"Employers didn't like figuring out when a distribution is necessary. Now there's a straightforward three-part test that covers the employer ," Forbes reported, the three parts being:

- The employee must first access other employer plan money if available, such as deferred compensation.

- The employee signs off that he or she has insufficient cash or other liquid assets reasonably available.

- The plan administrator signs off that he or she doesn't have any reason to believe the employee could do without the hardship withdrawal.

• Provide disaster relief.

To take a hardship withdrawal, employees currently must show an immediate and heavy financial need that involves one or more of the following:

- Purchase of a primary residence.

- Expenses to repair damage or to make improvements to a primary residence.

- Preventing eviction or foreclosure from a primary residence.

- Post-secondary education expenses for the upcoming 12 months for participants, spouses and children.

- Funeral expenses.

- Medical expenses not covered by insurance.

The final rule adds a seventh safe harbor category for expenses resulting from a federally declared disaster in an area designated by the Federal Emergency Management Agency.

"Making expenses related to certain disasters a safe harbor expense is intended to eliminate any delay or uncertainty concerning access to plan funds that might otherwise occur following a major disaster ," noted Nevin Adams, chief of communications at the American Retirement Association in Arlington, Va., which represents retirement plan sponsors and service providers.

According to the IRS, the agency will no longer need to issue special disaster-relief announcements to permit hardship withdrawals to those affected by federally declared disasters.

The SECURE Act enacted in December 2019 waives early-withdrawal penalties for qualified disaster distributions up to $100,000 from retirement plans for participants who lived in a presidentially declared disaster area. Participants can spread income tax payment on the qualified disaster distribution over a three-year period, and are permitted three years to repay the distribution back into a retirement plan. The SECURE Act's disaster relief provisions must be adopted no later than the last day of the plan year beginning on or after Jan. 1, 2020, or two years later in the case of a governmental plan. See the article |

Plan Amendments Required

401(k) plans that permit hardship distributions will need to be amended to reflect these new rules by Dec. 31, 2021, but operational changes will be needed to comply with the new regulations by Jan. 1, 2020 , attorneys at law firm Proskauer pointed out. "Plan sponsors that previously took action in response to the proposed regulations should review prior plan amendments and administrative changes to confirm operational and plan document compliance with the final regulations," they added.

Adams said "the regulations note that the amendment deadline for 403(b) plans is March 30, 2020, but indicate the Treasury and IRS are considering extending that deadline for the adoption of amendments to conform to the final hardship regulations."

Joshua Rafsky, an attorney in the Chicago office of Jackson Lewis, advised that "plan administrators may also want to consider whether updates are needed to the plan's summary plan description and other communications documents that describe the plan's hardship rules, and to election forms and online election pages."

[SHRM members-only toolkit: Designing and Administering Defined Contribution Retirement ]

Related SHRM Articles:

IRS Clarifies Amendment Period for Final Hardship Withdrawal Regulations , SHRM Online , December 2019

Hardship Distributions Rule Reflects a Decade of Legislative Changes , SHRM Online, October 2019

Retirement Plans Are Leaking Money. Here’s Why Employers Should Care , SHRM Online , October 2017

Related Content

Why AI+HI Is Essential to Compliance

HR must always include human intelligence and oversight of AI in decision-making in hiring and firing, a legal expert said at SHRM24. She added that HR can ensure compliance by meeting the strictest AI standards, which will be in Colorado’s upcoming AI law.

A 4-Day Workweek? AI-Fueled Efficiencies Could Make It Happen

The proliferation of artificial intelligence in the workplace, and the ensuing expected increase in productivity and efficiency, could help usher in the four-day workweek, some experts predict.

Advertisement

Artificial Intelligence in the Workplace

An organization run by AI is not a futuristic concept. Such technology is already a part of many workplaces and will continue to shape the labor market and HR. Here's how employers and employees can successfully manage generative AI and other AI-powered systems.

HR Daily Newsletter

News, trends, analysis and breaking news alerts to help HR professionals do their jobs better each business day.

Success title

Success caption

Employee Benefits & Executive Compensation Advisory : Final Hardship Distribution Rules Are Here: Does Your 401(k) or 403(b) Plan Comply?

Our Employee Benefits & Executive Compensation Group examines the numerous changes – mandatory and permissible – plan sponsors can make to their 401(k) or 403(b) plans in light of new regulations for hardship distributions.

- When do you need to amend your plan?

- What are the mandatory and permissible changes?

- What next steps should you take?

The IRS published final regulations relating to hardship distributions from 401(k) and 403(b) plans on September 23, 2019. These regulations reflect the changes made by both the Tax Cuts and Jobs Act of 2017 and the Bipartisan Budget Act of 2018. The final regulations are substantially similar to the proposed regulations that were released in 2018 and state that “plans that complied with the proposed regulations will satisfy the final regulations.” However, all plan sponsors should review and, if necessary, amend their 401(k) and 403(b) plans to ensure compliance with the final regulations. Plan Amendment Timing

Plan sponsors may need to amend their plans to comply with the mandatory provisions of the final regulations, and such amendments must be effective no later than January 1, 2020. Each plan is different, and whether an amendment is required will depend on the terms and operation of the plan. If an amendment is required, the deadline for adopting such an amendment differs depending on the type of plan:

- Individually designed 401(k) plans must amend by the end of the second calendar year that begins after the issuance of the Required Amendments List, which will be December 31, 2021, if the final regulations are included in the 2019 Required Amendments List.

- Preapproved 401(k) plans must amend by the 2020 tax-filing deadline, inclusive of any extensions.

- 403(b) plans must amend by March 31, 2020. However, the Treasury Department and IRS are considering providing for a later amendment deadline for these plans that would be issued in separate guidance.

Plan sponsors may also choose to amend their plans to comply with permissible, but non-mandatory provisions of the final regulations. Timing for these permissible changes will depend on when the plan provision is adopted operationally. Next Steps for Plan Sponsors

In preparation for the January 1, 2020 effective date of these hardship regulations, plan sponsors and administrators should:

- Determine what provisions will be adopted on what date. Mandatory changes must be effective no later than January 1, 2020. Plan sponsors may also choose whether to adopt an earlier effective date, such as January 1, 2019, for some provisions. If any provisions were adopted operationally in 2019, a January 1, 2019 effective date may be appropriate, and such amendments should be adopted no later than December 31, 2019.

- Update hardship withdrawal provisions on participant communications, including summary plan descriptions and safe harbor notices, if applicable. Keep in mind that safe harbor notices for the 2020 plan year must be provided at least 30 days before the beginning of the plan year. If a safe harbor notice describes hardship withdrawal provisions in detail and if a description of the new hardship withdrawal provisions is not already included in the safe harbor notice, participants must be provided with an updated safe harbor notice reflecting the new hardship withdrawal provisions and must be given a reasonable opportunity to change their cash or deferred election.

Background

Active plan participants are permitted by the Internal Revenue Code to obtain a distribution from their plan account if they are facing a financial hardship. These distributions are commonly known as “hardship distributions.” Many plans have already been administering hardship distributions for several years and are already familiar with the requirements, but in general for a distribution to qualify as a hardship distribution, the distribution must satisfy the following two-pronged test:

Prong 1: The distribution must be made on account of an “immediate and heavy financial need”

While this can be determined on a facts and circumstances basis, the IRS has previously provided a safe harbor list of financial needs that will be deemed to constitute an “immediate and heavy financial need,” including:

- Expenses for medical care for the participant, the participant’s spouse, or dependents.

- Costs directly related to the purchase of a principal residence for the participant (excluding mortgage expenses).

- Post-secondary education expenses, including tuition, related educational fees, and room and board expenses for the next 12 months for the participant or the participant’s spouse, children, or dependents.

- Payments necessary to prevent the eviction of the participant from the participant’s principal residence or foreclosure on the mortgage on that residence.

- Funeral expenses for the participant or the participant’s spouse, children, or dependents.

- Expenses for the repair of damage to the participant’s principal residence that would qualify for the casualty deduction under Section 165. 1

Prong 2: The amount must be necessary to satisfy the financial need

Again, this can be determined under a facts and circumstances basis or under an IRS safe harbor. If used, the previous IRS safe harbor required that:

- The distribution does not exceed the amount of a participant’s need.

- The participant has obtained all other currently available distributions and nontaxable loans under the plan and all other plans maintained by the employer.

- The participant is prohibited from making elective deferrals or contributions to the plan or any other plan maintained by the employer for at least six months after receipt of a hardship distribution.

The new hardship regulations make changes to both of these prongs. Some of the changes are mandatory for plan sponsors to adopt, while other changes are permissible, but not required. Mandatory Changes

There are no mandatory changes made to Prong 1 of the existing hardship requirements. The only mandatory changes affect Prong 2. New determination for satisfaction of financial need

The final regulations change Prong 2 to incorporate a single general standard for determining whether a distribution is necessary. Under this new standard:

- The participant must have obtained all other available distributions from all the employer’s plans.

- The participant must represent that he or she has insufficient cash or other liquid assets “reasonably available” to satisfy the need. The “reasonably available” standard can be satisfied even if the participant has cash or other liquid assets on hand, but those assets are earmarked for other purposes (for example, rent).

- The plan administrator must not have actual knowledge to the contrary.

This new certification standard in Prong 2 does not replace or eliminate the substantiation and documentation standards required to show proof of actual expenses incurred found in the safe harbor list of permissible expenses in Prong 1. Plan administrators and recordkeepers should continue to obtain source documents or rely on the summary model as detailed in the Internal Revenue Manual in addition to seeking this new certification from employees. In addition, plan administrators should consider how to communicate with their recordkeepers to coordinate situations when the plan administrator may have actual knowledge that is contrary to a plan participant’s certification.

Six-month suspension of contributions is no longer permissible

Many plans previously suspended participant contributions for six months following a hardship withdrawal. The final regulations no longer allow any automatic suspension for plan years starting January 1, 2020 or later. This prohibition on suspensions applies to qualified plans, 403(b) plans, and eligible 457(b) plans. However, the final regulations clarify that nonqualified deferred compensation plans subject to 409A that provide for a six-month suspension may retain their suspension provisions (or, to the extent consistent with 409A, remove them). Permissible Changes

Permissible changes affect both prongs of the existing hardship requirements. In addition, plan sponsors may adopt a permissible change affecting the available sources of funds for hardship withdrawals. Additional permissible hardship withdrawal safe harbor (Prong 1)

The safe harbor list of expenses that are deemed to constitute an “immediate and heavy financial need” is modified and expanded by adding expenses and losses (including loss of income) incurred by a participant on account of a disaster declared by FEMA, provided the participant’s principal residence or principal place of employment at the time of the disaster was in the designated disaster area. Additional permissible recipient of hardship withdrawals (Prong 1)

The new “immediate and heavy financial need” safe harbor provisions state that medical expenses, tuition and educational expenses, and funeral or burial expenses required for a participant’s “primary beneficiary” under the plan would also qualify as a hardship withdrawal. Before this change, these withdrawals are limited for the benefit of certain specified relatives or dependents. The regulations define the term “primary beneficiary” broadly to include any person entitled to receive a portion of the account on the participant’s death. A participant could name an unrelated individual as a primary beneficiary for a small percentage of the participant’s account and then take a hardship withdrawal to pay the individual’s otherwise qualifying tuition, medical expenses, or funeral or burial expenses. This represents a planning opportunity for participants in plans that permit this change because it significantly expands the universe of people whose needs may now qualify for a hardship distribution. Amended application of personal casualty loss (Prong 1)

Separate from the new hardship regulations, the Tax Cuts and Jobs Act added a new Section 165(h)(5) to the Code. This new section provides that, for taxable years 2018 through 2025, the deduction for a personal casualty loss is generally only available to the extent the loss is attributable to a federally declared disaster. The final hardship regulations clarify that for purposes of the “immediate and heavy need” safe harbor provisions, Section 165(h)(5) can be ignored. Plans that reference the casualty loss deduction in Section 165 may need to be amended to clarify that Section 165(h)(5) does not apply. Plan loans are no longer required to demonstrate a financial need (Prong 2)

Participants are no longer required to take out all available plan loans before making a hardship withdrawal to demonstrate a financial need. Additional permissible sources of hardship withdrawals

The regulations expand the sources of hardship withdrawals to include QNECs, QMACs, safe harbor contributions, and earnings on all these amounts regardless of when contributed or earned. Previously, only participant elective contributions (but not earnings thereon) were eligible for a hardship withdrawal. QNECs and QMACs in a 403(b) plan that are in a custodial account continue to be ineligible for distribution on account of hardship. Conclusion

The final regulations provide helpful guidance on both mandatory and permissible changes to hardship withdrawal procedures. Plan sponsors should closely review their hardship withdrawal procedures to determine compliance with mandatory provisions and consider whether to adopt any permissible changes. Please do not hesitate to contact your Alston & Bird attorney if you have any questions about hardship withdrawals or if we can assist you in amending your 401(k) or 403(b) plan.

1 The list of hardships is a general summary and is not intended to outline all the requirements for complying with the IRS hardship safe harbor.

- Advisories November 2, 2022 Employee Benefits & Executive Compensation Advisory : Retirement Plan Amendments and 2022 Year-End Action Items Our Employee Benefits & Executive Compensation Group reminds plan sponsors to get ready for 2022 IRS year-end amendments and offers year-end action items.

- Employee Benefits & Executive Compensation

This website uses cookies to improve functionality and performance. For more information, see our Privacy Statement . Additional details for California consumers can be found here .

Fraud Alert: Scam Calls Impersonating Affinity—Do not share your login credentials or one-time access code. Affinity will NEVER call you and ask for it, ever.

- CONTACT AFFINITY

- MAKE LOAN PAYMENT

- Please Select English Spanish

- FIND A BRANCH/ATM

- SCHEDULE AN APPOINTMENT

Understanding 401(k) and IRA Withdrawals for Education Expenses

A student's education expenses may be reduced when a parent uses their tax-advantaged retirement account to help cover tuition and other related costs. With many students graduating with college loan debt, using a 401(k) or IRA may help lessen the burden of paying off education-related debt. However, before deciding to withdraw from a 401(k) or an IRA, knowing the rules and how they may impact you is essential.

Usually, if one withdraws money from a 401(k) or IRA before age 59 1/2, they will pay a 10% penalty and taxes on the withdrawal. But, the 10% penalty does not apply to 401(k)s and IRA withdrawals when used for 'qualified' education expenses. The IRS views qualified education expenses as the amounts paid for tuition, fees, and other related expense for an eligible student that are required for enrollment or attendance at an eligible educational institution. Qualified expenses include:

- Tuition and enrollment fees

- Books and equipment

- Student activity fees

These expenses are not considered qualified expenses:

- Room and board

- Medical expenses (including student health fees)

- Transportation

- Similar personal, living, or family expenses

- Sports, games, hobbies, non-credit courses

Here's what you need to know when using your 401(k) or IRA for education expenses:

401(k) withdrawals- If your employer's 401(k) plan allows for withdrawals for education expenses, you can withdraw from your 401(k) and avoid the IRS' 10% early withdrawal penalty. You may also take a loan from your 401(k) plan; visit with your plan administrator or human resources department to understand how the rules may impact you.

If you take a loan, you may be able to take a tax credit when you file taxes for the year you paid the expenses; however, not in the year, you get the loan or the year you repay the loan. Because this may need clarification, consult your tax professional before taking a 401(k) loan.

Remember that penalty-free does not mean tax-free. Since contributions to a 401(k) are made pre-tax, taxes will be due on the amount you withdraw for education expenses. It's essential to keep records of each education expense for tax filing purposes.

401(k) Roth IRA withdrawals- The same rules as 401(k) withdrawals apply to a Roth 401(k), but only if the employer's plan permits withdrawals for qualified education expenses.

IRA withdrawals- IRA withdrawals are IRS 10% penalty-free if used to pay for qualified education expenses, regardless of the account owner's age. However, taxes will be due on the withdrawal amount in the year taken.

Roth IRA withdrawals- Contributions to a Roth IRA can be taken out penalty-free for qualified education expenses at any time after the account has been open for at least five years, even if the account owner is under age 59 1/2. Since Roth IRA contributions are made with after-tax dollars, no taxes are due on the withdrawal.

Investing in education for your child is an investment that pays off over time. Suppose you are considering a 401(k) or IRA withdrawal to help pay college expenses for your child. In that case, your financial professional can help you understand how taxes and early withdrawal penalties may impact your situation.

Important Disclosures:

Content in this material is for educational and general information only and not intended to provide specific advice or recommendations for any individual.

Contributions to a traditional IRA may be tax deductible in the contribution year, with current income tax due at withdrawal. Withdrawals prior to age 59 ½ may result in a 10% IRS penalty tax in addition to current income tax.

The Roth IRA offers tax deferral on any earnings in the account. Withdrawals from the account may be tax free, as long as they are considered qualified. Limitations and restrictions may apply. Withdrawals prior to age 59 ½ or prior to the account being opened for 5 years, whichever is later, may result in a 10% IRS penalty tax. Future tax laws can change at any time and may impact the benefits of Roth IRAs. Their tax treatment may change.

This information is not intended to be a substitute for specific individualized tax advice. We suggest that you discuss your specific tax issues with a qualified tax advisor.

All information is believed to be from reliable sources; however, LPL Financial makes no representation as to its completeness or accuracy.

This article was prepared by Fresh Finance.

LPL Tracking #1-05372941

https://www.bankrate.com/retirement/ways-to-take-penalty-free-withdrawals-from-ira-or-401k/

Access Online Banking

Can 401(k) Be Used for Education

Written by True Tamplin, BSc, CEPF®

Reviewed by subject matter experts.

Updated on September 08, 2023

Are You Retirement Ready?

Table of contents, understanding 401(k) plans.

401(k) plans , named after the tax code that governs them, are tax-advantaged, defined-contribution retirement accounts typically offered by employers. They enable employees to save a portion of their pre-tax salary, reducing their annual income tax bill.

While these plans are primarily designed to foster retirement savings by providing tax incentives, under certain conditions, they can also be used for other purposes like education expenses.

However, despite the temptation to use these funds for immediate needs, it's vital to remember that the main purpose of a 401(k) is for retirement .

Tapping into it prematurely may address current financial requirements but could potentially jeopardize future financial stability.

Therefore, careful planning is needed before redirecting 401(k) funds for non-retirement purposes.

Using a 401(k) for Education Expenses

401(k) withdrawals for education costs.

Under certain conditions, you can use your 401(k) for education expenses. However, the process isn't as straightforward as merely taking money out of a traditional savings account.

If you're under the age of 59½, any withdrawal you make from your 401(k) is generally subject to income tax plus a 10% early withdrawal penalty .

There are, however, some exceptions to this rule, including certain allowable hardship withdrawals and loans.

Essential Conditions for Utilizing 401(k) Funds for Education

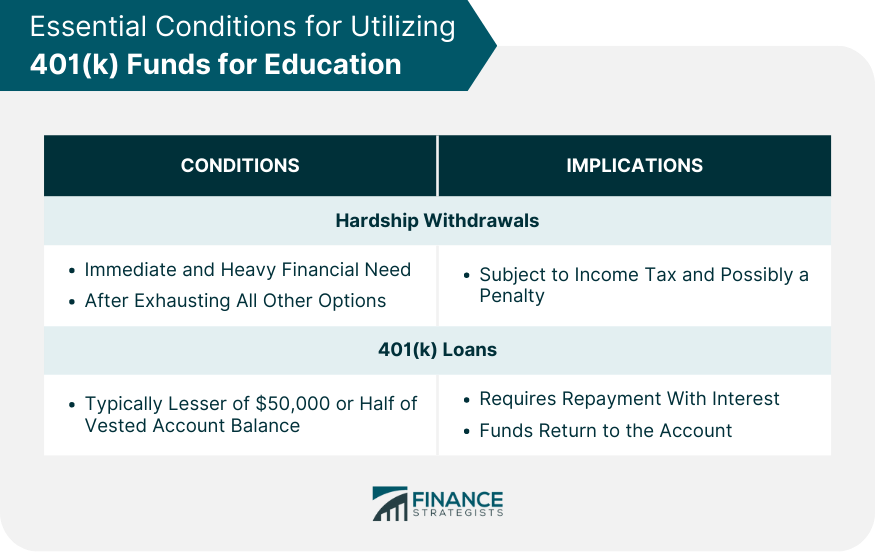

There are two main ways to use your 401(k) for education expenses without incurring the standard penalties: through hardship withdrawals and loans.

Hardship Withdrawals

Hardship withdrawals from a 401(k) are permissible when there's an immediate and substantial financial necessity, such as education expenses.

Nevertheless, the Internal Revenue Service (IRS) mandates that these withdrawals should only occur after all other distribution and loan avenues have been exhausted.

This method, while accessible, should be a last resort due to the potential impact on your retirement savings .

- 401(k) Loans

A more flexible option for accessing your 401(k) for education costs is taking a loan against your retirement account. The loan limit is typically the lesser of $50,000 or half of your vested account balance .

A significant advantage of this option over hardship withdrawals is that the money repaid, including interest , is re-contributed to your account, thereby mitigating some of the impact on your future retirement funds.

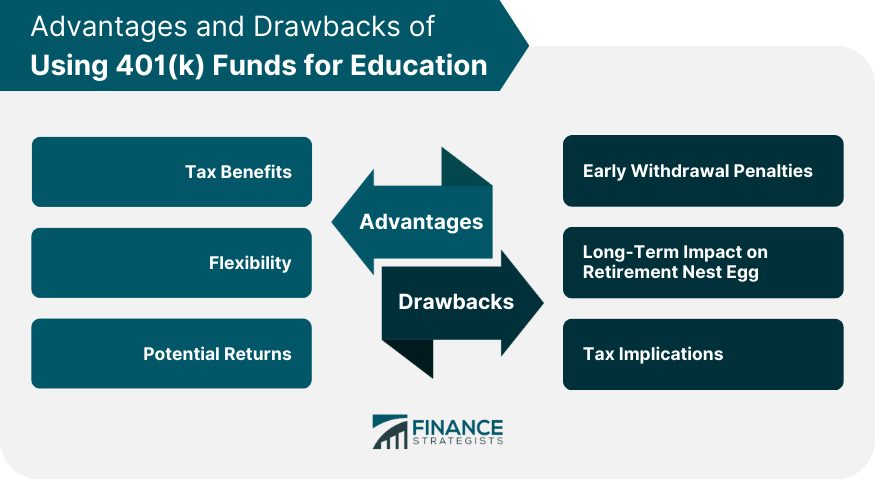

Advantages of Using 401(k) Funds for Education

Tax benefits.

Using a 401(k) loan for education expenses may allow you to avoid the 10% early withdrawal penalty and potentially save on taxes .

If the loan is repaid within the specified period (usually five years, unless it's used to buy a primary home), the only cost is the interest — which goes back into your account.

Flexibility

The funds from a 401(k) loan can be used for any purpose, including education costs. This includes tuition, fees, and other associated expenses for higher education.

As long as you can demonstrate that the expenses are necessary and meet the loan terms, you can use a 401(k) loan to help finance an education.

Potential Returns

If your 401(k) is performing well, it can be an attractive source of funding, especially when compared to high-interest credit cards or private student loans.

While you will lose out on potential gains while the money is withdrawn, you will be repaying the loan with interest, which is funneled back into your account.

Risks and Drawbacks of Using 401(k) Funds for Education

Early withdrawal penalties.

If you can't pay back a 401(k) loan within the specified period, it becomes classified as a distribution. This means the remaining balance is subject to income taxes and possibly a 10% early withdrawal penalty if you're under 59½.

Also, if you leave your job (or are let go) while you have an outstanding 401(k) loan, the remaining balance usually becomes due much sooner.

Long-Term Impact on Retirement Nest Egg

When you borrow from your 401(k), you're effectively reducing the amount of money that's invested for your retirement.

Even if you pay back the loan, the overall amount may be less than if you had left the money untouched due to missed investment gains during the loan period.

Tax Implications

Although 401(k) contributions are made with pre-tax dollars, both the principal and interest on a 401(k) loan must be repaid with after-tax dollars.

This effectively means you'll pay taxes twice on the same money: once when you repay the loan and again when you withdraw the funds in retirement.

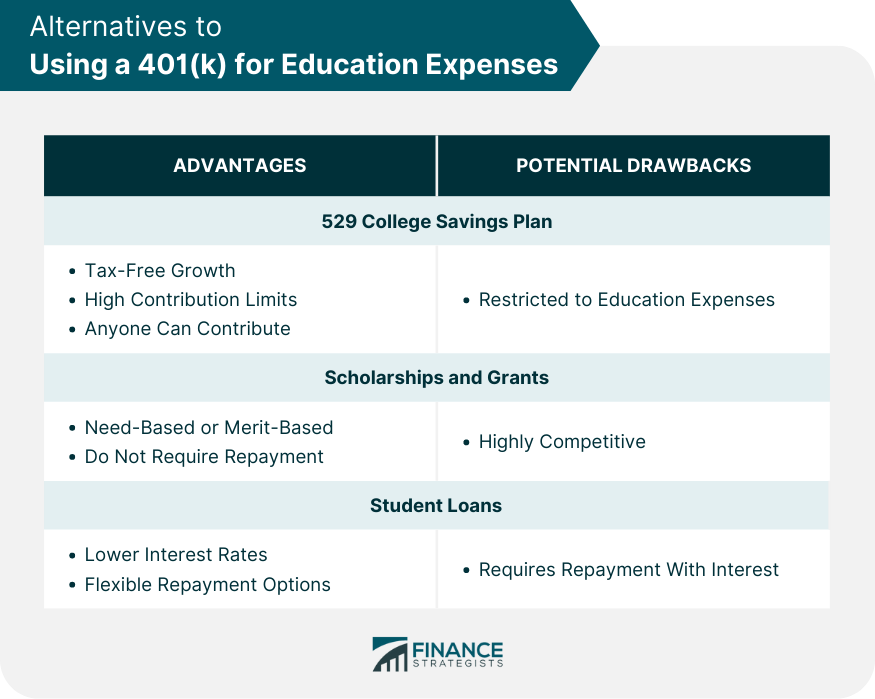

Alternatives to Using a 401(k) for Education Expenses

529 college savings plan.

A 529 plan is a tax-advantaged savings plan designed specifically for education expenses. These plans can be a more efficient way to save for education, offering tax-free growth and tax-free withdrawals for qualified education expenses.

They also have high contribution limits , and anyone can contribute to a plan, making them a great option for family members or friends who want to help.

Scholarships and Grants

Scholarships and grants offer another way to finance education without dipping into retirement savings. They are often need-based or merit-based and don't have to be repaid. The application process can be competitive, but the potential benefits are significant.

Student Loans

Student loans are another common way to pay for education.

While these do need to be repaid with interest, federal student loans often have lower interest rates and more flexible repayment options than other types of debt. Plus, unlike with a 401(k) loan, there's no risk to your retirement savings.

Is Using a 401(k) for Education Right for You?

Key factors to consider in the decision-making process, potential return on education investment.

Before using your 401(k) for education, consider the expected return on investment (ROI) for the educational pursuit.

Will this education lead to a significantly higher income or new opportunities that outweigh the depletion of your retirement savings? If the potential ROI is not high, it might be wise to seek other financing methods.

Time Until Retirement

Your proximity to retirement is a key factor. If retirement is close, using your 401(k) funds might be risky, as it reduces the time for your investments to rebound and grow.

However, if you're further from retirement, you may have more time to replace the funds and recover from any potential investment losses.

Performance of 401(k) Investments

The current performance and future prospects of your 401(k) investments should also be taken into account. If your investments are doing well, withdrawing from the fund may mean missing out on potential earnings.

If the performance is mediocre, it might seem less risky to use these funds, but remember that market conditions can change.

Availability of Other Education Financing Resources

Examine all available education financing resources before tapping into your retirement savings. Other options might include grants, scholarships, work-study programs, or student loans.

These options could be a more financially prudent route than potentially jeopardizing your future retirement security.

Bottom Line

Using a 401(k) for education expenses can be advantageous. It can provide a tax-deferred way to save for education, and it can help you reach your retirement savings goals.

The convenience and flexibility offered by 401(k) withdrawals or loans for education are undeniably appealing.

Yet, it's crucial to remember that these choices come with potential pitfalls, such as early withdrawal penalties, long-term impacts on your retirement nest egg , and double taxation .

As such, alternatives like 529 plans, scholarships, grants, and student loans should be explored before tapping into your retirement savings.

Given the high stakes and long-term implications of this decision, professional advice from a financial planner or advisor can be invaluable.

To ensure your financial future remains secure, seek retirement planning services that can offer tailored strategies for your unique circumstances.

Can 401(k) Be Used for Education FAQs

Can you use my 401(k) for education expenses.

Yes, under certain conditions like hardship withdrawals or loans, you can use your 401(k) for education expenses.

What are the tax benefits of using a 401(k) for education?

If you take a 401(k) loan for education, you may avoid a 10% early withdrawal penalty and potentially save on taxes.

What are the drawbacks of using a 401(k) for education costs?

Drawbacks include potential early withdrawal penalties, a decrease in retirement savings, and double taxation upon repayment.

What are alternatives to using a 401(k) for education expenses?

Alternatives include 529 College Savings Plans, scholarships and grants, and student loans.

How can you decide if using a 401(k) for education is right for you?

Consider factors like potential education returns, time until retirement, 401(k) performance, and seek advice from a financial advisor.

About the Author

True Tamplin, BSc, CEPF®

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide , a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University , where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon , Nasdaq and Forbes .

Related Topics

- 401(k) Blackout Period

- 401(k) Discretionary Contributions

- 401(k) Early Withdrawal Alternatives

- 401(k) Plans for Small Businesses

- 401(k) Recordkeepers

- 401(k) Statement

- 401(k) Without an Employer Match

- 401(k) vs IRA

- 401(k) vs Mutual Funds

- After Tax 401(k) Rollover to Roth IRA

- Buying Gold With Your 401(k)

- Can I Invest My 401(k) In Stocks?

- Does Filing for Bankruptcy Affect My 401(k)?

- Factors Affecting Your 401(k) Return

- How a 401(k) Is Split in a Divorce

- How a 401(k) Works After Retirement

- How to Invest Your 401(k)

- How to Invest in Cryptocurrency Through 401(k)

- How to Manage a 401(k) If Your Company Closes

- How to Pay Back 401(k) Loan Early

- How to Protect Your 401(k) During a Stock Market Crash

- How to Rollover 401(k) to Gold IRA

- How to Withdraw Early From Your 401(k)

- IRA to 401(k) Rollover

- Mega Backdoor Roth 401(k)

- Pros and Cons of 401(k) Loan

- Safest Investments for a 401(k)

- Should You Put Your 401(k) Into an Annuity?

- What to Do if Your 401(k) Is Losing Money?

Ask a Financial Professional Any Question

Meet retirement planning consultants in your area, our recommended advisors.

Claudia Valladares

WHY WE RECOMMEND:

Fee-Only Financial Advisor Show explanation

Bilingual in english / spanish, founder of wisedollarmom.com, quoted in gobanking rates, yahoo finance & forbes.

IDEAL CLIENTS:

Retirees, Immigrants & Sudden Wealth / Inheritance

Retirement Planning, Personal finance, Goals-based Planning & Community Impact

Taylor Kovar, CFP®

Certified financial planner™, 3x investopedia top 100 advisor, author of the 5 money personalities & keynote speaker.

Business Owners, Executives & Medical Professionals

Strategic Planning, Alternative Investments, Stock Options & Wealth Preservation

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.

Fact Checked

At Finance Strategists, we partner with financial experts to ensure the accuracy of our financial content.

Our team of reviewers are established professionals with decades of experience in areas of personal finance and hold many advanced degrees and certifications.

They regularly contribute to top tier financial publications, such as The Wall Street Journal, U.S. News & World Report, Reuters, Morning Star, Yahoo Finance, Bloomberg, Marketwatch, Investopedia, TheStreet.com, Motley Fool, CNBC, and many others.

This team of experts helps Finance Strategists maintain the highest level of accuracy and professionalism possible.

Why You Can Trust Finance Strategists

Finance Strategists is a leading financial education organization that connects people with financial professionals, priding itself on providing accurate and reliable financial information to millions of readers each year.

We follow strict ethical journalism practices, which includes presenting unbiased information and citing reliable, attributed resources.

Our goal is to deliver the most understandable and comprehensive explanations of financial topics using simple writing complemented by helpful graphics and animation videos.

Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications. Our work has been directly cited by organizations including Entrepreneur, Business Insider, Investopedia, Forbes, CNBC, and many others.

Our mission is to empower readers with the most factual and reliable financial information possible to help them make informed decisions for their individual needs.

How It Works

Step 1 of 3, ask any financial question.

Ask a question about your financial situation providing as much detail as possible. Your information is kept secure and not shared unless you specify.

Step 2 of 3

Our team will connect you with a vetted, trusted professional.

Someone on our team will connect you with a financial professional in our network holding the correct designation and expertise.

Step 3 of 3

Get your questions answered and book a free call if necessary.

A financial professional will offer guidance based on the information provided and offer a no-obligation call to better understand your situation.

Where Should We Send Your Answer?

Just a Few More Details

We need just a bit more info from you to direct your question to the right person.

Tell Us More About Yourself

Is there any other context you can provide.

Pro tip: Professionals are more likely to answer questions when background and context is given. The more details you provide, the faster and more thorough reply you'll receive.

What is your age?

Are you married, do you own your home.

- Owned outright

- Owned with a mortgage

Do you have any children under 18?

- Yes, 3 or more

What is the approximate value of your cash savings and other investments?

- $50k - $250k

- $250k - $1m

Pro tip: A portfolio often becomes more complicated when it has more investable assets. Please answer this question to help us connect you with the right professional.

Would you prefer to work with a financial professional remotely or in-person?

- I would prefer remote (video call, etc.)

- I would prefer in-person

- I don't mind, either are fine

What's your zip code?

- I'm not in the U.S.

Submit to get your question answered.

A financial professional will be in touch to help you shortly.

Part 1: Tell Us More About Yourself

Do you own a business, which activity is most important to you during retirement.

- Giving back / charity

- Spending time with family and friends

- Pursuing hobbies

Part 2: Your Current Nest Egg

Part 3: confidence going into retirement, how comfortable are you with investing.

- Very comfortable

- Somewhat comfortable

- Not comfortable at all

How confident are you in your long term financial plan?

- Very confident

- Somewhat confident

- Not confident / I don't have a plan

What is your risk tolerance?

How much are you saving for retirement each month.

- None currently

- Minimal: $50 - $200

- Steady Saver: $200 - $500

- Serious Planner: $500 - $1,000

- Aggressive Saver: $1,000+

How much will you need each month during retirement?

- Bare Necessities: $1,500 - $2,500

- Moderate Comfort: $2,500 - $3,500

- Comfortable Lifestyle: $3,500 - $5,500

- Affluent Living: $5,500 - $8,000

- Luxury Lifestyle: $8,000+

Part 4: Getting Your Retirement Ready

What is your current financial priority.

- Getting out of debt

- Growing my wealth

- Protecting my wealth

Do you already work with a financial advisor?

Which of these is most important for your financial advisor to have.

- Tax planning expertise

- Investment management expertise

- Estate planning expertise

- None of the above

Where should we send your answer?

Submit to get your retirement-readiness report., get in touch with, great the financial professional will get back to you soon., where should we send the downloadable file, great hit “submit” and an advisor will send you the guide shortly., create a free account and ask any financial question, learn at your own pace with our free courses.

Take self-paced courses to master the fundamentals of finance and connect with like-minded individuals.

Get Started

To ensure one vote per person, please include the following info, great thank you for voting., get in touch with a financial advisor, submit your info below and someone will get back to you shortly..

An official website of the United States Government

- Kreyòl ayisyen

- Search Toggle search Search Include Historical Content - Any - No Include Historical Content - Any - No Search

- Menu Toggle menu

- INFORMATION FOR…

- Individuals

- Business & Self Employed

- Charities and Nonprofits

- International Taxpayers

- Federal State and Local Governments

- Indian Tribal Governments

- Tax Exempt Bonds

- FILING FOR INDIVIDUALS

- How to File

- When to File

- Where to File

- Update Your Information

- Get Your Tax Record

- Apply for an Employer ID Number (EIN)

- Check Your Amended Return Status

- Get an Identity Protection PIN (IP PIN)

- File Your Taxes for Free

- Bank Account (Direct Pay)

- Payment Plan (Installment Agreement)

- Electronic Federal Tax Payment System (EFTPS)

- Your Online Account

- Tax Withholding Estimator

- Estimated Taxes

- Where's My Refund

- What to Expect

- Direct Deposit

- Reduced Refunds

- Amend Return

Credits & Deductions

- INFORMATION FOR...

- Businesses & Self-Employed

- Earned Income Credit (EITC)

- Child Tax Credit

- Clean Energy and Vehicle Credits

- Standard Deduction

- Retirement Plans

Forms & Instructions

- POPULAR FORMS & INSTRUCTIONS

- Form 1040 Instructions

- Form 4506-T

- POPULAR FOR TAX PROS

- Form 1040-X

- Circular 230

Retirement topics - Hardship distributions

More in retirement plans.

- Types of retirement plans

- Required minimum distributions

- Published guidance

- Forms and publications

- Operate a retirement plan

- Topic index

Although not required, a retirement plan may allow participants to receive hardship distributions. A distribution from a participant’s elective deferral account can only be made if the distribution is both:

- Due to an immediate and heavy financial need.

- Limited to the amount necessary to satisfy that financial need.

Immediate and heavy financial need

The employer determines a participant has an immediate and heavy financial need based on the plan terms and all relevant facts and circumstances.

- Consumer purchases (such as a boat or television) are generally not considered an immediate and heavy financial need.

- A financial need may be immediate and heavy even if it was reasonably foreseeable or voluntarily incurred by the employee.